Ana Teresa Solá is a personal finance reporter who currently works for CNBC. Solá has ample knowledge about the dynamics of personal wealth, having once interned with Bloomberg News as an equities reporter.

Solá carved a niche for herself by first obtaining a bachelor’s degree from the University of Puerto Rico. She later had her graduate studies in bilingual, business and economic reporting.

A Gen Z Makes an Issue of Becoming Financially Free

At the beginning of 2024, Solá set out to give more priority to her savings. To pursue this goal with discipline, she has deployed a number of helpful strategies.

Solá is not a doomsday prophet, but she is always on the lookout for a bleak economic future. So, she looks to do everything she can to prepare adequately for such a future.

Telltale Attributes of a Gen Z

The average Gen Z tends to live at the spur of the moment. They work hard and play hard, and something similar seems to play out in their finances.

It is not entirely Gen Z’s fault that they live this way. Every day, we see in the news how crises, both natural and man-made, erupt around the world.

Making Use of Financial Enlightenment

So, most Gen Zs would rather utilise their resources, now, than lose it in an economic or diplomatic depression. However, one thing Solá does differently is being intentional with her money.

Of course, she questions the necessity of accumulating savings, like many of her peers. However, Solá has come to conclude that it all boils to perspective, because her exposure helps her to know better.

Boarding Up for the Future

So, Solá has made a resolve to put aside money for the future. While she is not entirely sure of what these savings would go to in the future, she has earmarked some potential outlets for the fund.

For one, it could help her remedy an emergency. Likewise, she could fall back on it as a retirement fund, or even use it to save herself the headache of longhaul mortgage payments.

How Liberating Information Can Be

Despite being in the process of paying off her student loan debt, Solá is still optimistic enough to visualize herself becoming a future philanthropist, after amassing enough wealth.

However, she does admit that her role as a personal finance reporter has made her aware of many fascinating ways to get out of debt, and build wealth rapidly.

Unboxing Two Saving Tools

So far, Solá has identified two savings accounts that can help grow her wealth and she has been proactive enough to exploit their functionalities.

One is the Roth IRA account, and the other is the high-yield savings account. Solá is vouching for these two financial tools as a smart choice for any Gen Z. According to her, they are surefire routes to grow your savings over time.

The Roth IRA

Many people remain unaware of the functionalities of a Roth IRA. That name in itself means Roth individual retirement account.

Unlike other retirement funds that permits workers to lump up taxes and penalties until they are ready to withdraw their funds, the Roth IRA requires you to pay taxes as you go. So, all deposits into the Roth IRA are tax-free.

How to Grow Your Wealth, Tax-free

By implication, as the funds in the Roth IRA grows over time, there is no fear of parting with huge taxes and levies at the point of accessing your retirement benefits.

