The duo of Representative Ro Khanna of California and Debbie Dingell have proposed a legislative bill to the House.

The bill is called the “Made in the USA Tax Credit Act,” and its major goal is to encourage local and small enterprises to fly the Made-in-America flag.

Creating Enabling Environments for Local Enterprise

There is no better way to encourage local manufacturers than to create available markets in which they can sell their wares. Likewise, the market can only be made to favor these enterprises when American consumers prioritize their products over imported alternatives.

So, the Federal government will give $2,500 to individuals and $5,000 to individuals and couples, respectively, as tax credits for consuming locally made goods.

To the Rescue of Cottage and Family Industries

Examining the fine print of the ‘Made in the USA Bill’ reveals that the legislation is designed to favor small-scale manufacturers. So, the policy is designed to open up the local market to businesses with fewer than 500 employees.

Encouraging local businesses would equally naturally boost the economy and the standard of living of employees affiliated with that industry.

Not All Products Qualify

To discourage expatriates from importing parts or components of a product and then formulating or assembling it in the US, the bill has a clause to address such scenarios.

So, for a product to receive the stamp of Made in the USA, there are certain expectations. One such requirement is that the product must meet up to Federal Trade Commission (FTC) standards.

It’s All or Nothing

The clause states that a product must be “all or virtually all” made in the US to obtain a stamp of approval from the FTC and qualify for the tax credit.

So, an electronic gadget entirely manufactured outside the country but assembled and packaged in the US is not likely to qualify.

No Luxury or Contraband Goods, Please

Some products were particularly penned in the bill as excluded from the list of beneficiary products. These are vehicles, firearms, tobacco, and luxury goods.

This will ensure that the tax credit applies majorly to everyday consumer goods that will benefit all and sundry irrespective of their level on the personal income scale. This will likely stimulate the economy than products that are only purchased by the ultra-rich.

A Glimpse Into the Intention of the Representatives

Representative Dingell expressed optimism about the potential outcome of the bill if the House eventually ratifies it. She said, “Investing in American manufacturing drives innovation, prosperity, and progress.”

She further acknowledged her colleague’s contributions in pitching the bill before the necessary stakeholders. She feels that supporting smallholder and family-owned businesses will improve the quality and patronage of their local products.

All In the Service of the United States

Representative Ro Khanna is equally proud of the prospects that the Made in the USA bill will bring to reality.

During a statement, Khanna said of the bill, “It’s an important piece of what needs to be a sweeping set of policy actions designed to restore American manufacturing and technology leadership and a call to respect workers who will help our country achieve that goal.”

America’s Long-Declining Manufacturing Sector

There couldn’t have been a better time to revive America’s manufacturing streak than now. The decline has not rebounded for almost 20 years. It is even suggested that 70,000 factories, in the US, have closed down from 1998 to date.

The credit tax incentive is set to nip the decline right in the bud by reviving and growing the manufacturing sector in the United States.

The World War II Crossroad

The decline of local manufacturing capacity in the US is thought to have trickled down from the end of World War II. Right after the war ended, most workers downed tools, moved out of the factories, and became involved in rebuilding the infrastructural devastation of the country.

So, the manufacturing sector naturally became a victim of deindustrialization.

Building a Manufacturing Legacy After a Devastating War

While most countries were particular about improving their manufacturing technologies after World War II, the United States did not think it was a priority.

