Retirement is a period that every senior citizen looks forward to. However, states to retire influence how much bliss folks get out of retirement.

According to Bankrate, a finance publication entity, Delaware is the best state for retirees in 2024. West Virginia comes in close stride, followed by Georgia, South Carolina, and Missouri. Delaware knocked off Iowa from the top spot after coming up a spot from second place in the previous year. Probably wondering where Iowa, the first from last year went. Well, Iowa’s score on affordability crashed significantly between then and now. Since then, expenses like homeowners insurance, property taxes, and overall cost of living went through the roof.

Similarly, the five worst U.S. states for retirees in 2024 are North Dakota (46), California (47), Washington (48), New York (49), and Alaska (50). Alaska will hold the post of the worst U.S. state for retirees for the second consecutive year. All the factors used for this retirement categorization were stoked against America’s last frontier.

Bankrate runs an annual poll that helps them list the best and worst U.S. states for retirement. Of course, we do not recommend that retirees move to the best-ranking state each year. However, we shall help senior citizens identify if their state is a cool place to retire or if they need to consider relocating. Bankrate uses the following factors to generate its annual list of retirement locations. Some of the factors are the cost and quality of healthcare, cost of living, weather, affordability, crime rate, etcetera.

Best States to Retire in the U.S

The top five places to retire in 2024, in the order of their preference, are Delaware, West Virginia, Georgia, South Carolina and Missouri. These five U.S. states are in the top five for a reason. Delaware has several selling points that make it one of the best places to retire in 2024. Delaware’s tax-friendliness for retirees is at the top of the list of these selling points. Delaware’s local and municipal administrations don’t tax social security benefits.

In addition, the best retirement state, 2024, has one of the cheapest property taxes in the U.S. Delaware is an ethnically diverse state that scores high on overall well-being. Finally, Mother Nature smiles upon her, as the weather is friendly to senior citizens, with rare or no natural disasters. No one state has it all, and Delaware definitely has its Achilles heel. For example, crime is as common there as in other states. The cost of living and health care are not comparatively better off than in other states.

West Virginia, on the other hand, ranks highest on the affordability scale. Georgia pushed its way through to third position from 15th, thanks to a sharp drop in the cost of living. Superb weather shot South Carolina out of the averages, from 19th to fourth place. Most of the top five states were propelled in the ranking by affordability, which takes up 40% of the ranking criteria for top retirement states.

ALSO READ: Researchers Find That 79% of Americans Who Take This Step Won’t Run Out of Money in Retirement

Worst States to Retire in the U.S.

For clarity, hereafter are highlights of the criteria and percentages for ranking the best and worst states for retirement. Crime (5%), weather (10%), cost and quality of health care (20%), overall well-being (25%) and affordability (40%) are the ranking criteria.

Now, Alaska sits comfortably at the bottom of the ranking because it has the poorest score on all five criteria.

Essential Considerations Before Relocating for Retirement

For retirees who are not enjoying retirement in their state or locale and are giving relocation a thought, please consider the following factors before taking that bold step:

- Climate of your destination: There’s a reason we said climate and not weather. Weather is situational, while climate is an assessment of weather over some time. It is important to know that the weather in the new location is friendly.

- Financial health: Few factors are more important for a retiree to consider. Relocation and resettling can be capital-intensive, so count the cost before taking that leap.

- Tax regime: The best bet is for retirees to speak with a tax expert who is familiar with the city they prospect to move to. Doing that would save them the trouble of falling into a difficult situation after relocating.

- Sense of community: It may shock retirees to know that some locations do not welcome senior citizens, not intentionally but systematically. So, it is always good to find out from retirees currently living in your target location before moving.

- Cost, quality, and proximity of health care: For retirees, health care is second to only housing in the list of their top necessities. Data from the Census Bureau suggests a 65-year-old retiree will spend an average of $157,500 throughout retirement. So, retirees want to keep that amount to the barest minimum by staying where health care is cheap, of top quality, and accessible.

- Cost of living: This is a no-brainer. Except they’re Warren Buffett. Retirees don’t want to move to Silicon Valley or board up in Trump Tower.

ALSO READ: Delaware takes the No. 1 spot for the best state to retire in 2024

How Much Does It Cost To Retire in the U.S.?

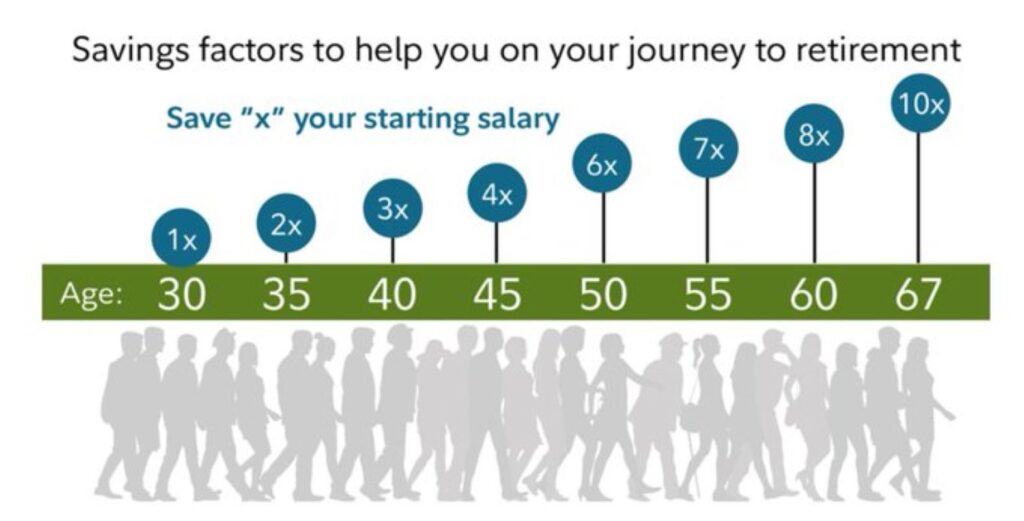

No clear-cut amount is required to sustain every retiree in each age bracket. Instead, it is better to help workers pursue targets tailored to their annual income.

Assuming a retirement age of 67, workers are advised to have 1x of their current annual salary by 30. By 45, workers should pursue to have 4x of their yearly income in savings. By retirement at 67, a retiree should have about 10x of their annual income in savings. So, there may be more to a successful retirement than identifying the state to retire.