It is no longer news that living alone can be very challenging in the United States as you have to shoulder some heavy bills alone. We can agree that the expense of living alone is peculiar to singles in every state.

However, some states will make folks regret being single more than others, and we are about to itemize the 15 most expensive for singles.

Moving Soon? Pause Before Making that Leap

As a single person about to embark on an inter-state migration, we are looking at some states that may be advisable to keep off your list of prospects if it can be helped.

The US Bureau reports that single people comprise 46% of the country’s population. This fragment consists of widowed, divorced, and unmarried Americans over 18.

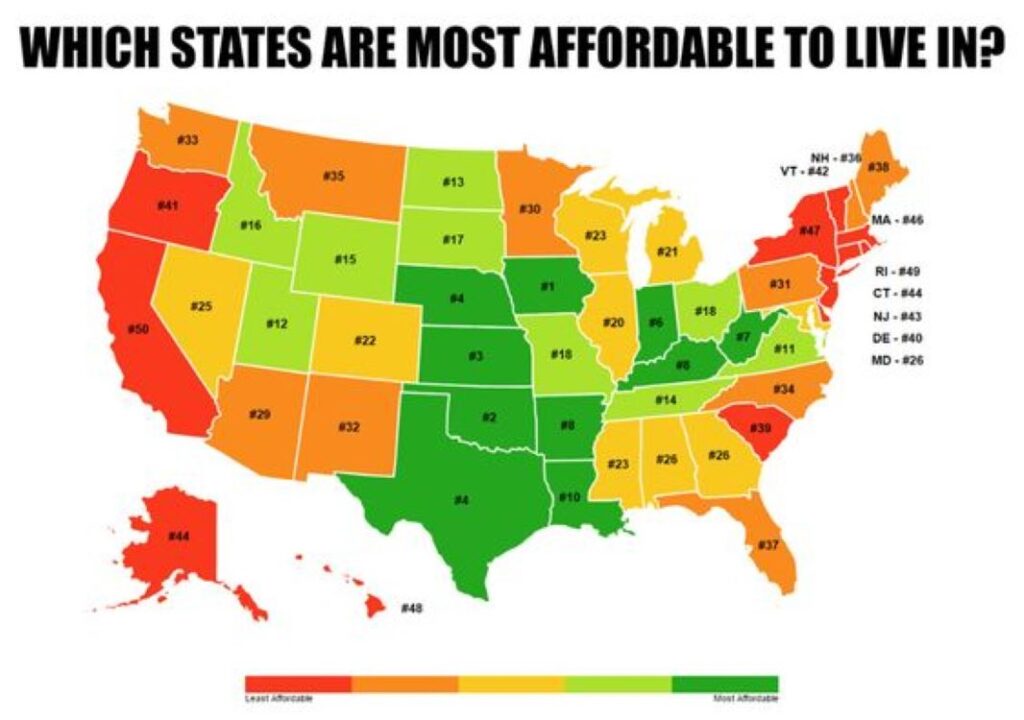

Massachusetts Wears the Crown of the Most Expensive State for Singles

According to an analysis by SmartAsset, a single person would need a minimum annual income of $60,000 to live in Massachusetts. This figure was arrived at by using publicly available data to compare the cost of obtaining necessities of life in each state of the US.

So, that figure covers taxes, healthcare, transportation, housing, and other necessary expenses incurred by a single person.

Housing, Tax, Food; the Income Guzzlers

As we pointed out earlier, each of those expenses varies in cost from state to state. For example, the rent for an average-sized condo in California significantly varies from one with similar amenities in Arkansas.

Other items that make the cost of living vary significantly per state are food and taxes. So far, financial analysts have found that the biggest gap in these expenses for single people exists between Massachusetts and West Virginia.

West Virginia Could Be a Safe Haven for Single People

In West Virginia, a single person can survive on an annual income of $39,387. However, that amount climbs to $58,010 for singles living in Massachusetts.

If those figures are narrowed down to hourly rates, based on a 40-hour week, a single person needs $19 and $28 to get by in West Virginia and Massachusetts, respectively.

The 15 Most Expensive States for Singles

Here is the list of the 15 most expensive states for single people, in descending order: Massachusets ($58,010); Hawaii ($56,840); California ($56,824); New York ($55,877); Washington ($53,242); Colorado ($51,643); New Jersey ($51,504)…

Maryland ($51,460); Oregon ($50,553); Rhode Island ($50,418); Connecticut ($50,194); Virginia ($49,972); New Hampshire ($49,045); Arizona ($48,676) and Georgia ($48,447).

Housing Is the Highest Cost, With the Highest Interstate Variance

Housing costs are about the most important and expensive metric for collating the list of the most expensive states to live in as a single person.

A quick comparison reveals that the average cost of housing in the 15 most expensive states is almost 200% of the average in the 15 least expensive states.

The More Cities, the Higher the Cost of Living

The reason for high housing costs in some states is not far-fetched. Some of these states have large cities that host large industrial communes, like Silicon Valley.

There is a high demand for workers in these large cities, which drives the demand for real estate up, driving its pricing through the roof. Like housing, other major income-eaters, like taxes and healthcare, trail behind inexpensiveness.

A Quick Disclaimer

It is important to note that the figures cited so far cover just the necessities. So, singles with special indulgencies that cost a couple of bucks can expect the annual costs to increase significantly.

So, for singles with a knack for weekly nights out and investment savings, the annual living costs will be greater.

ALSO READ: How and When to Start Giving Kids Allowance

Singles Are Not Better Off in States With Relatively Higher Minimum Wage

Unfortunately, the minimum wage is not sufficient for working single people in any US state. In most states, the very basic expenses far outweigh the hourly minimum wage workers receive.

Even in states like California, which recently increased its hourly minimum wage to $20, MIT’s Living Wage calculator suggests that even that is not enough for the $27.32 hourly pay needed to sustain workers’ basic expenses.

A Single New Yorker Testifies

According to a single man, Kaishon Holloway, who resides in New York City, most of his single friends are always anxious about keeping up with their living expenses.

It is a given that single people in the US incur what has been tagged the “singles tax.” This is the extra cost that a single person would have to cough up, unlike someone living with another person or significant other, by footing all the major bills alone.

Financial Experts Have Got Some Advice

Kamila Elliott, a certified financial planner, suggests toning down the impact of housing costs on income by boarding or co-renting with a friend. In addition, budgeting and monitoring cash flow in and out of your kitty is equally important.

Overall, Elliott further reiterates cohabitation by saying, “Think about yourself integrating into a community and identifying ways to help minimize some of your day-to-day expenses.”

You Might Also Like:

Amazon Lures Back Erstwhile Customers With 30% Discount on Groceries

Tips for Requesting a Lower Minimum Payment on Your Credit Card

Here Are Useful Tips To Get Cheap Car Insurance This Year

Strong Economic Performance Keeps Mortgage Rates Steady Above 7%

Smart Strategies To Get the Lowest Mortgage Rates on the Market