Upon hearing the alluring price of the Palm Springs property, a couple decided to schedule a tour. In the pictures they saw online, the house was supposed to have a swimming pool, which looked quite attractive.

However, after arriving on site, the prospective buyers were not quite impressed.

The Joy of Buying a New Home

First, the swimming pool was no longer as impressive as depicted in the pictures; its surface was covered with green algae. A casual inquiry with the broker revealed after arriving on site that the pool equipment had been stolen a while back.

This detail indicates that petty pilfering is normal in the neighborhood, but the buyer kept mum.

The Popping of Red Flags

Just as the group was about to step into the living area of the house to inspect the interior, a jetliner roared over the property. The buyers, who were unfamiliar with the neighborhood, looked on in disbelief.

The broker had no explainer for this and gave a disclaimer that the home is located in the flight path of a nearby airport.

Cashing Out Through House Flipping

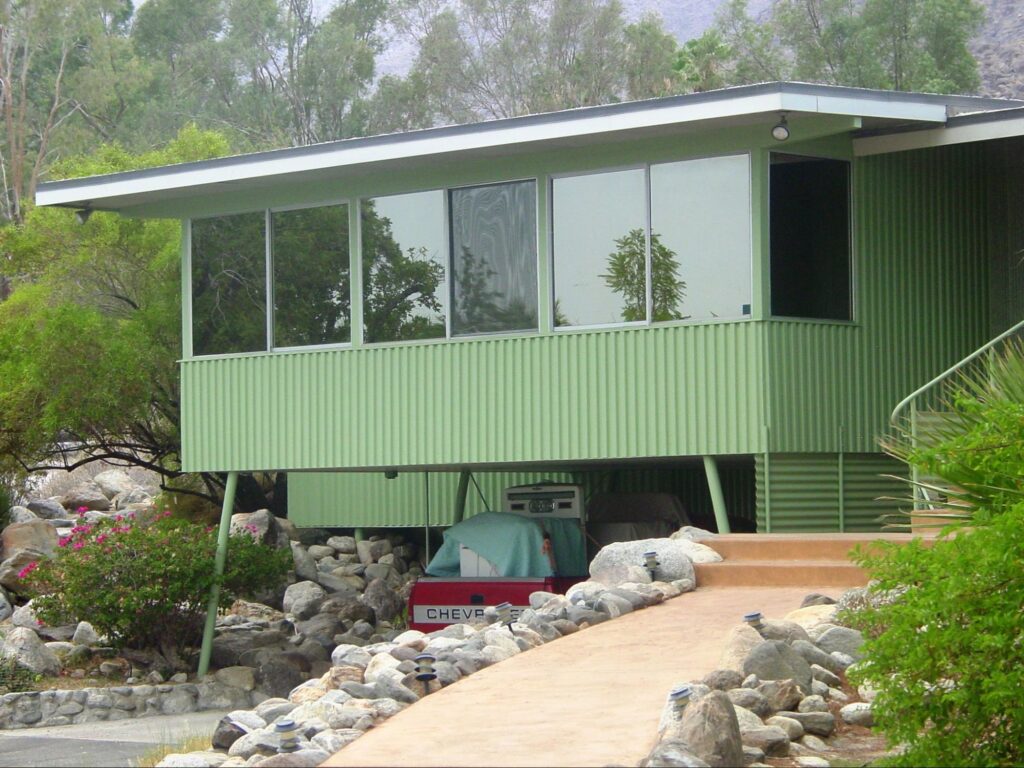

The prolific property spotlighted here is at 2190 North Deborah Road, Desert Park Estates, Palm Springs. In July 2021, an investment company specializing in real estate bought the house and all its trappings for $611,000.

The Sacramento-based company held onto the property till February 2023 and sold it for $1.3 million!

Having a Ready Market

For the 2023 sale, the house did not spend even a single day on the market before it was sold for the quoted price. This is a record amount for a house flip, particularly at a time when real estate sales were still recovering from the post-pandemic sluggishness.

However, things have gone south for the property as it is on the verge of a short sale, barely a year after the record flip.

Details of the Property

The Palm Springs property sits on a 1,242-square-foot lot. The property’s developer managed to squeeze a three-bedroom home into the available space and also outfitted a swimming pool.

Going by its 2021 standard, when some of the features, like bathroom, kitchen, and swimming pool, an average broker would value for around the $611,000 it sold for that year.

Some Details of How the Deal Went Down

A little investigation into how the modest Palm Springs property sold for $1.3 million in 2023 unveiled a trail that led back to William Green. Green, a real estate agent based in San Diego, served as the broker for both the buyer and seller during that deal.

He explained that he had a buy buyer and seller’s broker on the market.

Sharp Moves in Real Estate Deals

While the progression of that deal seemed shady, Green explained that buyers do it all the time. According to him, it is a ploy to gain an advantage over a property that is about to go on the market.

In such situations, the home buyer simply reaches out to all the realtors in the area of choice and strikes a deal before their choice property goes on the public market.

Real Estate Deals Outside the MLS

Green even added that many homes are sold this way without listing on the multiple listing service (MLS), where the public can see all the properties available for sale.

Interestingly, California real estate agents don’t quite support Green’s stand. Many of them feel the average buyer, most needing a mortgage, does not pose any form of threat to an entity willing to buy out a property in a single swoop.

