Planning a wedding can be a very exciting experience, but if you’re not careful, it can be overwhelming and affect your finances. Many couples dream of a perfect day, but wedding expenses can become unmanageable without proper planning and budgeting. It’s easy to get carried away by the romance of it all, and if you’re not careful, you could end up making costly wedding budget mistakes that will cause you to suffer financially long after the honeymoon is over.

This article explores the ten most common wedding budget mistakes couples make and, more importantly, how to avoid them.

1. Not Setting a Realistic Wedding Budget

One of the most common wedding budget mistakes you can’t afford to make is failing to set a realistic budget from the beginning. It can be tempting to start planning your dream wedding without considering the expenses, but doing so can lead to overspending.

To avoid this, sit down with your partner and determine how much you’re willing and able to spend. Take into account any savings or contributions from relatives and set a clear limit on what you’re prepared to pay.

2. Not Prioritizing

Another common wedding budget mistake couples make is forgetting to prioritize. By creating a priority list, you can save more money for the things that are most important to you and avoid having to make sacrifices at a later stage.

Sit down with your partner and make a list of the top priorities. This list should contain items or plans you can’t afford to settle for less. After that, you’ll be better positioned to decide which vendors are worth spending money on and which ones you can go without.

3. Not Discussing Who Is Paying for What

If you haven’t had this conversation yet, you better start now. You need to establish where the wedding funds will come from, who will pay for what, and how you will divide the wedding expenses.

Every couple has different circumstances; some may receive money from their family as a donation for their wedding budget, while others have to cover everything themselves. The planning process will be much easier once the decision on who is paying for the wedding has been made.

ALSO READ: ‘Micro Weddings’ Are the New Trend as Couples Cannot Afford Inflated Wedding Prices

4. Ignoring Hidden Costs

It’s easy to focus on the major items like the dress, venue, and catering, but many couples overlook hidden costs like service fees, taxes, tips, and overtime charges. These unexpected expenses can add up quickly and drain your budget.

To avoid this, ask for a complete cost breakdown and read the fine print when getting vendor quotes. Remember to set aside 10-15% of your budget for unexpected expenses.

5. Overspending on the Wedding Venue

The wedding venue is often one of the biggest expenses, and many couples blow their budget by choosing a venue that is too expensive. While it is tempting to go beyond to get a beautiful location, it’s essential to consider how much of your total budget the venue would consume.

To avoid this, look for flexible venues that allow you to bring in your vendors or provide in-house catering at a fair price. Be sure to compare several venues before making a decision, and don’t be scared to negotiate prices or ask for package deals that can save you money.

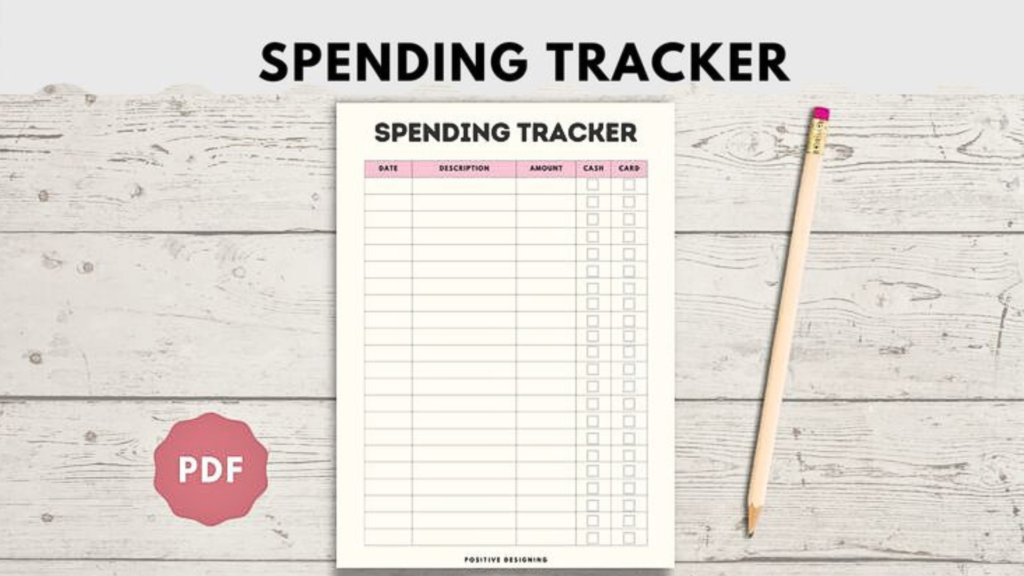

6. Forgetting to Keep Track of Spending

It is easy to lose track of how much you’re spending when there are so many aspects involved in wedding planning. Small purchases like decorations, bridal party gifts, or dress alterations may seem small initially, but they can add up very quickly.

To avoid this, use a budgeting tool or spreadsheet to keep track of every expense, no matter how small. Review and adjust your spending to stay within your budget. To answer how often you should review your budget, you should check it at least once weekly to stay on top of your expenses.

7. Underestimating Food and Drink Costs

Underestimating the cost of food and drink can easily blow your budget. Couples sometimes forget to factor in extras like alcohol, hors d’oeuvres, or late-night snacks.

To avoid this, stick to a menu that fits your budget and avoid overspending on unnecessary extras when choosing your catering option. You can also consider a buffet setting instead of a sit-down meal or limit your bar options to a few signature cocktails instead of having an open bar.

8. Inviting Too Many Guests

Your guest list can directly affect your wedding expenses, from catering and seating to invitations and souvenirs. Inviting too many people and underestimating the cost of each extra guest is another big wedding budget mistake.

To avoid this, choose your guests carefully. Although inviting only a few people may be challenging, having a small wedding might help you reduce your overall expenses. Focus on inviting close family and friends, and if needed, consider hosting a separate celebration for extended family.

ALSO READ: This Expert Tip Is the Best Way To Cut Your Wedding Guest List

9. Buying Items Instead of Renting

Paying for your wedding set-up from top to bottom instead of renting the items you’ll only use once is a big wedding budget mistake. It is not practical to buy 70 candle holders, vases, or table napkins. What use will they be after the wedding day is over?

Even if you want to keep them for sentimental value, you can buy only a few and rent the others. This move will help you cut costs and save extra money to channel to other aspects of planning the wedding.

10. Not Having a Clear Contract for Wedding Vendors

This sometimes occurs when couples try to cut costs by hiring family or friends to provide wedding services on their special day. This might be because they’re getting a discounted rate or offered for free as a wedding gift.

This might be okay, but a lack of contract could lead to problems later on and cost you money. Though it may seem insignificant initially, you should always have exactly what you and your vendor have agreed to for the wedding in writing.

Remember, setting a realistic wedding budget, tracking every expense, and being mindful of hidden costs are crucial to managing your wedding expenses. Avoiding these wedding budget mistakes will help you begin your married life on solid financial ground.