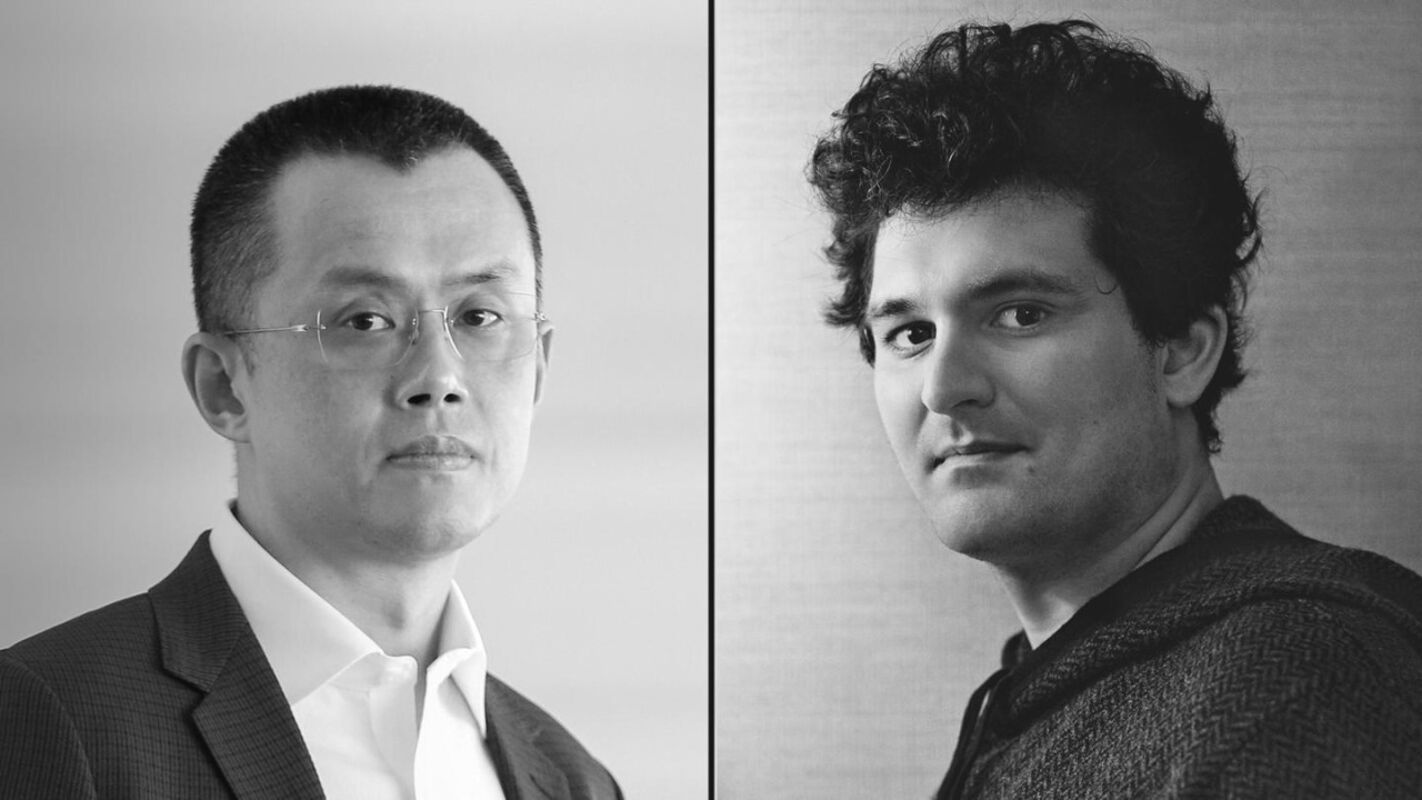

FTX files a lawsuit against Changpeng Zhao, the former CEO of Binance, and the company itself. The legal proceedings intend to receive compensation for a good deal gone sour that FTX exchange had with Binance in 2021. Whatever compensation FTX gets from this lawsuit would go to investor claims.

