Reading a book can be one of the best ways to learn how to manage your money. Personal finance books can provide valuable insights if you’re trying to get out of debt, save for retirement, or improve your investing skills. The right book can help you form better money habits, understand how to grow wealth and give you confidence in managing your finances.

Here are twelve of the best personal finance books that have been celebrated for their practical advice and actionable strategies. These books are perfect for anyone looking to take control of their financial future. They are:

1. Rich Dad Poor Dad by Robert Kiyosaki

Rich Dad Poor Dad is one of the best personal finance books ever. Robert Kiyosaki uses his own experiences to compare the financial mindset of his “rich dad” (his friend’s father) with that of his “poor dad” (his father).

The book emphasizes the importance of financial literacy and prioritizing assets over liabilities. It is a great book to start with for anyone interested in investing and learning how to make their money work for them.

2. Your Money or Your Life by Vicki Robin & Joe Dominguez

Your Money or Your Life was first published in 1992. This book challenges readers to rethink what money means to them, how much is enough, and how to reach financial independence and live more meaningful lives.

Its practical steps on tracking expenses and living below your means make it an excellent pick for those wanting a sustainable approach to personal finance.

3. The Simple Path to Wealth by JL Collins

The Simple Path to Wealth was written initially as a series of letters by JL Collins, the author, to his daughter. Collins emphasizes the importance of saving and investing in low-cost index funds in the book, making it the perfect book for those looking for an easy, stress-free way to grow their wealth.

It’s also one of the best personal finance books in 2024 for anyone wanting straightforward advice on building a secure financial future.

ALSO READ: 20 Best Books on Money Management

4. Broke Millennial by Erin Lowry

Erin Lowry’s Broke Millennial is perfect for people who are just beginning to manage their finances. This book addresses issues like credit scores, student loans, and debt management in a relatable, humorous way.

Broke Millennial is packed with practical tips and is very easy to understand. It’s among the best personal finance books for young adults like millennials who want to get a solid start.

5. The Intelligent Investor by Benjamin Graham

The Intelligent Investor by Benjamin Graham is regarded as one of the most influential books on investing. The book, written by Warren Buffett’s mentor, is about stock market and value investing strategies, including buying undervalued stocks with the potential for growth.

It’s a must-read for those looking for the best books about money and investing to build long-term wealth.

6. The Psychology of Money by Morgan Housel

The Psychology of Money analyzes the emotional and psychological factors influencing financial decisions. It reveals the real ways people make money decisions and helps readers make sense of their own behaviors regarding finances.

The Psychology of Money gives a unique approach to money management, helping readers understand the mindset needed to build lasting wealth.

7. I Will Teach You to Be Rich by Ramit Sethi

I Will Teach You to Be Rich is a bestseller by Ramit Sethi. This book is aimed at millennials and young professionals who want to automate their finances and grow their wealth.

The book covers many topics, including how to optimize your credit cards, save for retirement, and make smart investment decisions.

