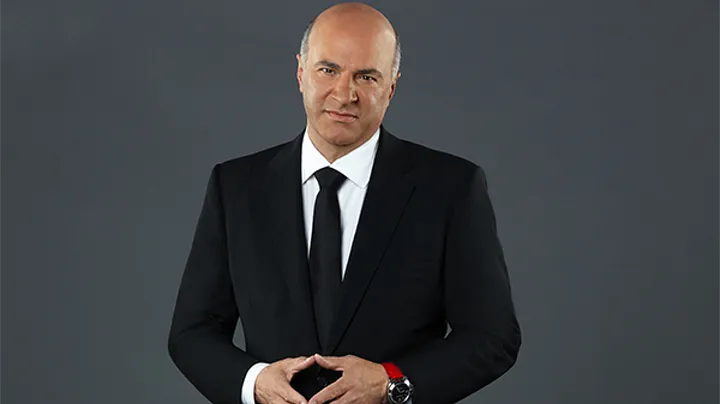

Kevin O’Leary does not seem to belong to the retire-early school of thought, as the 69-year-old is way past the traditional retirement age. However, even if he decides to retire today, O’Leary will surely have a decent trove awaiting him.

During many speaking engagements, O’Leary explained that he set up his nest egg long before becoming a senior.

Sharing the Life Essence of Financial Freedom

O’Leary has gone out of his way to share his financial epiphany to help fellow Americans achieve financial security similar to his own.

According to him, any American retire comfortably if they make the effort to put away at least 15% of their earnings in a 401(k) account. If they can brave the odds, then the benefits are sure.

Escape the Impact of the Consumerism Culture and Build Saving Habits

While speaking on a recent episode of Swimming with Sharks, O’Leary said, “Stop buying all that crap you don’t need. You have to adjust your lifestyle to ensure you put 15% away.”

O’Leary then affirmed that any working American who denies themselves as recommended would “end up with $1.5 million in the bank after a career.”

The Benchmark for Retirement Savings Keeps Going Higher

In a 2024 Progress and Planning Study, Northwestern Mutual found that the average American adult feels they would need about $1.46 million in savings before considering retirement.

O’Leary is not the only expert to harp on the benefits of starting a retirement fund early. However, many Americans are also invested in student loans, mortgages, and credit card debt.

ALSO READ: Private Job Growth in June Sits at 150,000, Lower Than Anticipated

Anyone Can Start Over With the Right Guidance

Managing those financial crises can leave the head of almost anyone in the clouds. However, the situation is salvageable, as they can use a financial advisor’s services.

As a financial expert, O’Leary offers targeted advice to students. He recommends prioritizing offsetting their student loans and getting them refinanced, which is a fast strategy for getting out of a student loan fix.

How a Student Loan Refinance Works

A student loan refinance is a fresh loan facility that allows students to pay off their old loan with a new one. The catch is the new loan comes with a cheaper interest rate and can be repaid in monthly installments.

O’Leary suggests that paying off the loan alone is not enough. He says young adults refinancing their student loans should endeavor to simultaneously invest some portion of their annual income.

Cultivating Complementary Financial Habits

Saving and investing, while paying off some existing debt may be a daunting task for most folks. However, the goal is not to amass great wealth but to build the muscle of their saving habit.

To make the savings worth the effort, they can put them in a high-yield savings account. This will serve as a foolproof method of keeping themselves from dipping their hands into the cookie jar.

Not Everyone Thinks a Retirement Plan Necessary

According to 2023 data from the Bureau of Labor Statistics, about 72.8% of working Americans have access to retirement plans courtesy of their employers. However, 60 % of this group choose not to use them.

Another report by CNBC, Your Money Survey, suggests that even workers who exploit retirement plans with their employer tend to make less of it.

Make the Most of Your Employer’s Plan or Go Solo

The Your Money Survey found that 8% of workers who use an employer-sponsored retirement plan save just the default amount. Indeed, an employer not offering their employees a retirement plan is no excuse for lacking one.

Workers can go solo with their retirement plan by enlisting for the regular IRA or Roth IRA. In addition to the tax exemptions on post-retirement withdrawals from the two other IRAs, a gold IRA can make your savings inflation-proof.

Secure Your Retirement Savings From the Scourge of Inflation

With your retirement fund pegged against the value of gold, a worker’s retirement savings could become many times greater than the eventual withdrawals from a regular or Roth IRA.

American Hartford Gold makes this possible by purchasing commodities like coins, gold bars, and other precious metals as a store of value for its customers.

ALSO READ: Too Much Cash on Hand? Here’s Why It Could Be a Mistake

Saving For the Rainy Day Never Goes Out of Fashion

All these findings of the plausibility of retirement savings give credence to Kevin O’Leary’s affirmations about how a 15% savings from a worker’s annual income can emancipate them financially.

O’Leary calculated the $1.46 million retirement payout based on an average annual salary of $60,000. He feels that even the basic 401(k) plan would yield that much after retirement if the worker starts their plan early enough.

Adventuring In the Stock Market Could Also Yield Great Dividends

In the past, investing in the stock market could be a great hassle, discouraging many investors who did not know the ropes. However, O’Leary points out that multiple investment apps now make stock investment more accessible for the average person.

With the right knowledge of market trends and automated investment apps, getting notable returns on savings is no longer rocket science.

You Might Also Like:

Expert Highlights Growing Threat as Romance Scams Cost Consumers $1.14 Billion in One Year

Austin Home Realtor Says Homeowners Are ‘Screwed’ as the Real Estate Market Plunges

Here Are 11 of the Richest People in the LGBTQ+ Community

Jennifer Aniston Tears Down Her $15m Mansion for a Major Renovation