We’ll be sure to update you on how the investor claims litigation pans out. However, breaking down and understanding the motivation behind the battle between these two former crypto exchange confederates is essential.

Allegations of Fraudulent Share Deal Involving FTX and Binance in 2021

FTX filed the class action lawsuit at a Delaware court on Sunday, November 10, 2024. The lawsuit claims that Binance, under Zhao’s then leadership, made fraudulent financial moves in 2021 while trying to liquidate its digital assets in FTX.

Specifically, the fraud allegations against Binance include reselling a 20% stake in FTX and another 18.4% stake in an affiliate firm, West Realm Shires, back to the holding company. The bone of contention in this lawsuit is not that Binance sold out digital assets to FTX but that the transactions were bogus and illegitimate. After FTX went bust, some regulatory scrutiny was triggered.

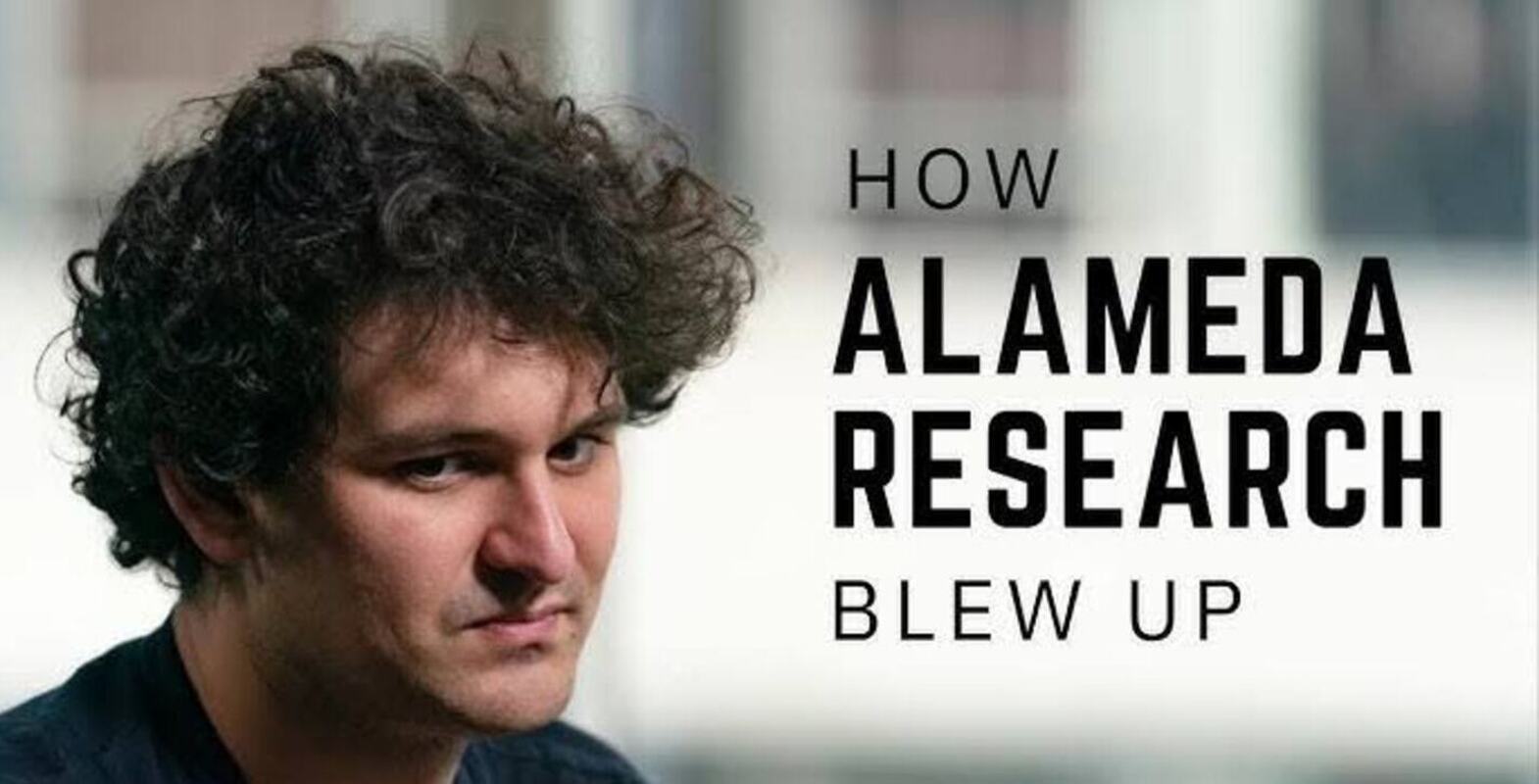

FTX Claims Insolvent Alameda Research Funded the Share Repurchase

In a string of new revelations, FTX filed a lawsuit claiming that Binance was not entirely forthright in the share buyback deals. For one, the class action lawsuit suggests that the transaction was funded with exchange tokens jointly owned by FTX and Binance under the FTX Alameda Research division. Binance also used its dollar-pegged stablecoin to fund the transaction. However, the involvement of Sam Bankman-Fried’s Alameda is the major bone of contention.

For more perspective, the lawsuit explains that as at the time of the share transfer, jointly funded by Almeda and Binance, the former was in a ditch of financial losses. A portion of the lawsuit reads, “Alameda was insolvent at the time of the share repurchase and could not afford to fund the transaction.”

Binance Yet to Respond to Latest Legal Claims

So far, Binance has not responded legally to the FTX lawsuit’s claims. However, a recent statement by the crypto exchange giant affirms that the lawsuit is baseless and that Binance is ready to fight the accusations in court.

Anyone familiar with the cryptocurrency industry from a few years back would remember that FTX and Binance were jolly good corporate fellows. The two companies had many service integrations and partnerships until things started falling apart. FTX, the former behemoth that used to be $32 billion strong, suffered major reverses that rocked the global crypto market.

