Starbucks has made headlines by offering the incoming CEO, Brian Niccol, a staggering $10 million cash bonus and $75 million in equity awards totaling $85 million to make up for what he’s forfeiting with his departure from the burrito chain. This daring leadership change comes as Starbucks seeks to capitalize on Niccol’s proven track record at Chipotle.

Starbucks values attracting top talent to drive its future growth, and this deal reflects the high stakes involved in leadership transitions for major brands.

How Did Brian Niccol Become CEO of Chipotle?

The story of Brian Niccol’s rise to the CEO position at Chipotle is one of transformation and strategic leadership. Prior to joining Chipotle in 2018, Niccol was the CEO of Taco Bell, where he was successful in modernizing the brand’s aesthetic and cuisine to appeal to a younger clientele.

After a string of food safety issues, Chipotle was in serious need of a makeover and was drawn to his creative approach at Taco Bell. With a focus on digital growth and menu innovation, Niccol led the company through a period of rebirth, so his hiring signaled a big transition for Chipotle.

How Much Is Niccol’s Compensation Package at Starbucks?

Brian Niccol, Starbucks’s incoming CEO, will receive a base salary of $1.6 million, with the possibility of earning up to $7.2 million in cash and up to $23 million worth of annual equity awards.

In addition, Niccol will be compensated for lost benefits by receiving a $10 million cash bonus and $75 million (60% of which is based on performance and 40% of which is stock-based) in equity for quitting Chipotle. The equity will vest over a period of three to four years, subject to the company’s performance and Niccol’s tenure.

ALSO READ: Why Wall Street Believes Brian Niccol Can Revive Starbucks and Close the Howard Schultz Chapter

How Much Is Chipotle CEO Worth?

Brian Niccol’s net worth is estimated to be in the hundreds of millions by 2024, owing to his great work at Taco Bell and Chipotle. His pay at Chipotle, which consists of stock options, bonuses, and salary, has made a substantial contribution to his wealth.

Niccol’s ability to overcome obstacles and spur growth, along with his leadership abilities, adds value to these companies. He is one of the most sought-after leaders in the food and beverage sector, as proven by his recent salary deal of $85 million in cash and shares from Starbucks.

How Much Was Niccol’s Pay at Chipotle?

In 2023, Brian Niccol made $22.5 million in stock options and bonuses from Chipotle Mexican Grill, which included a base salary of $1.3 million, a cash bonus of $5.2 million, and substantial stock awards. Niccol’s pay in 2023 was $1,354 to the hourly wage of the average Chipotle employee.

Chipotle’s stock shot up by 773% while he was in leadership. Niccol receives a higher salary at Starbucks than his predecessor, Laxman Narasimhan, who was paid $14.6 million in 2023. Unlike Narasimhan, Niccol’s new role will be more flexible because he won’t have to move to Seattle.

How Does Niccol’s Compensation Compare to Other CEOs in the Industry?

Brian Niccol’s $85 million salary package is among the highest in the food and beverage industry, given the value placed on top executive talent. Compared to his contemporaries, Niccol’s compensation is significant, highlighting the competitive nature of obtaining experienced leadership in a dynamic market.

The compensation package is similar to the salary structures at other major companies, which include a mix of cash, stock, and performance-based incentives. This level of compensation is not uncommon for CEOs who are brought in to lead major companies through phases of transformation, as Niccol is expected to do at Starbucks.

How Much Cash Does Chipotle Have?

Chipotle has substantial cash reserves, reflecting its strong financial standing under Niccol’s leadership. As of the most recent financial filings, Chipotle had approximately $1 billion in cash and cash equivalents.

This significant cash reserve provides the company with the flexibility to invest in new technology, expand its digital capabilities, and enhance its menu choices. The strong cash position is also a testament to Niccol’s strategic management, which prioritized increasing profitability while maintaining a healthy balance sheet.

What Does Brian Niccol’s Move Mean for Starbucks?

Brian Niccol will take over as CEO of Starbucks on September 9 and will have to tackle the company’s dropping revenues as well as problems in its China operation. He will need to restore Starbucks’ premium brand image while appealing to budget-conscious consumers. In addition, he needs to address the company’s digital infrastructure, barista operations, and strained relations with the union.

If targets are met, his compensation package, which is largely equity-based and performance-based, may total $116.8 million in his first year. Niccol is well-positioned to spearhead Starbucks’ comeback despite these obstacles, having improved operations and increased traffic at Taco Bell and Chipotle.

Why Did McDonald’s Sell Its Shareholding in Chipotle?

