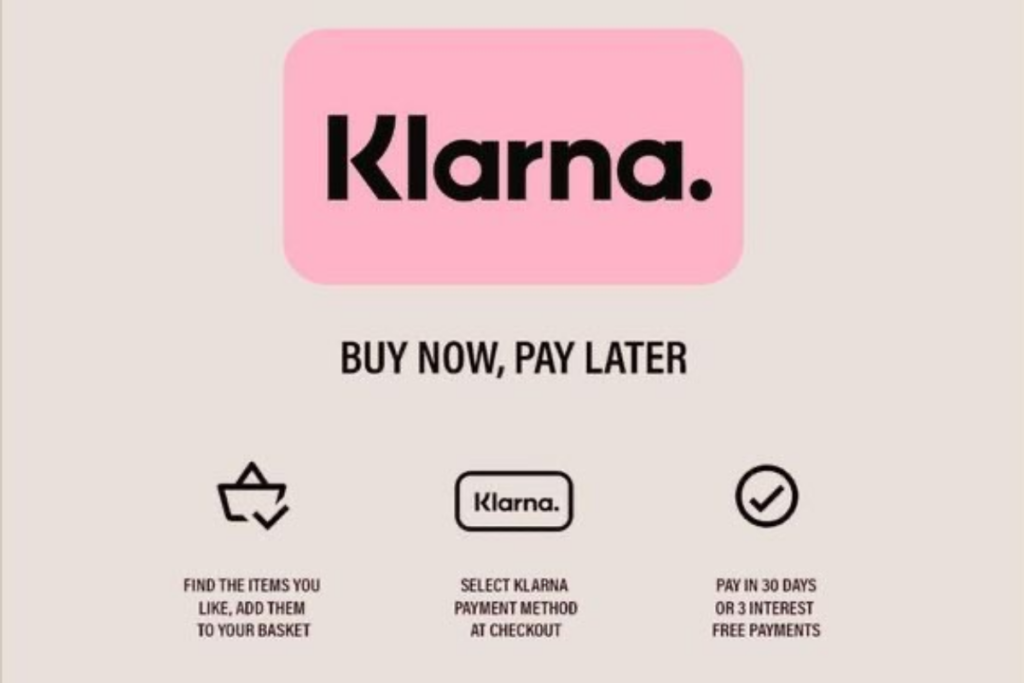

Klarna offers various payment plans. However, it is well known for its “buy now, pay later” services. The company recently announced its profit in the first half of the year. This is especially good for the company, as the profit improved from last year’s loss. This profit is a positive sign as the company prepares for a possible stock market debut.

klarna’s Revenue

Klarna reported an adjusted operating profit of 673 million Swedish krona, or about $66.1 million, from January to June this year, compared to a $456 million loss in the same period last year. Meanwhile, Klarna’s revenue grew by 27% to 13.3 billion krona.

The company still lost 333 million krona in net income. However, it prefers to focus on its adjusted operating profit because it believes the number reflects its business performance.

Klarna is one of the major companies in the “buy now, pay later” sector, along with PayPal, Block’s Afterpay, and Affirm. These companies allow people to pay for what they purchase in interest-free monthly installments, with businesses covering the service cost through transaction fees.

Sebastian Siemiatkowski, the company’s CEO and co-founder, said that the company saw strong revenue growth in the U.S. In America, the company’s sales increased by 38%. This sales increase occurred because more businesses signed up to use their services. The CEO also mentioned that Klarna’s global network is multiplying. The company saw millions of new users and 68,000 new merchants join them.

ALSO READ: Kohl’s Focuses on Cost Controls and Leaner Inventories to Boost Profit Targets

Leveraging Al to Reduce Costs

Klarna achieved its adjusted operating profits by focusing on sustainable growth and using artificial intelligence (AI) to lower costs.

Klarna has been a significant leader in using AI to improve efficiency and reduce operating expenses. As a result, the company’s revenue per employee over the past year increased significantly by 73%, reaching 7 million Swedish krona.

Is Klarna Going to IPO?

Yes, Klarna is considering an initial public offering (IPO); however, it has not yet set a specific date for its stock market listing. The company’s CEO hinted during an interview in February that a Klarna IPO date this year is not impossible.

The company is trying to become a primary banking option for its customers as it prepares for an anticipated initial public offering (IPO). Recently, it launched a product called Klarna Balance, similar to a checking account.

Klarna did this to encourage its customers to handle more of their finances through the Klarna app. This move shows that Klarna is making considerable effort to expand beyond its main “buy now, pay later” service.

Earlier this year, Klarna sold its online checkout technology business to investors. The company described the decision as a strategic move that removes competition from other online payment services like Stripe, Adyen, Block, and Checkout.com.

ALSO READ: Top Wall Street Analysts Are Optimistic About These Dividend Stocks

What Are IPO Payments?

An Initial Public Offering (IPO) is when a company decides to go public by offering its shares for the first time. IPO payments are the payments investors make to buy these shares.

First, there’s the application process. Investors who want to buy shares during an IPO have to apply. They will show interest in the number of shares they are willing to buy and, in some cases, the amount they are willing to pay.

Along with the application, they must pay for the shares upfront. Payment can be made through several methods, including bank transfers or brokerage accounts. After the application period, the company will decide how to distribute the shares among the investors.

In some cases where the IPO is very popular and there is more demand than the number of shares available, not every investor will get the number of shares they asked for. If this happens, the investors will get a refund for the shares they couldn’t get. Once the shares are distributed, the payments are finalized and transferred to the investors’ accounts. After all of this, the shares start trading in the stock market.

How Will Klarna IPO Impact Klarna Revenue?

Klarna going public might not directly impact its revenue as IPOs are not always profitable, especially when a company is overvalued. However, Klarna’s growth has remained stable through the years, and with the current Klarna IPO valuations, it should be able to raise money to expand and improve its operations.

You Might Also Like:

Kohl’s Focuses on Cost Controls and Leaner Inventories to Boost Profit Targets

Starbucks Rushes to Win Back Customers Amid Falling Sales

Why Gold Has Been Outperforming Most Other Assets This Year

Volkswagen China Spends a Lot of Time With Xpeng To Develop New EVs

Eli Lilly Launches a New, Cheaper Version of Weight Loss Drug Zepbound to Improve Access and Supply