Background: Sam Bankman-Fried’s Conviction and Impact on FTX’s Collapse

Things fell apart for FTX in 2023 when the company suddenly found itself struggling to keep up with a fast stream of customer withdrawals. FTX became insolvent in November 2023 after a court found its co-founder, Sam Bankman-Fried, guilty of seven counts of fraud allegations.

The lawsuit was primarily a probe into how Bankman-Fried handled FTX’s bankruptcy and his alleged mismanagement of customer funds.

Interestingly, the legal accusations of sharp financial practices were not peculiar to Bankman-Fried alone. The FTX co-founder was slammed with a 25-year jail term after being found guilty of the seven-count charge leveled against him. However, a month after Bankman-Fried’s sentencing, Binance’s Zhao also pleaded guilty to charges that border on violating US financial regulations.

ALSO READ: Another Fast Food Chain Facing Lawsuits Declares Bankruptcy

Broader Implications for Governance and Transparency in the Crypto Industry

In Zhao’s case, his 2023 lawsuit involved accusations about breaching the US Bank Secrecy Act, after due regulatory scrutiny, by not instituting an in-house mechanism to discourage money laundering among users of Binance services.

As FTX files a lawsuit against Binance, there’s more to the accusations than financial losses and misappropriation. The litigation also accuses Zhao of complicity in the bankruptcy and collapse of FTX. The lawsuit suggests the former CEO “triggered a predictable avalanche of withdrawals at FTX” through “a series of false, misleading and fraudulent tweets.”

The accusations against Zhao regarding inciting FTX users cite two particular tweets. One was from November 6 and reads, “Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won’t pretend to make love after divorce.” It is suggested that this tweet triggered an avalanche of panic withdrawals by FTX crypto customers.

In another X thread from 2023, Zhao said: “As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have [come] to light, we have decided to liquidate any remaining FTT on our books.” Consequently, these legal proceedings are far from over.