Some women may have built mini-cash reserves in the past without having a specific tag for them. However, the few women who have been practicing the tips outlined in this piece would agree that they are lifesavers.

While we cannot predict our financial future, it is possible to put coping mechanisms in place.

Saving On a Low Income

Not earning as much as you would love is no longer an excuse for financial instability. It is already an old gist that women earn relatively less than their male counterparts.

Of course, there have been campaigns to correct this imbalance over the years. Indeed, some major organizations have tried to eliminate the disparity, but it is hardly budging.

Hold ‘Motherhood Penalty’ Responsible

One would think that the situation would improve as women’s qualifications improved and as more women held key positions in organizations.

However, things are still bleak, almost like a corporate conspiracy. The major excuse that has been repeatedly tabled for this disparity is called the ‘motherhood penalty.’ This entails the cost of having a woman inevitably step away from work for caretaking responsibilities.

Financial Stress Runs Rampage

According to Stacy Francis, the President and CEO of Francis Financial, the wealth disparity between men and women is likely to increase. Francis is also a certified financial planner.

Likewise, a recent report by Fidelity Investments suggests that 93% of women are susceptible to financial stress, irrespective of their household income.

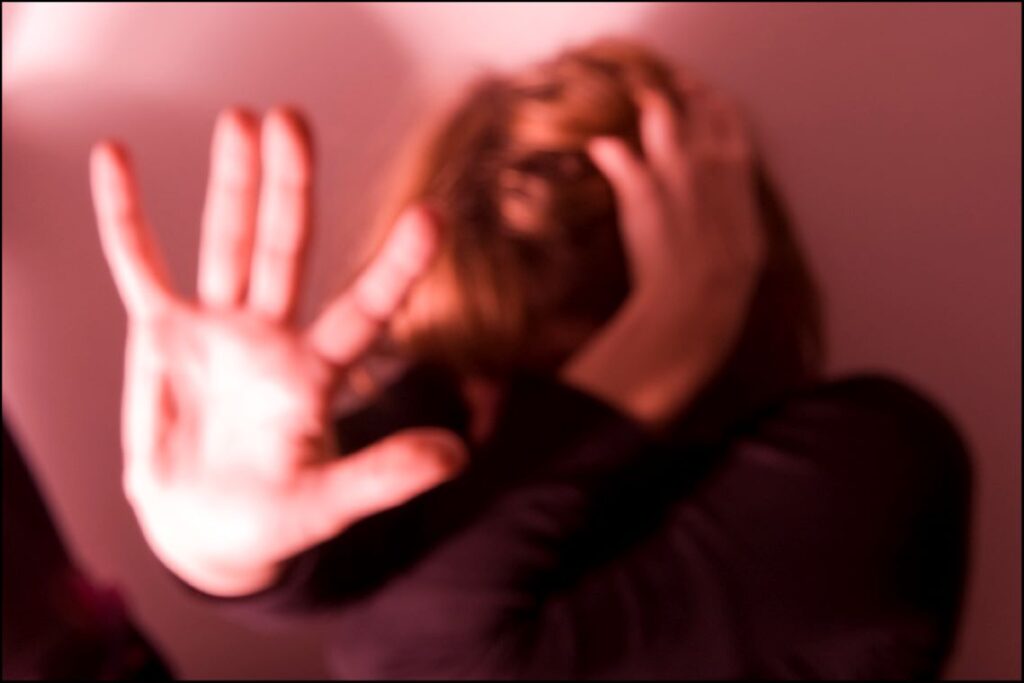

A Deadly Precursor of Other Stressors

Similarly, another report suggests that several women are forced to stay in unhealthy relationships, all because of their financial insecurity.

And don’t we see several examples of this around us? Women become victims of domestic abuse but get more scared of banding off on their own than having to live with their abusive partner.

Women Live Longer than Men

Stacy Francis also reminds women that even when they find themselves in relationships that are heaven-on-earth, the tendency to outlive their male partners is quite high.

So, Francis makes it a point to advise her female clients about building their financial muscle for when they find themselves alone and have to bear all the burden.

Take Responsibility Now!

To illustrate this situation in which women are likely to find themselves in the future, Francis says, “Most all of us are going to be in the driver’s seat of our finances alone in the car at some point.”

For either men or women, cultivating a saving habit is unarguably beneficial. However, it is additionally empowering for women, who also acquire the ability to become independent.

The Little Droplets

In 2016, writer Paulette Perhach designed a Billfold piece that has since gone viral. In each of these pieces, Perhach outlined in friendly terms the benefits of building a cash reserve, no matter how small.

Perhach recommended having savings that could calm one’s mind and provide respite even in non-emergency situations.

Welcome to the ‘F— Off Fund’

Guess what Perhach called her cash reserve habit. The ‘f— off fund’ is the name. The writer explains that her saving strategy is all about creating multiple options so you never find yourself in unwanted straits.

Perhach said, “Whether the system protects you or fails you, you will be able to take care of yourself.”

Money Brings Peace of Mind, No?

Fidelity Investment also found that the level of financial stress of women dropped sharply with each additional month of emergency savings that they could accumulate.

Indeed, with three months of accumulated emergency savings, only 26% of the women complain of experiencing financial stress, relative to the 81% figure before they started saving.

One Size Does Not Fit All

Financial experts recommend that you accumulate at least three months’ worth of emergency savings to eliminate all forms of financial stress and build a cash reserve.

However, single mothers or women who run a business are advised to accumulate upward of six months’ worth of emergency savings.

Go Slow and Steady

Francis then reaffirms that accumulating necessary emergency funds is not a feat that can be achieved at the speed of light. So, she recommends that women be gentle with themselves.

“The best thing you can do is make room in your budget…in a consistent and sustainable way, so you don’t find yourself strapped,” Francis said.

The 50-30-15-5 Formula

Lurna Kapusta, head of women and engagement at Fidelity Investments, proposed a 50-30-15-5 formula for income utilization while keeping faithful to emergency savings.

Kapusta recommends spending 50% of income on recurrent expenses like food, rent, and utilities. 30% is set aside to compensate for the ever-fluctuating cost of living. 15% and 5% go to retirement and emergency funds, respectively.

It’s Not Easy, Do It All the Same

Kapusta acknowledges the fact that keeping up with a formula like this may be a tug of war at the onset. Nonetheless, she recommends setting something significant aside without fail.

To prevent the fund from lying dormant, Kapusta also advises women to open a high-yield savings account, which now pays as high as 5% in interest.

From a Sprint to a Marathon

Once you have a steady habit of accumulating an emergency fund, the average financial expert would advise you to approach a financial advisor. The goal is to chart out a long-term plan for wealth accumulation.

Some employers offer free financial consultation services through their benefits department. If none of these options work for you, you should take advantage of the free help provided by the National Foundation for Credit Counselling.