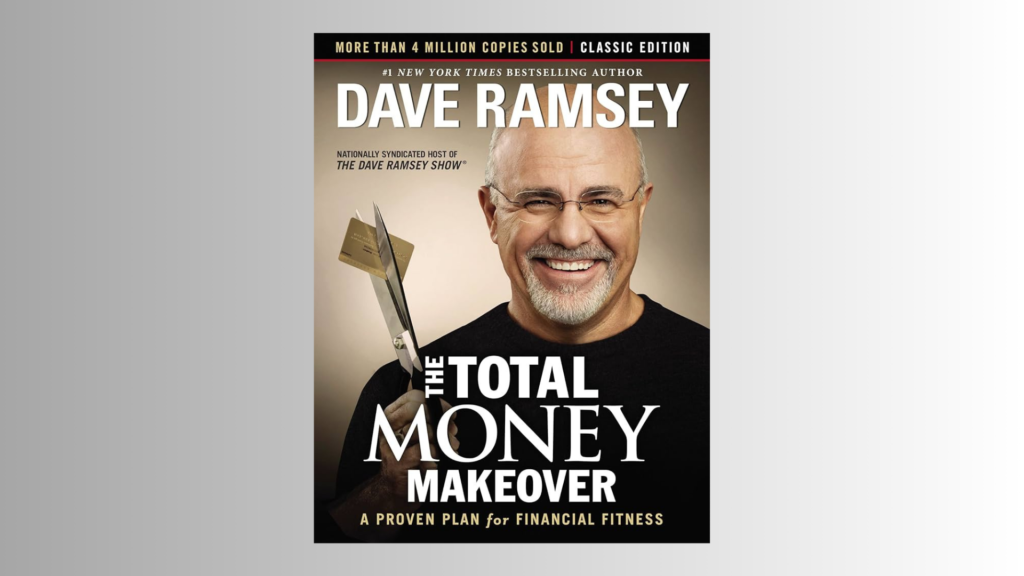

8. The Total Money Makeover by Dave Ramsey

Dave Ramsey’s The Total Money Makeover has been a trusted guide for people with debt and credit cards. Ramsey provides a step-by-step plan for money management, focusing on eliminating debt, saving for emergencies, and investing for the future.

The “baby steps” approach is easy to follow, making it one of the best books on money and investing for beginners.

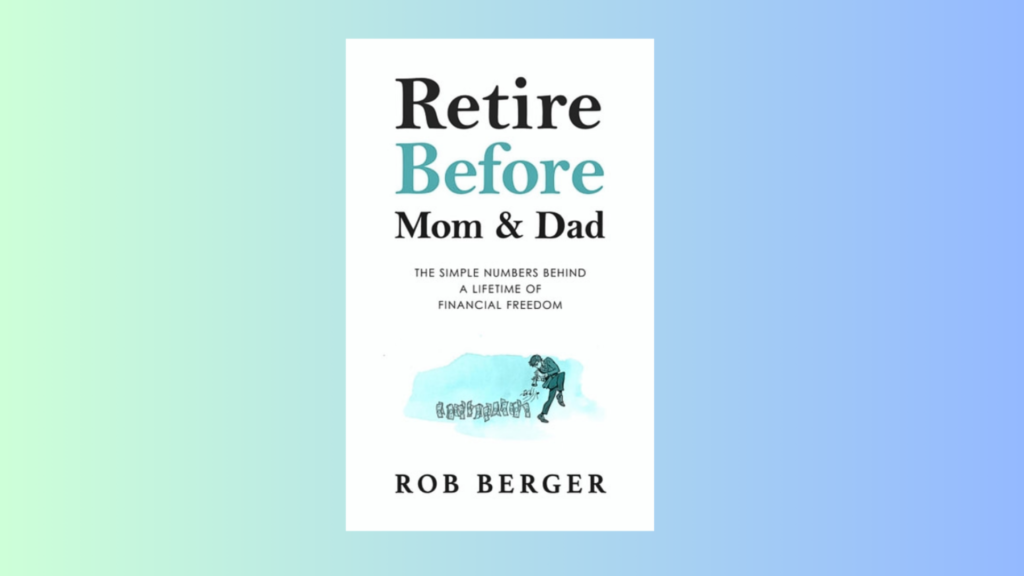

9. Retire Before Mom and Dad by Rob Berger

“Retire Before Mom and Dad” is an essential introduction to starting an early retirement through the FIRE (Financially Independent, Retire Early) movement.

Even if retiring early isn’t on your list of goals, this book addresses the principles that make financial independence and retirement achievable. It is a good read for both those who want to retire early and those who want to build wealth.