Not a One-time Thing

It doesn’t stop there, though, as Green has been reported as being involved in a similar backdoor deal in the Desert Park Estates area. In the second instance, he sold the house at 2002 North Whitewater Club Drive for $1.4 million in March of23.

Similar to the first property, the seller bought this property a year earlier for $750,000.

Strictly Business

After a little prodding, it was discovered that the same buyer, an incorporated company that defaulted on the first house, was responsible for the purchase and recent sale of the other.

Like the first, the LLC installed a new bathroom, kitchen, and swimming pool and then short-sold the second house for $635,000.

Companies in Real Estate

When Green was confronted with these revelations, he feigned ignorance and said companies that dabble in real estate investments do that all the time. They mop up multiple houses in the same area and realize they can’t handle the portfolios. In the long run, they default and offload the properties at a shortfall.

Green also played another card to absolve himself of wrongdoing in the transactions.

The Anonymous Appraiser

Though he acted as both the buyer’s and seller’s agent in the deal, Green said he does not have the details of the appraisers. However, one thing he does know is that they are locals from the Palm Springs area.

Green said of the appraisers, “They were local and selected at random by the buyer’s lender.”

The Trend Persists

However, contrary to the price of these deals being sealed outside the MLS, Zillow lists properties in Desert Park Estates at an average price of $771,995. Zillow is a company that lists rental and for-sale properties.

So, it is disturbing for local real estate agents that random properties in Desert Park Estate are still selling between $1.2 million and $1.5 million.

Disruptions in the Pricing of Local Properties

The local agents are not too concerned about the backdoor deals being perpetrated in their neighborhood by LLCs. Instead, their chief concern is that the over-a-million-dollar sales are later posted on the MLS, which misguides regular buyers about how expensive properties are in the neighborhood.

Even a qualified appraiser, aware of the trend in the area, may get easily misled.

Take Nothing at Face Value

All that transpired between Green, the local real estate investors at Desert Park Estates, and the LLCs is all a wake-up call. Investing in real estate requires understanding the nuisance and taking nothing at face value.

If nothing, the banks funding the real estate deals of LLCs ought to be aware of this coming away from future real estate deals with a shortfall.

The Fading Star in Paradise

However, besides all the two-faced real estate deals unraveling in Palm Springs, the locale is an amenable suburb of California. The area has some historic prestige as it was once home to celebrities like Frank Sinatra, Lucille Ball, Liberace, and Bing Crosby.

The Coachella Valley also offers an attractive terrain for people who favor a laidback lifestyle.

The Last Glimpse of Lustre

For an outsider looking to buy a residential property in Palm Springs, the area may seem like heaven on earth. Yes, there are some really good deals, like cheap listing prices and huge discounts.

However, no amount of renovation can lift the shadow of desertion from the estates of Palm Springs.

Palm Springs Clamps Down on Airbnb

Green proffered an explanation about how a $611,000 property could sell for $1.3 million in a matter of years. During the recent pandemic, there was a short-term rental bust in the area. However, things are looking bleak in the post-pandemic drills that have people returning to the cities.

So, the oversized buyouts popping up randomly around Palm Springs reflect the city’s crackdown on Airbnb listings in the area.

The Business Potential in Economic Lows

Buyers see investment potential in the short-term rent crackdown and are out to flip the properties, hoping to turn the area into what Green calls a haven of ‘sober-living homes.’

Real estate properties in Palm Springs are great buys for out-of-town prospects. Green said, “They’re popping up all over the place. It’s not a popular investment strategy, but I’m seeing more of that.”.

Weighing Another Perspective

Another real estate broker, Madeline LaVoie, in Coachella Valley, offered a similar analysis of what is presently playing out in Palm Springs. She said the COVID pandemic is driving up real estate prices in the area, which is not a surprise.

A similar explosion in the value of properties was observed in the San Francisco Bay Area during the pandemic.

More Than Meets the Eyes

However, LaVine feels there is a mystery still begging to be unraveled, and it is unrelated to the COVID-19 pandemic. According to her, there is more to the spiking and crashing of property value in a locale within the space of three years.

Efforts have been made to reach the LLC involved with purchasing and selling the two spotlighted properties.

The Rise and Fall of Palm Spring Houses

Alex Dethier is the real estate agent who sold the North Deborah Road house for $611,000 in 2021. He said the random exploitation of the property spike was a good bargain if you were lucky enough to play your cards right during the 2022 peak.

However, Dethier affirmed that if the buyer who purchased the property for $1.3 million in 2023 had been his client, he would have advised them not to sign the deal.

The Desert Can Still Bloom

Another Coachella Valley broker, Stephen Burchard, said he would not discourage anyone from buying a property in Palm Springs. On the contrary, he suggested that the area has quite amenable properties.

However, Burchard strongly advises against relying on the words of an appraiser or agent. Visit the area. If possible, inquire about how many similar properties in the neighborhood sold recently.

Making Good Bargains in Investment

Making a good buy in a very bad area is possible. It may become a life-changing investment in posterity. No one knows what will become of Palm Spring in the coming year.

So, when you get a good offer and are disposed to buy, please do not refrain. Albeit, the due diligence part is very important. Ensure you are not paying an outrageous price for what later turns out to be a bad bargain.