When people think of Warren Buffett, images of massive wealth and successful investments often come to mind. Buffett is among the wealthiest people on the planet and has unmatched financial knowledge. He has frequently expressed his belief that time itself is something he loves even more than money.

He once said, “Money has no utility to me. Time has utility to me.” In 2016, during an interview with Bloomberg’s The David Rubenstein Show: Peer-to-Peer Conversations, the chairman of Berkshire Hathaway stated that if there were anything on his bucket list, he would have done it already.

Warren Buffett’s Perspective on Retirement

Even at 86, Warren Buffett found humor in routine retirement activities like planning haircuts and shuffleboard games. He expressed his happiness at being able to work and emphasized how he gets to spend every day doing what he loves with the people he loves. Life couldn’t get any better for him.

The great business titan acknowledged that running his company, making profitable investments, and spending time with his family are his three biggest joys in life.

Understanding Buffett’s True Wealth

“Money in terms of making trips or owning more houses or having a boat or something—it has no utility to me whatsoever.” That’s quite the claim coming from a man whose net worth was over $100 billion as of the last check. However, Buffett emphasized that he values his remaining time.

Gaining insight into Buffett’s perspective and approach to time management can teach us all a great deal. Let’s explore Buffett’s insights regarding the actual worth of time and how we can apply these ideas in our own lives.

The Most Valuable Asset

Though he is well known for his investment expertise, Warren Buffett’s lessons on time management may be the most insightful. He always says that money is a limited and replaceable resource; time, on the other hand, is the most valuable resource.

Buffett famously said, “I can buy anything I want, basically, but I can’t buy time.” This emphasizes that everyone has the same number of hours in a day, regardless of money or achievement, which emphasizes the significance of prioritizing the things that matter.

ALSO READ: Like Warren Buffett, Young Investors Can Side-Step Retirement Worries by Starting Early

Position Yourself for Retirement Success

Despite his statement that “money has no utility” for him, Buffett recognizes the value of money for the typical American, who may not wish to labor until they are 93 years old like him. To position yourself for retirement success, you should manage your money carefully while you are still working.

This includes diversifying your investment portfolio with traditional stocks, bonds, and real estate and taking full advantage of tax-advantaged investment accounts such as 401(k)s and individual retirement accounts (IRAs). Ideally, this means that during your golden years, you can spend your leisure time doing the activities you love with the people you love.

Utilizing Wealth for Comfortable Retirement

Although Buffett stated he wasn’t interested in having many homes or a boat, he believes if that’s how you enjoy spending your free time, relaxing at a lake house and taking grandkids for boat rides, money can make that possible.

In the same way, it can support early retirement and build confidence in one’s ability to maintain a comfortable standard of living as one age.

Maximizing Social Security Benefits

If you’ve managed your money well enough to retire early and live off savings and profits, you can put off accepting Social Security, which will result in larger monthly payments when you start claiming benefits at age 70 or older.

It can be difficult, but not impossible, to prepare for a long, prosperous, and financially beneficial retirement. You can guarantee financial stability and enjoy your later years without having to work by making investments with your money.

The Power of Compound Interest: Buffett’s Key to Success

In a 2016 interview, Buffett emphasized the value of early investing and attributed his success to compound interest. Thanks to compound interest, your initial investment and the interest it generates can grow tremendously over time.

A $100,000 investment, for example, would increase to $110,150 in the first year, $121,330 in the second, and $133,645 in the third at an average yearly growth rate of 10.15%. Reinvesting dividends can further additional growth, demonstrating the effectiveness of compound interest.

Embrace the Benefits of Compound Interest Without Being an Expert Investor

Remember that the market is subject to change, so your annual rate of return may vary. Buffett is a fervent supporter of compound interest’s benefits. He is well-known for his buy-and-hold approach as a seasoned value investor, frequently hanging onto stocks for decades and watching them rise.

Making the most of compound interest doesn’t require you to be an expert investor like Warren Buffett or make significant investments to gain.

Investing in Relationships

Relationships are extremely important to Warren Buffett, even outside his investment portfolio. Having been mentored by brilliant minds and cultivating meaningful relationships throughout his life, he emphasizes the significance of surrounding oneself with the right people.

Building a support system that provides emotional, intellectual, and occasionally financial advantages can be achieved by investing in relationships just as much as financial ones. Even though these connections take time and work, they have major long-term benefits that improve both personal and professional lives.

ALSO READ: Who Will Be the First Trillionaire in the World?

The Power of Lifelong Learning

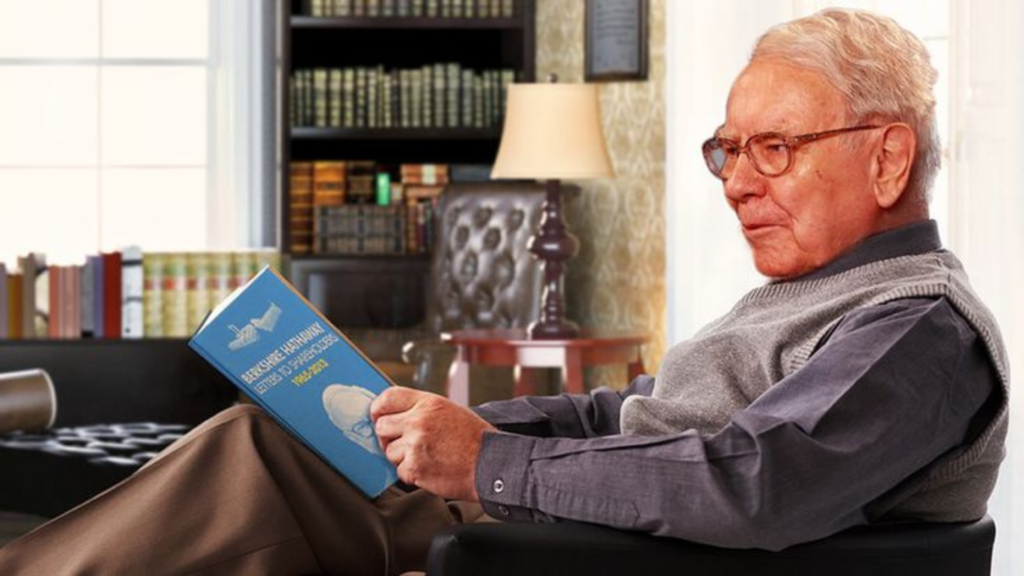

Buffett makes good use of his time by continuing to learn new things. Buffett reads for roughly eighty percent of the day, even though he is ninety years old. His dedication to acquiring knowledge keeps him knowledgeable and perceptive, which empowers him to make wiser choices.

Incorporating continuous learning into our professional and personal development can greatly improve our lives. By increasing our knowledge through reading, attending classes, or going on new adventures, we can increase our chances of success and become better at making decisions.

Achieving Balance

One of the fallacies surrounding wealthy people like Buffett is the idea that they are always working. Buffett is obviously committed, but he also recognizes the need for moderation. He likes to play bridge, spend time with his loved ones, and participate in enjoyable and unwinding activities.

A balanced life is important for long-term well-being. Time spent well on work, hobbies, leisure, and relationships helps us stay mentally and physically well, which in turn improves our happiness and productivity.

You Might Also Like:

10 Warning Signs to Watch Out for at Any Pizza Shop

Man Surprised by the 25 Percent Increase of His Insurance Premium After a Minor Crash

Experts Say You’re “Good” Once You Hit This Credit Score

This Man Married His Wife Because of $100,000 and Regrets It