The Boeing company has been having a rough year as it is expected to burn a lot of cash again in the third quarter of the year after suffering losses in both the first and second quarters of 2024.

The company has hired a new CEO who will take over at the end of the year in hopes of improving things.

The Boeing Company

The Boeing Company (simply Boeing) is an American multinational corporation known for designing, manufacturing, and selling airplanes, rockets, missiles, satellites, and rotorcraft worldwide.

It is the largest aerospace company in the world. William Boeing founded it in Seattle, Washington, on July 15, 1916, but it merged with McDonnell Douglas on August 1, 1997. In the 2020 Fortune 500 and Fortune Global 500 lists by the same-name company, the company ranked 54th and 121st, respectively.

Boeing’s Huge Loss in the Second Quarter

The aerospace company reported disappointing results at the end of the second quarter of 2024. According to the company’s reported data, this loss was a notable decline that was even wider than the first quarter for several reasons.

Boeing’s commercial airplane and defense programs are both struggling greatly, and this has been evident in its first—and second-quarter numbers. Here is a detailed look at Boeing’s huge loss in the second quarter of 2024.

ALSO READ: Citigroup Smashes Second-Quarter Expectations in Both Profit and Revenue

A Higher Loss Than Expected

Some analysts predicted the company’s loss in the second quarter after it reported its first-quarter numbers. However, the decline still shocked many, as the report was far worse than the expected numbers that the company reported from the beginning of April until the end of June.

In addition, these disappointing numbers have now made analysts predict another loss in the third quarter of the year, ending in September.

Boeing Burned $4.3 Billion in Cash

The report showed that the company burned about $4.3 billion in cash between the first day of April and the last day of June 2024. The company’s CFO, Brian West, also said this was because of “near-term working capital pressures.”

Moreover, he said he expects the third quarter to have a similar sending cost as the “third quarter is expected to be another use of cash.”

A Net Loss for the Second Quarter of $1.44 Billion

The company reported a substantial net loss of $1.44 billion for the second quarter of 2024, or a $2.33 per share loss. This is a considerable loss when compared to the results of the first quarter of the year, which reported a loss of $149 million or 25 cents per share.

According to LSEG, the adjusted value of the company’s loss was $2.90 per share, which is almost $1 per share below what analysts expected from the country between April and June.

A Loss of $2.90 per Share

The aerospace giant also reported a revenue of $16.87 billion versus the expected $17.23 billion that experts thought it would generate. This $16.87 billion revenue shows that it went down by a staggering 15% in the three months between April and June.

Therefore, experts are not only surprised that the reported numbers were low but that they went down much lower than many had thought it would be.

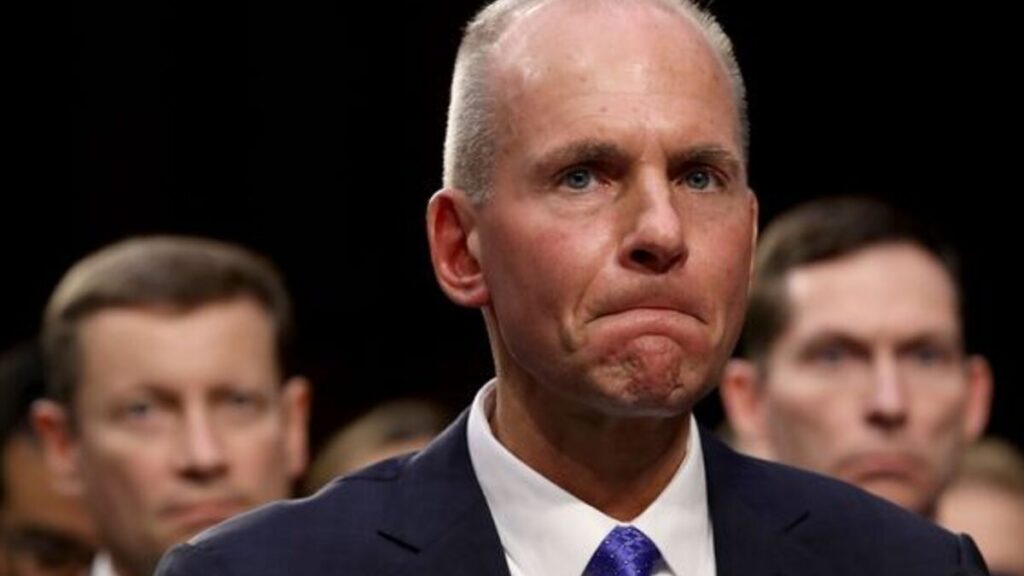

CEO’s Remarks

Dave Calhoun, the company’s current CEO, also gave a statement after the release of the second quarter report. He said, “Despite a challenging quarter, we are making substantial progress in strengthening our quality management system and positioning our company for the future.”

However, his days at Boeing are coming to an end as he announced in March that he is set to step down for a new CEO by the end of the year.

A New Veteran CEO

Boeing has also announced that it has hired a new CEO to replace Dave Calhoun after he steps down at the end of the year. He will be replaced by Robert “Kelly” Ortberg, a veteran of the aerospace industry with over thirty years of experience.

Under his guidance, the company hopes to regain its footing and increase share prices and revenue.

ALSO READ: Predicted Fed Interest Cuts May Make Traveling Abroad More Expensive for Americans

Boeing Is Trying To Stabilize Its Operations

The replacement of its CEO shows that Boeing is trying to stabilize its operations, starting at the top. This comes as the company has had a tough year and has also faced a lot of criticism.

One of the biggest operation problems the company faced this year was one of its biggest ever, and several months into the year, it is still reeling from its aftermath. This door plug blowout happened in January and went viral on the internet.

The Door Plug Blowout Incident

Earlier this year, on January 5, a nearly new 737 Max 9 aircraft produced by Boeing took off at an airport. Suddenly, the door plug blew off, taking the entire door with it mid-air.

This caused a huge uproar, and Boeing has been blamed for causing the incident and putting the lives of many passengers in danger. This has further slowed down the company’s aircraft sales significantly.

Boeing Plans To Increase Output of Max Planes

However, Boeing is not letting this stop them from producing more of its aircraft. Instead, the company has announced its plans to increase the output of its Max planes to 38 pieces in a month. In the second quarter of the year, it produced aircraft in the mid-20s and had trouble selling all of them due to reduced demand.

Therefore, many wonder why it chose to increase production to 38.

A Drop in Year-Over-Year Revenue

The second quarter report also showed that there was a 32% year-over-year drop in the revenue of the company’s all-important commercial airplanes unit. This reduced to $6 billion. Low deliveries and production have also forced the company to push back some of its financial targets for the year.

As the company might burn more cash in the third quarter, it will likely end the year with a red mark if things don’t pick up soon.

You Might Also Like:

Cathie Wood Offloads $25 Million Worth of Underperforming Tech Stock

McDonald’s Might Have to Leave California