Robinhood, an app used to trade stocks, has recently added a new feature. This program is a share lending program that helps people make extra money from the stocks they already own. It lets users lend their stocks to others who want to borrow them.

After two previous attempts to enter the market, Robinhood launched in the UK last November. Now, it is developing a new feature that would allow retail investors in the country to lend their stocks to those who are interested in borrowing.

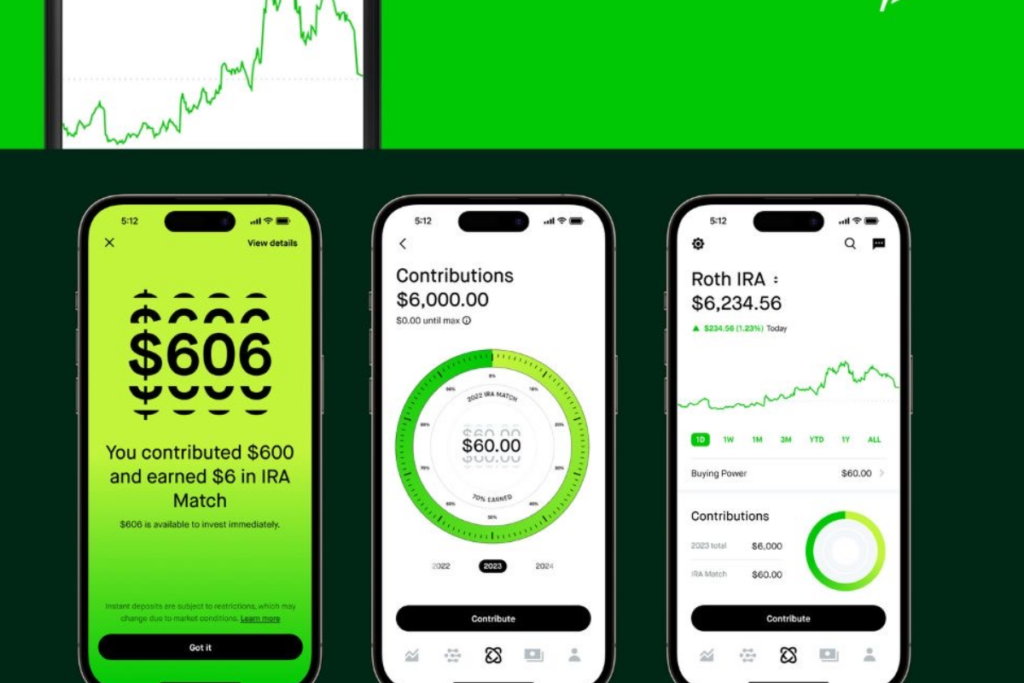

Robinhood New Feature Launch

Robinhood’s new feature can be likened to an individual renting out their property to someone and getting paid for it. For example, an individual can lend out their stocks, and the person borrowing them, usually a financial company, will pay a monthly fee.

These companies borrow stocks for various reasons. Some reasons include completing trades, betting on declining stock prices, or protecting themselves from risks. However, when an individual lends out their stocks, they own them. This means they can sell them whenever they want to. Also, if the stock prices go up or down, the changes remain theirs.

Robinhood handles this feature by treating the borrowed stocks as collateral and receiving interest payments from people who borrow them. They then give this money to the lenders every month. If the stock earns dividends, the lender can still get the money, usually from the person borrowing the stock.

According to the online brokerage platform, individuals who lent out their stocks can sell the lent stocks at any time. Once the sale is done, the individual can take out their money. However, Robinhood mentioned that it is not always guaranteed that a person’s stock will be borrowed.

ALSO READ: Xpeng Launches Affordable Mass-Market EV Car With Basic Driver-Assist for Under $20,000

Robinhood Taps Into Niche Market With New Share Lending Feature for UK Users

Jordan Sinclair, the president of Robinhood UK, explained the situation. He said this new stock lending program is another way for people in the UK to earn money without having to do much. He also said they are excited to keep making it easier for an average person in the UK to get involved in the financial system. This feature is now available on the Robinhood app.

Share lending is uncommon in the UK, even though some companies offer it. Firms like BlackRock and Interactive Brokers have programs that let people lend out their stocks. When companies in the UK offer these programs, they usually give their customers half of the money made from lending the stocks. The offer is way more than Robinhood offers, just 15%.

It is essential to know that share lending can be risky. This is because the borrower might not be able to pay back the value of the stock. However, the stock trading platform says it has a plan that can make share lending less risky. They will keep cash equal to the value of the borrowed stocks in a separate bank account.

This way, if the borrower can return this stock, customers should still be able to get the money back. Robinhood holds this cash with Wilmington Trust, which uses JP Morgan Chase to manage the account.

According to an expert, Simon Taylor, the risks of Robinhood’s program seem low. This is because Robinhood carefully chooses who can borrow the stocks. The experts also said that most people using Robinhood’s shares might not fully understand how it works. However, Taylor says it’s easy to make extra money from stocks people hold onto anyway.

Is Share Lending a Common Practice?

Big financial companies do share lending, but now it is becoming available to the average person. The Robinhood new feature app has more functions and could test how open UK regulators are to new financial products. UK financial regulators normally have strict rules to protect investors in the U.K. market. These rules make sure they understand the risks of what they are doing.

According to the guidance published on the FCA website, firms must be open and honest with people who want to trade under Britain’s Financial Conduct Authority’s consumer duty rules. They must avoid causing harm and support investors’ ability to pursue their financial goals.

Still, Robinhood’s move is also a chance for the online brokerage platform to try to build its presence in the U.K. stock market. Apart from some European countries, the U.K. is the only big market for Robinhood, along with the U.S.

ALSO READ: JD.com Shares Rise on $5 Billion Buyback Announcement, Bucking Hang Seng Downtrend

Robinhood and Other Online Brokerage Platforms in the UK

Robinhood’s new feature comes as other domestic trading firms in the UK have faced difficulties over the years. Hargreaves Lansdown has been struggling. A group of investors recently bought it for £5.4 billion, about $7.1 billion. The acquisition was made by a group of investors, including CVC Group.

Hargreaves Lansdown faced regulatory changes and struggled because of new competitors, including Revolut. The expectation of falling interest rates was also a challenge. Unlike Robinhood, which doesn’t charge fees to trade stocks, Hargreaves Lansdown charges various fees for buying and selling shares on its platform.

You Might Also Like:

Supermarkets and Beauty Retailers Face Backlash Over ‘Murky’ Loyalty Pricing Tactics

Oil Giant Petrobras Brazil Accesses Global Markets With Dollar Bond Sale

Parents Turn to Second-Hand School Uniforms as Back-to-School Costs Hit £422

The New Tesla Truck Stands Alone in Its Category, for Better or Worse

How Elon Musk’s Endorsement of Trump Might Have Backfired