The effect of inflation on small businesses is making business owners see things from a different perspective. The Federal Reserve and the economy at large made significant progress in reducing inflation throughout last year. While almost every demographic seems to accept that the rate of inflation has been reduced, one particular group is not convinced that prices are falling: small business owners.

What Is the Fed Saying About Inflation?

Recently, Federal Reserve Chair Jerome Powell made an important admission. He admitted that after three months of unsatisfactory data on inflation, there has been no further progress this year.

At first, only business owners disagreed with the notion that inflation was reducing when every other demographic agreed. However, recently, more influential parties are starting to agree with what small businesses have been saying.

They are beginning to agree that inflation is not decreasing as quickly as they hoped. Market traders, who once expected about six interest rate cuts by the Federal Reserve, now expect one or two at most.

ALSO READ: Annual Inflation Rate Eases to 2.9% in July, Hitting Lowest Point Since 2021

How Does Inflation Affect Small Business Owners?

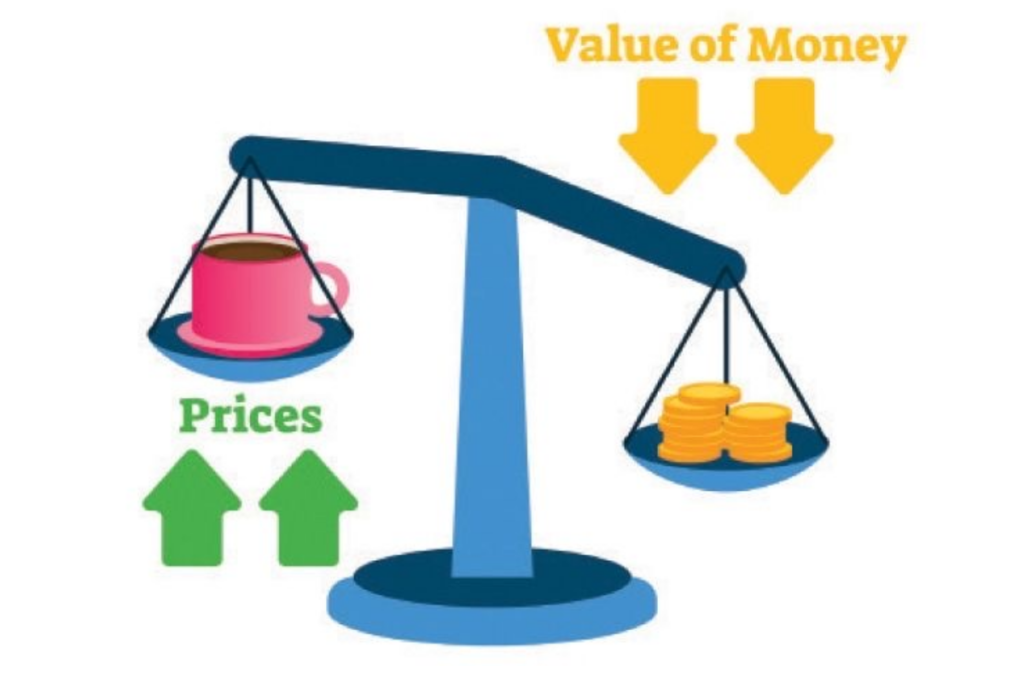

The impact of inflation on small businesses is a major issue. Inflation affects small businesses by increasing the cost of goods, services, and wages. Every business has a cost of production, and to be profitable, its profit has to be more than its cost of production.

However, when there’s inflation, the prices of raw materials, inventory, utilities, and other things needed for production will rise. This problem will cause small businesses to face the challenge of maintaining profitability, especially when they cannot pass the cost onto their customers.

Rising inflation means a higher cost of living; therefore, workers expect increased wages to keep up with inflation. While it is necessary to maintain a stable workforce, higher wages will only increase the operating expenses of small businesses that are already operating on tight margins, putting a lot of pressure on them.

Although increasing the prices of the goods and services they offer consumers is an option, it should also be noted that inflation also reduces consumers’ purchasing power. This is another effect of inflation on small businesses. Reduced purchasing power means consumers have less disposable income, which can reduce their sales.

Other effects of inflation on small businesses include cash flow problems and higher interest rates. In the long run, the economic instability that inflation causes can reduce the ability of small businesses to expand, leaving them more vulnerable to downturns.

How Have Small Business Owners Reacted to the Current Inflation?

Small business owners have been frustrated with inflation for some time, and the frustration keeps growing. According to a small business survey for the second quarter of 2024, only 24% of small business owners now believe that inflation has peaked.

This number has reduced compared to the last quarter of 2024, when 29% thought this. Meanwhile, 75% expect inflation to continue rising. The percentage of small business owners who believe this increased from 69% in the last quarter.

Small business owners are essential to the economy. Still, according to Lara Belonogoff, senior director of brand management and research at SurveyMonkey, the data shows that they still have doubts about overcoming inflation. The survey was conducted online from April 8 to 12 this year. The correspondents included 2,130 small business owners across the nation.

Although the market might have reacted positively to Jerome Powell’s comments after Wednesday’s Federal Open Market Committee (FOMC) meeting, some didn’t. Small businesses’ confidence in the Fed has significantly reduced. Last year, about 35% of business owners expressed their confidence in the Fed; that number has now fallen to 31%.

ALSO READ: Inflation in the U.S. Falls by 0.1% With a Similar CPI Drop

How Do Businesses React to Inflation?

Businesses react to inflation by using various strategies. The objectives of these strategies are to manage increasing costs and maintain profitability. One way companies respond to inflation is to raise the prices of their goods and services. This approach, however, can reduce consumer demand.

Another approach is to cut expenses by negotiating better deals with their suppliers. This approach enables small businesses to reduce production costs and offer customers affordable prices.

Some small businesses tackle inflation by entering new markets or finding another market target to increase revenue. Inflation can also cause small business owners to offer discounts or special deals.

How to Survive Inflation as a Small Business

Small businesses can do various things to survive inflation. They can monitor their cash flow closely. Small business owners can check and remove unnecessary expenses to help lower their production costs.

Small businesses can also adjust their prices strategically. Instead of suddenly introducing inflated prices to their customers, they can do it gradually over time. Slowly, they can offer more affordable options in smaller quantities.

To effectively manage the impact of inflation on small businesses, owners can diversify their sources of revenue. They shouldn’t rely on one source of income during inflation. They can expand their sources by entering a new market, offering new products and services, or using online sales channels.

Small business owners can strengthen their relationships with consumers by offering loyalty rewards and better customer service. They can also hedge against inflation by partnering with their suppliers and locking prices through long-term contracts. Owners can also mitigate the effect of inflation on small businesses by investing in assets that can hold their value during inflation, such as real estate or commodities.

You Might Also Like:

WeRide, China’s Self-Driving Startup, Delays U.S. IPO as Deadline Approaches

How Total Costs Compare and Why Location Matters for Owners of Gasoline and Electric Cars

Philadelphia Fed President Harker Calls for Federal Interest Rate Cut in September

Global Bond Traders Look for Protection Against Inflation Risks