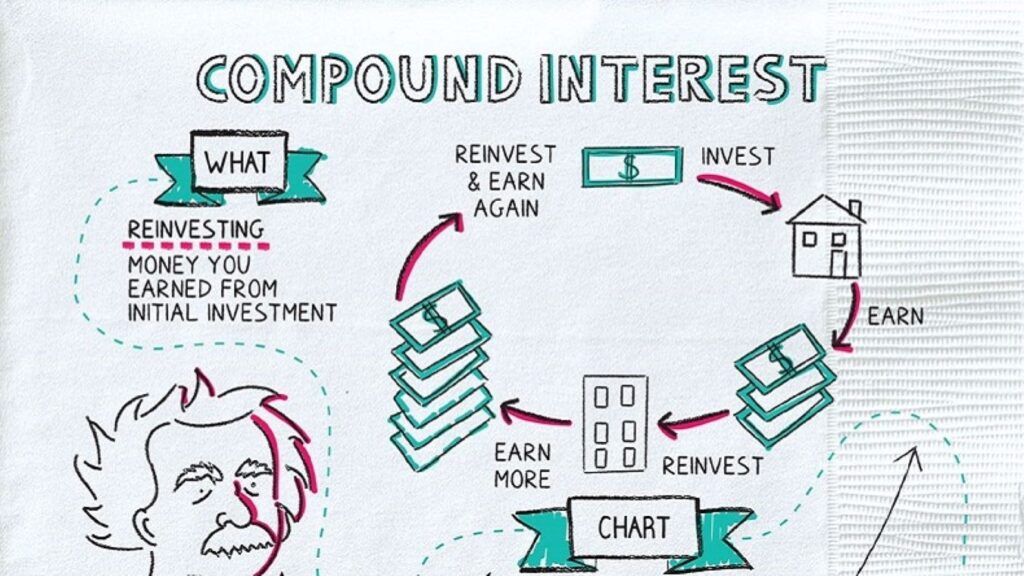

Furthermore, it is a great tool for young people in the Gen Z niche who are just starting their careers. Netting a low income is inconsequential as the Roth IRA combines the forces of time and compound interest to grow their savings.

Save While Uncle Sam is Not Hounding, Yet

Another advantage of a Roth IRA as a Gen Z saving tool is that it allows them to save on their income at a low tax rate. The more they save at this point in their career, the better.

Why? Relative to later in their career when they would earn more and pay higher tax rates, early savers tend to recoup more of their income, dollar per dollar.

Taking Savings Advice from a Qualified Gen Z

Clifford Cornell is an associate financial adviser at Bone Fide Wealth and also a certified financial planner. But above all, he is a Gen Z.

Cornell has this to say about the Roth IRA, “For younger professionals, the Roth IRA is an incredible savings vehicle, because given our earnings, it’s very likely that we’re not being taxed at the highest rate.”

Young Savers Can Mould Their Financial Fate

Roth IRA is the go-to tool for young savers as it affords many benefits. Unlike other retirement plans, savers can access and withdraw their funds after a buffer period. Also, these withdrawals come with no penalties.

So, the Roth IRA is a two-pronged saving tool, one as a long-term retirement account and as a panacea for unexpected emergencies.

Pay It Forward or Back

Solá also proceeds to share some strategies she learned to adopt while opening her Roth IRA account. One is that “Investors can make deposits for the previous year, even in a new one.”

For example, you can make deposits for 2023 up until April 2024, which marks the end of the 2023 tax year. Likewise, you can equally start your 2024 savings in the same time frame.

Eat Your Cake and Have It

Another benefit that comes with a Roth IRA is that it comes with credit functionality. Pending the time a saver qualifies to start drawing their tax-free savings, the low- or moderate-income Roth saver can have access to credit.

Their savings serve as collateral, and they may be granted credit up to 50% of the total amount in their Roth IRA account.

Roth IRA, the Landing Ground

Finally, Solá also rings a bell for every young person looking to open a Roth IRA account. She once made a mistake and wants others to avoid it.

There’s more to a Roth IRA than just depositing tax-free cash and leaving it to sit there. You still need to invest the fund before the interest can start compounding.

Investment Advise for Roth Savers

There are tons of investment products for a Roth IRA account holder to key into. However, there are some key factors to consider before initiating such investments.

The first is, “How familiar are you with investing, and would you like to handle your portfolio yourself?” The Second is, “How tolerant are you to financial risks?”

How to Manage Your Investment Portfolio

Your response to those questions will advise you on whether to consign out your investment choices and how aggressive you will be with your portfolios.

Often, young investors do not draw from their Roth for some decades. So, they can decide to be adventurous with their investments or to play it safe by allowing an account manager or robo-advisor to make investment decisions on their behalf.

The High-yield Savings Account

A 2023 survey conducted by Bank of America revealed that about 56% of young adults between the ages of 18 and 26 cannot survive on their savings for more than three months.

At one point, this estimation was true of Solá, too, but she decided to correct that anomaly. To do this, she opened a high-yield savings account.

Benefits of Going High-yield

A high-yield savings account allows you to make multiple penalty-free withdrawals per month, albeit with a cap. This saving tool can serve as your long-term stash and simultaneously act as an emergency nest.

However, there are some things to note as you proceed on the journey of wealth accumulation, using this account would yield fruits.

Heads Up!

One, there’s no compound interest magic happening here. Depending on the bank you open the account with, the interest rate is fixed and applies annually.

Second, the use of savings is taxable. For example, if you have $20,000 in your savings account, at an interest rate of 5%, $1,000 will be credited to your account at the end of the year. However, the IRS will tax any accruing interest above $10.