Until Attorney General Letitia James obtained a court order restraining the activities of an investment scheme, a Harvard Business School (HBS) graduate has been parading his investment proposals as legitimate.

However, it has been discovered that the mastermind merely ran a Ponzi scheme. A handful of HBS alums have entrusted their savings to him. One committed suicide after learning that he lost the $100,000 he invested in the scheme.

An Investment that Offers 900% Returns

According to James’ office, the scheme has successfully obtained a total of $2.9 million from alumni. The investment bait was a claim that the funds would earn returns of between 500% to 1000%.

In his pitch, Vladimir Artamonov, the scheme’s prime mover, claimed to know Berkshire Hathaway’s intended investment moves.

No More Profligate Spending

However, the attorney general has successfully obtained a court order restraining Artamonov’s fraudulent financial activities. The Supreme Court of New York, in Manhattan, has ordered freezing all bank accounts affiliated with him.

Likewise, Artamonov will be required to appear at the State Supreme Court on March 28 to present his defense on the allegations leveled against him.

HBS as a Rallying Ground

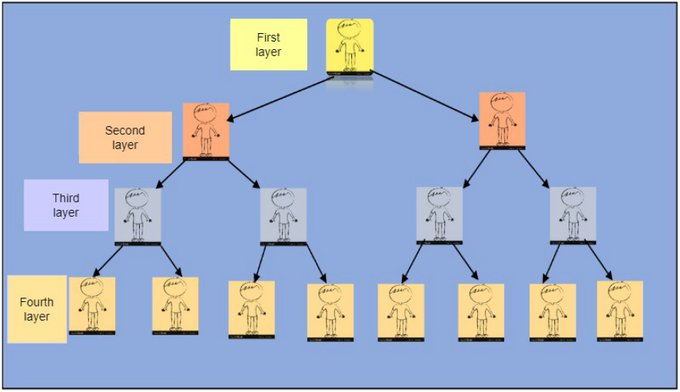

Artamonov won the trust of many of his victims thanks to their common affiliation with Harvard Business School. These investors were not only alumni of the school but also some of his associates.

So far, the office of the New York attorney general has confirmed 29 scheme victims. As stated earlier, the recurrent pattern is that most of the investors are HBS alumni.

Investment or Misinformation?

The attorney general’s investigations revealed that Artamonov invested the money he polled from his pitches. However, the short-term options he bought with the cash did not perform well, and he lost millions of dollars in investors’ money.

This was not the chiefest of Artomonov’s crimes, but his refusal to declare the loss is.

The Making of a Ponzi Scheme

After his massive loss, Artamonov proceeded to lure more investors into the scheme. His next step is astounding, as it moves to cover up the unprofitability of his investment scheme.

With the fresh cash injection from new investors, Artamonov proceeds to pay initial investors, building a sturdy-looking financial facade.

You Only Live Once!

The attorney general’s office also unearthed evidence revealing Artamonov’s debauchery, using investors’ money.

The records showed that he went on dining and shopping sprees and funded his many vacations and other personal expenses, all with money intended for investment and without the investors’ permission. Artamonov was quite audacious in using resources that did not belong to him.

Called Out By the Dead

Artamonov’s scheme would probably have continued cruising beneath the waves, with no disturbance, but for the reported case of a suicide.

With an undisclosed identity, the deceased party invested $100,000 with Artamonov in October 2022, making him one of the scheme’s initial investors. Unfortunately, Artamonov lost all the money to short-options trading.

Watering a Dead Seed

When the deceased asked Artamonov about the status of his investment, he claimed he had yet to invest the money and even tried to encourage the former to part with another $50,000.

The investor would later learn of the monetary loss, probably through constant urging, and proceeded to take his own life. Still, Artamonov was not ready to step off the gas.

Sustaining the Fraudulent Tempo

Even after the suicide, Artamonov continued pitching to new investors, shrouding the reality of his financial activities in a shadow of pretenses. He was assuring new investors of the scheme’s profitability while, in reality, he was only robbing Peter to pay Paul.

Artamonov would take money from fresh investors to reassure suspicious investors and pay the doubtful ones.

Exploiting Sentiment as a Tool of Manipulation

The attorney general of New York, Letitia James, made an official statement on her website explaining the reasons for Artamonov’s scheme’s short-lived success.

She said, “Even sophisticated investors can be conned by fraudsters, especially when personal relationships and networks are used to build a false sense of trust.”

How Not to Invest

Artamonov successfully lowered the defenses of his friends, colleagues, associates, and fellow alumni based on sentiments. He simply waved his status as an HBS alumni in their faces, and they let their guard down.

Despite trusting him and believing in the values HBS has impacted on him, many surrendered their life savings. However, they now regret ever dealing with Artamonov.

What Have You Got to Say?

So far, Artamonov has not been responding to communications from news outlets requesting his side of the story. Of course, his lawyers must have advised him against committing such a gaff, particularly now that the case is a subject of litigation.

However, the head of communications at HBS responded in an email that they were just learning about the development and would not comment any further.

The Qualifications of an Alleged Fraudster

In the official statement by the attorney general’s office, James explained that Artamonov studied at HBS and graduated in 2003 with a Master’s in Business Administration.

After graduation, Artamonov moved to New York and obtained a license to operate as a securities professional. However, he went full-time into what he called ‘the Artamonov Fund’ in September 2021.

Through the Grapevine

James’ office discovered that Artamonov had no personal relationship with most of his HBS investors. Instead, they were merely acquaintances whom he narrowed down through the HBS alumni network.

While the attorney general’s office has identified about 29 of Artomonov’s victims, they encourage any other victim to come forward with information that could help prosecute the case.