Given Chipotle’s potential to become a big player in the fast-casual dining business, many were startled when McDonald’s decided to sell its investment in the restaurant chain back in 2006. McDonald’s, however, made the decision to focus on its core brand and streamline its operations.

McDonald’s was going through a makeover of its own at the time, and selling its Chipotle stock allowed it to reinvest in its primary business. While Chipotle’s stock surged in the years that followed, making the sale seem premature in retrospect, McDonald’s saw it as a calculated move that would have served its long-term objectives.

ALSO READ: Starbucks Implements Bold Strategy to Reverse Sales Slump

What Bold Leadership Changes Can We Expect at Starbucks?

Starbucks is ready for bold leadership changes that could completely redefine the company’s future under Brian Niccol’s leadership. With Niccol’s reputation as a transformative leader, it seems likely that digital innovation, menu expansion, and perhaps even a new approach to global markets will be prioritized.

His approach to leadership, which is defined by a willingness to take risks and challenge the status quo, aligns very well with Starbucks’ innovative culture. The company expects Niccol to lead with a bold vision and drive major changes that will influence Starbucks’ future in the coming years, which is reflected in the $85 million remuneration package.

How Will Starbucks’ Competitors Respond to this Leadership Change?

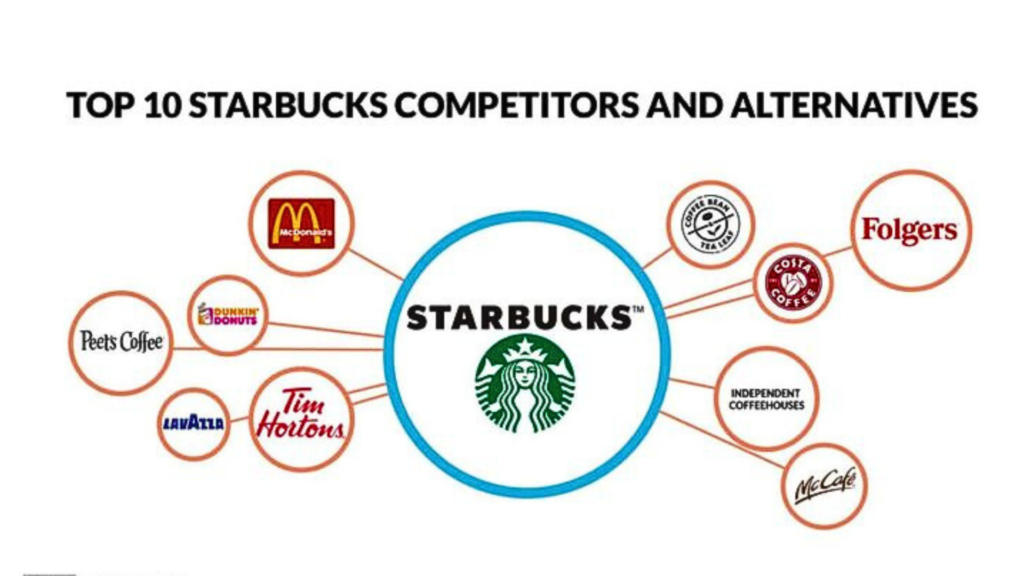

Competitors in the fast-casual dining and coffee industries will probably react to Starbucks’ appointment of Brian Niccol as CEO. Given Niccol’s track record of innovation and growth, other businesses will feel pressure to improve their strategies to stay competitive.

Starbucks’ audacious move to restructure its leadership, coupled with a hefty benefits package, indicates a new phase of competitiveness in the industry. Starbucks’ aggressive move to draw in top talent may prompt competitors to strengthen their own leadership teams or step up their innovation initiatives.

What Does the Future Hold for Chipotle Without Brian Niccol?

The future of Chipotle under its new leadership will be closely monitored as Brian Niccol leaves to work at Starbucks. The person who succeeds Niccol will need to maintain the momentum he created while navigating fresh obstacles in the fast-casual dining industry.

Chipotle has a great foundation because of its established brand and good financial position, but it will be important to continue on Niccol’s path of innovation and growth. The leadership transition at Chipotle will be a key factor in determining whether the company can maintain its recent successes and continue to thrive in a competitive market.

You Might Also Like:

Annual Inflation Rate Eases to 2.9% in July, Hitting Lowest Point Since 2021

Taco Bell Revives Fan-Favorites with New ‘Nostalgic’ Menu

Why Wall Street Believes Brian Niccol Can Revive Starbucks and Close the Howard Schultz Chapter

Starbucks Implements Bold Strategy to Reverse Sales Slump

Mold Risks Continue to Impact Homeowners Insurance As Coverage Gap Worsens