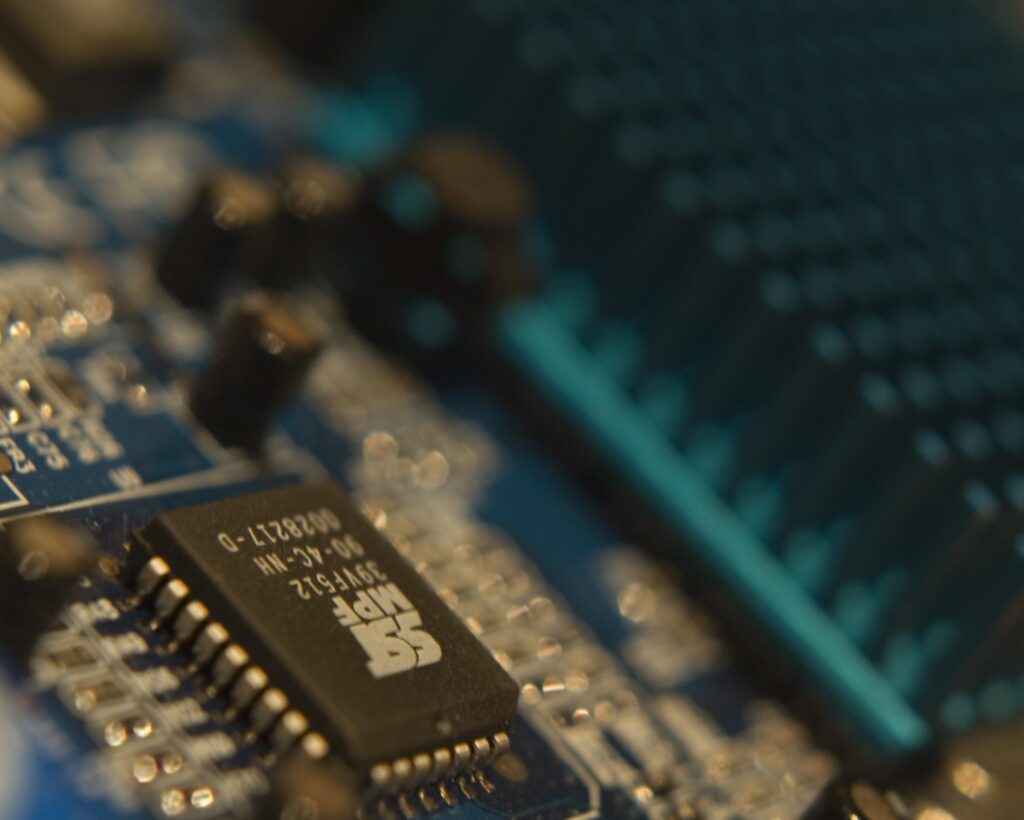

It was around this period that the likes of Japan started honing their potential in the manufacture of electronics. On the contrary, the United States was more reliant on imported products around the same period.

Going With the Ebb of Modern Manufacturing

By implication, this rapid transition of manufacturing technologies, over the years, seems to have caught the manufacturing sector in the US unawares.

Unlike the labour-centric manufacturing activities that the US was accustomed to before the war, the rest of the world has since moved on. Likewise, most of the local workforce lacks expertise in running the sophisticated machinery being adopted for automated manufacturing.

Are You Willing to Relocate?

Another factor that has caused the manufacturing sector to flounder is the unwillingness of skilled workers to migrate to take on manufacturing jobs.

This was not the case before WWII. The demography of entire communities would suddenly change when there are manufacturing employment prospects in some other parts of the country. However, the workforce of this era is not easily swayed.

Reviving the American Dream

Maybe it is safe to say the US briefly lost its American dream. Why? Because Americans used to be proud of their sovereignty, and their ability to build what was necessary to make the nation great, and a force to reckon with.

However, Americans seem to struggle to reconnect with that dream. So, they are trying to bring back the old glory through home-grown goods.

All About the Profit

Truth be told, beyond patriotism, every manufacturer is out to maximize profit. So, when opportunities to manufacture goods at cheaper unit rates surfaced, many manufacturers didn’t bat an eye before outsourcing the manufacturing portion of their enterprise. So, as soon as manufacturers discovered offshore alternatives for cheaper production, they didn’t think twice.

Since the 1970s, several industries have started practicing what we now know as outsourcing. Industries like steel, automotive, textile, etc., started moving to Latin America and Asia.

How Outsourcing Became a Thing

The reality of that time, the 70s, was that Asia and even some Latin American countries were experiencing phenomenal growth in their manufacturing sector.

Besides, some of these nations made their economy attractive for foreign investors to do business. They had a fast-growing transport infrastructure, and some even offered tax waivers to foreign businesses.

Labor at an All-time Low

To cap it all off, many of these nations that exploited the manufacturing vulnerabilities of the US also provided cheap labour to the companies looking to explore. Also, in some of these countries, running sweatshops was something that went on unchecked.

So, by the time the goods return to the US, they are much cheaper than those manufactured by competitors in America.

China’s Sudden Economic Boom

Taking China as a case study, the country used to be closed-off, culturally isolated and politically insulated. However, as manufacturing became a global phenomenon in the 70s, China equally made policy changes that threw open its doors to the rest of the world.

Soon enough, the one-time most populous nation experienced a massive boom in its manufacturing industries.

The Economic Reengineering of China

Meanwhile, China equally started somewhere, their government encouraged the growth and building of capacity among their cottage industries.

