It’s time to lay the “checking account vs savings account” debate to rest. While these two account types have different functionalities, they could be complementary depending on the holder’s financial profile. So, we shall be demystifying the differences between checking accounts and savings accounts.

Effective wealth management, both long-term and short-term, may require savings accounts and checking accounts simultaneously. Yes, they both serve as financial management devices. However, having a clear grasp of their individual purposes and differences will facilitate the bespoke deployment of these two accounts for wealth management purposes.

Checking and Savings Accounts: What Sets Them Apart

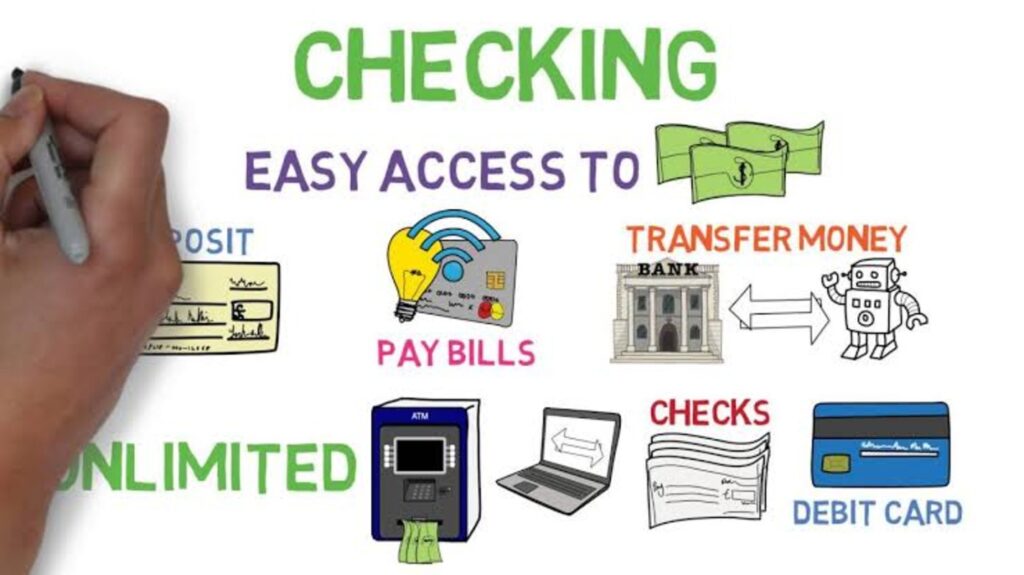

Checking accounts is best for managing your day-to-day financial transactions and expenses. They are also great for holding expendable funds. Due to their peculiarity, checking accounts often come with a debit ATM card. Wages can be deposited directly into this account, which can be used for bill payments, online shopping, and cash withdrawals.

On the other hand, a Savings account is more of a wealth stash. It helps you set aside portions of your monthly income and build up a wealth trove. Such savings are often set aside for specific purposes like investment, vacation, or emergency funds.

Below are highlights of some basic differences between checking vs. savings accounts:

Transfer Limits: To help holders of savings accounts meet financial targets, the bank only allows six transfers per cycle. Meanwhile, the number of transfers on a checking account is unlimited.

Common Fees: Account holders pay monthly maintenance fees on both checking and savings accounts. However, additional fees, such as withdrawal limits and a minimum balance charge, apply to savings accounts.

Interest Rates: Savings accounts always accrue interest on the amounts kept in them per time. However, the specific rate varies from bank to bank. Checking accounts seldom have interest; when they do, it is close to insignificant.

Primary Purpose: By now, it’s probably a no-brainer that checking accounts are meant for spending while holders of the other use it primarily to save.

ALSO READ: Let Us See How Much You Can Earn in Ten Years With a 4% Interest Rate

What Is a Checking Account?

A checking account is the best option for everyday transactions. It doesn’t require much to open and can be used as frequently as we make purchases. To save users the trouble of visiting a bank branch for each transaction, checking accounts come with ease-of-use features. For example, most checking accounts have a mobile app, checkbook, and debit card.

The major disadvantage of checking accounts is that their funds do not yield interest. So, it would be ill-advised to keep large sums of money that are not expendable in one. Monthly maintenance fees on checking accounts are negligible and easy to sidestep.

Individuals looking to open a checking account may want to look out for things to enjoy the best banking experience. First, open with a bank with a large network of ATMs and overseas coverage if you travel a lot. Second, check for checking accounts that come with mobile apps and seamless customer service. In addition, some banks offer sign-up bonuses of between $100 and $500 to attract more customers.

What Is a Savings Account?

Savings accounts are designed to make funds as inaccessible as possible. The idea is to discourage account holders from dipping their fingers into the kitty until they reach their savings target.

In addition, savings accounts don’t support checks and only allow six free withdrawals or transfers per month. Attempts to make extra withdrawals will come at an extra charge.

Savings accounts earn interest because they tend to hold funds for relatively longer periods. Interestingly, savers can get higher annual interest rates when signing up for a high-yield savings account.

Several factors should be considered when choosing a bank to open a savings account. Bonuses, fees, balance requirements, and annual percentage yields (APYs) from multiple banks should be compared before settling for one.

ALSO READ: What’s the Ideal Number of Savings Accounts That I Should Have?

Do Checking and Savings Accounts Pay Interest?

Checking accounts can be compared to Escrow accounts. So, they are largely transitional stations for your funds. Funds are kept in checking accounts on a short-term basis, pending deployment for financial transactions. Consequently, funds in checking accounts seldom stay long enough to earn interest.

Even if, for some reason, the holder of a checking account leaves money in it for a long time, it won’t earn interest. So, instead of committing such blunders, a better decision would be to move all unused funds to savings Accounts.

Almost all savings accounts earn interest on funds left in them. While interest rates vary from bank to bank, they tend to adjust commensurately with rates pegged by the Federal Reserve. For example, most banks recently increased interest rates in response to the 11 different Fed rate hikes between March and September.

You Might Also Like:

JPMorgan’s Chief Economist Urges Fed to Slash Interest Rates by Half a Point This Month

Top 10 Mutual Funds to Consider in September 2024

Young Wealthy Americans Are Moving From California to Florida in Growing Numbers

Tesla Electric Semi Truck Battery Ignites in Crash, Releasing Toxic Fumes in California

The Backdoor Roth IRA Solution for High Earners To Funnel Money Into a Roth IRA Retirement Account