The relationship between China and the U.S. seems to be rocky once more as the Asian country is continuously cutting off U.S. treasuries and moving away from the U.S. dollar. This could be because of a possible change in presidency in the next few months, as China doesn’t want to take a risk on its assets going under an unfavorable administration.

Now, this has caused a lot of tension between the two countries, which has cooled things over the past few years.

The Rift Between China and the U.S.

Throughout history, China and the U.S. have had a very turbulent relationship that fluctuates regularly. The Biden-Harris administration has kept this relationship at a steady level for the past few years, but this seems to be coming to an end as China started cutting ties with American treasuries in anticipation of a possible change of power in the November elections.

A record $53.3 billion in bonds were cut between the two countries this year, which suggests possible problems.

Why Is China Moving Away From the Dollar?

China is the world’s largest holder of foreign exchange reserves worth about $3.2 trillion in April this year. Of these bonds, about 60% are U.S. dollars, showing that the country has a lot of U.S. reserves.

However, the year’s first quarter showed that China is moving away from the U.S. dollar. Its stash of U.S. treasuries was reduced to less than $40 billion, and the agency bonds also fell to $10 billion.

China’s Strategic Move

It is evident that China is moving away from the U.S. dollar after cutting several financial ties this year. The country is looking to strengthen its financial portfolio with many other countries located in different parts of the world.

This strategic tactic will be used to increase the value of China’s currency, the yuan, and could benefit the country greatly in the future. However, the U.S. could suffer a lot from this move.

ALSO READ: Chinese Youth Are ‘Revenge Saving’ While Gen Z Globally Accumulates Debt

What Does De-Dollarization Mean for the U.S.?

As China continues to move away from the U.S. dollar, causing problems for the country, many wonder if this offloading action is a deliberate move to devalue the U.S. dollar. This is because the offloading has continued to reduce the dollar’s power and, in turn, increased the strength of the Chinese yuan.

Belgium, which holds a large portion of China’s debt, has also reportedly cut off more than $20 billion of treasuries this year, causing further problems.

China Is Still Struggling Against U.S. Dollar

According to several reports, the Chinese yuan is still struggling against the U.S. dollar. This year, it has been at a seven-month low against the U.S. currency.

Moreover, the Chinese currency has fallen by 2.1% against the dollar throughout the year. Therefore, this shows that the Chinese currency is also not in its best form and further explains why its government is looking for serious solutions.

Investing in Lower-Risk Assets

Asian countries are also looking to turn to gold, which carries much less risk than other types of assets. According to a report by F.X. Street, this plan kicked off in October 2022 when the People’s Bank of China added more than 30 tons of gold to its reserves.

Gold is a highly valuable asset, but it is less risky and not subject to debt securities when other countries do not follow through on bond agreements.

China’s Bonds’ Poor Performance

Another reason why China is moving to more low-risk assets is because its government bonds are not doing so well. In fact, the bonds were performing so poorly that the State Street Global Advisors (SSGA) closed its SPDR Bloomberg China Treasury Bond UCITS ETF in July earlier this year.

A representative shareholder said that the board does not “believe that [the yields] will increase materially in the near future and the fund is uneconomic to operate” and therefore decided to close them.

Low Security and Interest Rates

Since the U.S. is currently battling security issues and low interest rates, China is concerned about the future of its already low-performing bonds under a new administration. Since the interest rates are low, China is not making much money from these treasuries, which isn’t benefitting the country.

Therefore, it decided to look to other countries with higher interest rates, which would help the country’s reserves grow and flourish.

China’s Debt-Restructuring Plan With Other Countries

China is in a lot of debt, and its government has started reaching out to other countries with financial deals that could help them. However, Wall Street does not agree with these financial deals.

According to its experts, these deals do not serve the countries’ best interests. Instead, China alone will benefit early, to the detriment of the other countries.

ALSO READ: Where Are China’s Ultra-Rich Investing Their Wealth Amid a Stagnant Economy?

Is Dollarization Good for a Country?

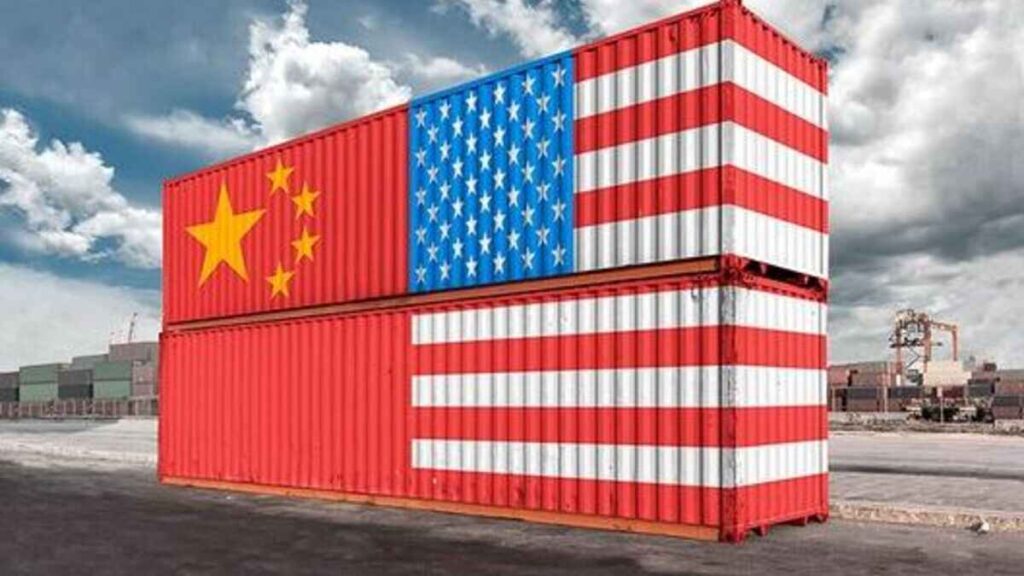

Dollarization can be good or bad for a country. However, in this case, it is not suitable for the U.S. According to Reuters, China’s withdrawal has forced Wall Street to start looking to replace its trade with China with other favorable countries.

Australia, India, and South Korea are three highly considered options for these new investments, even though they will unlikely fully replace China’s vast market scale.

Major Tariffs on Chinese Products

The U.S. has also made another significant move on global trade by imposing higher taxes and tariffs on Chinese products coming into the country. This is particularly highlighted in the case of Chinese electric vehicles.

Since many people are moving toward green energy, products imported from China are in high demand and are being taxed at a higher rate. These items include solar cells, aluminum, advanced batteries, medical equipment, steel, and many more Chinese products.

Is the U.S. Dollar Accepted in China?

Yes, the U.S. dollar is accepted in China. People who travel to the country can pay for hotels, food, and many other commodities in dollars. However, local markets and vendors may not accept dollars as a form of payment.

The U.S. dollar is not the only international currency accepted in Asia. Other currencies, like euros and pounds, are also widely accepted by major hotels and vendors. The price of all these items will increase if China continues to ditch the dollar.

You May Also Like:

Credit Card Debt Reaches Record $1.14 Trillion, According to New York Fed Research

5 Furniture Deals Where IKEA Outshines Costco

Advisor Recommends Seizing Stock Market Deals Now—Here’s What You Should Know

Top Wall Street Analysts Are Optimistic About These Dividend Stocks