Naturally, this change in perspective on global trade brought about unprecedented and massive development in China’s economy. Reps Khanna and Dingell are looking to replicate something similar in the 21st-century United States.

Replicating the Capacity of Other Manufacturing Giants

Indeed, the math is not that simple, because the factors that prompted the economic renaissance of China may not be entirely replicable in the US.

The US also needs to build up its manufacturing capabilities before the manufacturing boom can be achieved. Countries like China, which drove up their economies through manufacturing, gave logistics the utmost priority.

The Technological Monopoly

For example, Taiwan has built so much capacity in the technological industry, that they are the leading force, and have perfected the process of manufacturing semiconductors. And they are not done yet, Taiwan is honing in on this strength.

Presently, Taiwan produces 60% of all the semiconductors used worldwide. It may be difficult for any other nation to compete with them in terms of microchips.

Beyond Bills, Patriotism is Also Essentially

All said, even if the Made in USA Bill scales through legislative readings and gets passed into law, it is still up to consumers to make it a success. Without local patronage, the scheme would suffer a natural demise.

However, not all Americans would be eligible to benefit from the Tax Credit; there are certain criteria that citizens have to meet to enjoy them.

There are Requirements for Intending Beneficiaries

First off, it takes individuals who earn less than $125,000 annually, and couples who earn less than $250,000 annually, to benefit from the Tax Credit.

Likewise, the investment income of beneficiary individuals and couples must be less than $20,000 and $40,000, respectively. This helps the government target middle-class and low-income earning Americans as beneficiaries.

A Dynamic Legislation

The new bill will come with a dynamic mechanism that allows economic adjustments. In light of prevalent inflation, the US government may decide to adjust benefit percentages accordingly.

Doing this will ensure that the scheme does not die on arrival. So, in the long run, the scheme would retain its economic potency and relevance.

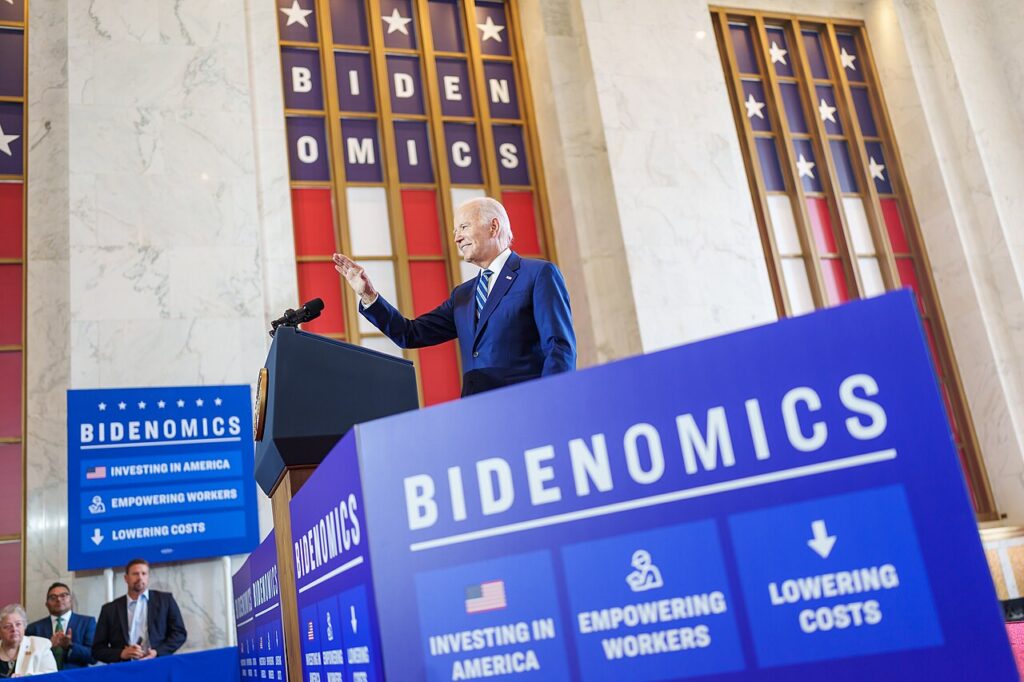

The Hurdles to Bidenomics

To become law, the Made in USA Act will have to be vetted by the House, Senate, and President Biden.

The scheme fits into the Bidenomics campaign. But Dingell insists that the goal has not changed. The manufacturing sector must be revived in the US, and its citizens must get well-paying jobs.