ALSO READ: 8 Best Places to Find Affordable Children’s Books

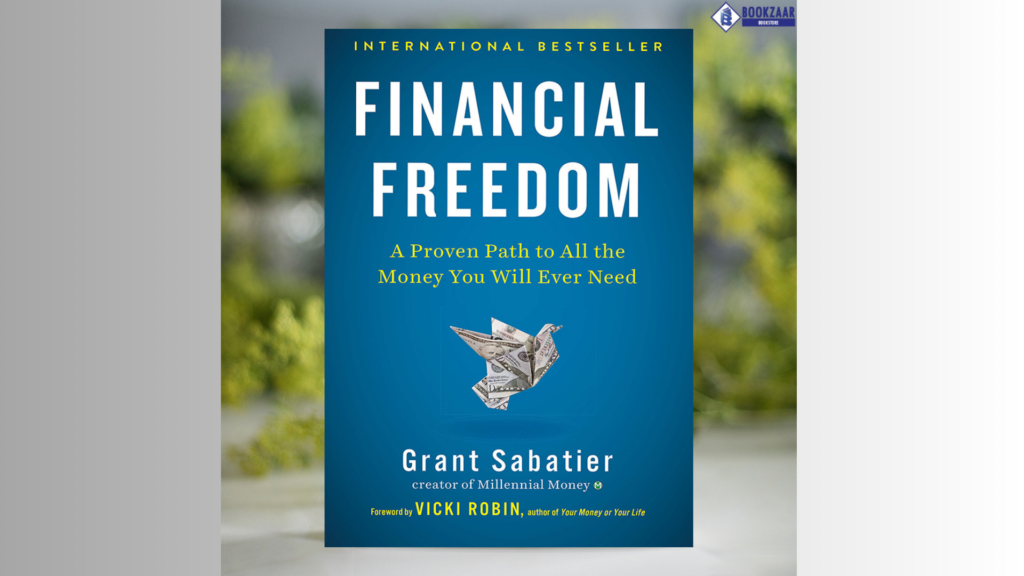

10. Financial Freedom by Grant Sabatier

Grant Sabatier’s Financial Freedom is a modern-day guide to achieving financial independence. Sabatier shares his story of going from broke to millionaire in just five years, offering practical strategies for boosting income, saving aggressively, and investing smartly.

It’s one of the best personal finance books for those serious about reaching financial independence.

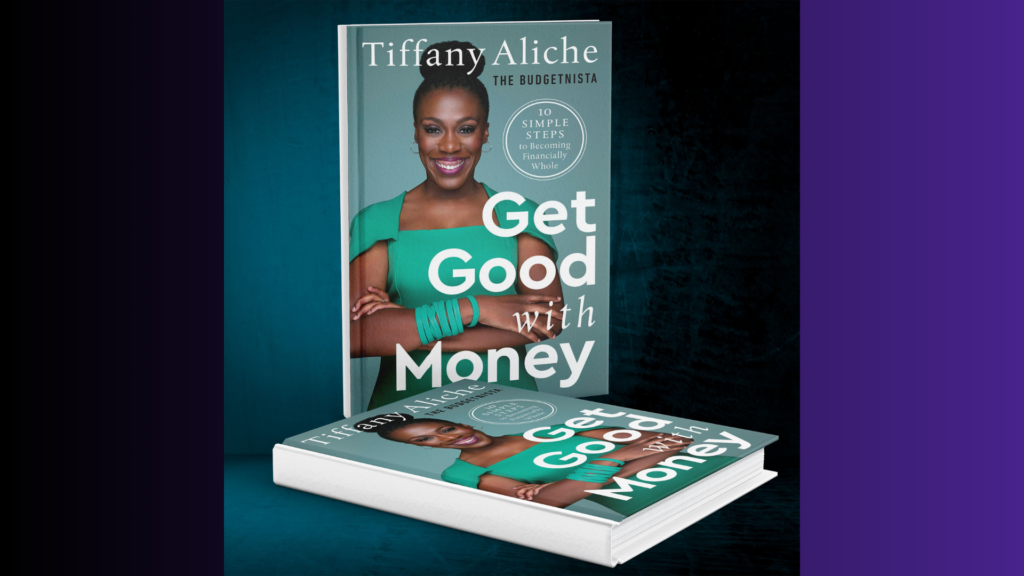

11. Get Good With Money: Ten Simple Steps to Becoming Financially Whole by Tiffany Aliche

In this book, Tiffany Aliche shares her 10-step process to financial peace. Her book, “Get Good with Money: Ten Simple Steps to Becoming Financially Whole,” focuses on short-term actions that aim to achieve long-term results.

According to Aliche, the book has done just that for more than 1 million women worldwide struggling with saving and paying off debt. This book is perfect for anyone building a budget from scratch.

12. The Millionaire Next Door by Thomas J. Stanley & William D. Danko

The Millionaire Next Door is a groundbreaking study of American millionaires’ financial habits. Stanley and Danko uncover the truth of what the life of a millionaire looks like—and it may not be what you’d expect.

This book shatters the myth that millionaires live in mansions and drive luxury cars. Instead, it focuses on money management strategies like living below your means, budgeting, and investing wisely.

These best personal finance books offer a wealth of knowledge and strategies for anyone trying to improve their financial situation. These books also serve as a reminder that economic knowledge is accessible to everyone, whether you’re a member of a finance group or someone seeking to improve your finances. So, grab one of these titles, start reading, and take your first steps toward financial independence.