Ask the average American adult what their retirement goals are, and many may infer they would love to amass savings upwards of $1 million.

However, this lingers only in the wildest dreams of most American retirees. Checking the investment accounts of retirees indicates that most of them fall short of the $1 million goal.

Bleak Realities for American Retirees

In a 2023 report by Benzinga, just a small portion of retirees —roughly 9%— attained the $1 million retirement savings benchmark.

The gloomy side of this report is the one that says an alarming fraction of retirees, about 37% of them, don’t have any form of savings. This necessitates a clarion call for young workers to start building a nest egg early enough.

A Million Dollar Retirement Fund Is Feasible

The same Benzinga report claims that the average American retiree had only $170,727 in savings.

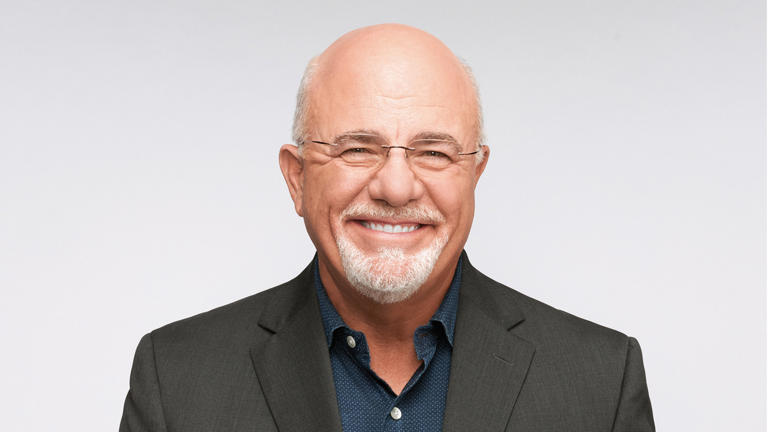

However, in the face of these daunting figures, Ramsey came forward to declare that accumulating a million-dollar retirement fund is not rocket science. The finance adviser affirms that it is way easier than most people think.

The Key Is Starting Small and Early

Rather than hunting around for major investments at the peak of your career, Ramsey suggests that it is better to start small, as early as possible, and remain consistent.

By setting aside as little as $100 monthly, a young worker can easily amass a seven-figure stash. Ramsey not only keeps us salivating but also proffers detailed tips and practical steps toward achieving this goal.

Adjusting the Return Rates for Retirement Projection

Ramsey bases his calculation on an annual returns rate of 12 percent. He says an annual savings of $1,200 will yield an account value of $1,176,000 in 40 years.

However, upon setting forth the details of his million-dollar retirement playbook, some analysts have criticized Ramsey’s choices of returns rate. The analysts argue that the average annual return of the S&P index oscillates closer to 10 percent.

Become a Millionaire Almost Effortlessly

Nonetheless, recalculating Ramsey’s long-term projections at an annual return rate of 10 percent would yield $1,048,247 at the end of 45 years—just an additional five years of work.

If 40 years is your ideal target, you can still hit the million-dollar mark by saving $159 monthly.

Better Late Than Never

If you have already spent a sizeable number of years in employment, all hope is not lost. For example, if you are 30, 40 or even 50 years old, that one million retirement mark is still attainable. So far, you are willing to go the extra mile.

Here is what that means. You would need to put aside more than the suggested $100.

The Advantages of Starting Early are Innumerable

Depending on how close you are to retirement, it may become necessary to put away an upward of $150 to make up for the lost time.

However, your investment savings work the hardest when you start early, as early as initiating retirement savings in your 20s. This is all thanks to the power of compound interest.

Heard of the Fibonacci Sequence?

Even nature takes advantage of compounding, so who are we to jettison it? To get an in-depth understanding of the multipliers effect of compound interest, kindly look up the Fibonacci Sequence.

Now, here is a simple explainer of how to go about it if you are starting your retirement savings in later life and are still aiming at the million-dollar mark.

Initiating a Retirement Plan at 30

If you got a wake-up call to start a retirement savings account at 30, then you are not too late to the party. According to available statistics, you are way better off than most Americans. The amount you would have to put aside per month shouldn’t bite that hard.

Retiring at 65 would afford you 35 years of compounding your savings.

The Earlier, the Easier

However, amassing seven-figure retirement savings in the space of 35 years and at an annual returns rate of 10 percent will require you to set aside upward of $264 per month.

Now, this depicts how much sacrifice is involved if you put off starting early. The longer you wait, the more grit and discipline are needed to put away retirement savings.

Initiating a Retirement Plan at 40

Kicking off retirement savings at 40 means you have robbed yourself of 10 – 15 years of savings. So, the monthly savings required to attain a million dollars become much more tangible.

To hit the bullseye, as much as $750 deductions will be needed. You can afford to down the bitter pill of $264, but if your monthly income is good enough, $750 should be easy to breeze through.

Initiating a Retirement Plan at 50

If you realize that setting up a retirement account is essential at age 50, then the monthly amount to put away becomes much more significant.

With just 15 years of employment to go before retirement and at an annual return rate of 10 percent, $2,425 should get you across the one million dollar mark by retirement.

There’s Nothing Like Too Late, Just Pay the Price

Putting away $2,425 at 50 would most likely be a walk in the park for many, as this period would coincide with their peak earning years.

Nonetheless, it may also be difficult for folks who have not learned how to delay their gratification. The question such people would ask is: “Why be a miser and wait for 15 years before spending my money?”

A Friendly Disclaimer

There is no way of predicting the returns on your retirement investment in detail. For example, while the stock market indeed offers a long-term annual return of 10 percent, that figure is not consistent year upon year.

In some years, you may get 15%, but it may dip by 20% in another year. So, this is another reason to start early. Compound interest will help taper off the average losses on your investments. The shorter the time, the higher your investment risks.