European markets climb as Trump makes moves to reduce tariffs on auto parts. Donald Trump’s administration is planning to cut taxes on car parts. The administration is doing this after top business leaders pushed for it. On Monday, April 28, White House officials released a statement. They confirmed that President Trump plans to reduce these extra costs on car parts that are used to build cars in the US.

The government also plans to prevent car manufacturers from having to pay tariffs in addition to existing levies. This way, they will avoid paying double taxes on materials such as steel and aluminum. The official announcements could be signed by the president as soon as Tuesday, April 29.

How Trump’s Trade Deal Affects Automakers

Commerce Secretary Howard Lutnik recently stated that President Trump is working closely with American car companies and workers. His goal is to strengthen their partnership. Lutnik explained that the new deal supports Trump’s trade goals by helping domestic automakers in the US. The new deal also gives companies more time to promise investing in making more cars in America.

Earlier in April, Trump said he wanted to support car companies. He wants to do this by giving them more time to start making car parts in the US. Because of this plan, Trump delayed a 25% tariff on imported auto parts until May 3. Some American car companies, like Tesla and Ford, had to put plans for mass-producing new models on hold. Others had to suspend shipments to China due to retaliatory tariffs.

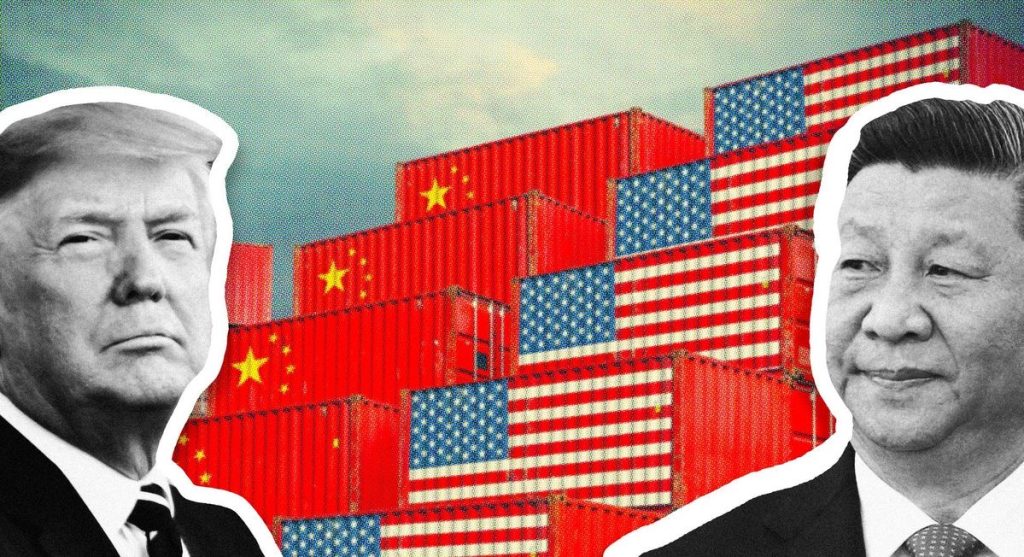

Since the beginning of April, President Trump has changed his mind several times since he announced reciprocal tariffs on all countries. Due to the confusion, many investors started selling off their U.S. investments. They were worried that the US-China trade war could hurt the economy.

Earlier this month, Trump also removed electronics, like phones and computers, from the list of taxed products. This occurred especially after Apple’s stock dropped significantly. The president told reporters that he helped Apple’s CEO, Tim Cook, with that decision.

On April 28, China denied any current tariff reduction negotiations with the US again. They said this even though President Trump keeps saying that trade talks are ongoing. Treasury Secretary Stott Bessent said in an interview that it is China’s responsibility to de-escalate the trade war.

However, it appears that President Trump’s administration is starting to soften its tough stance on tariffs. This more relaxed attitude is making global markets feel a bit more hopeful, especially with big US tech companies getting ready to share their latest earnings this week.

ALSO READ: Trump’s Tariffs May Put Hollywood Production and Box Office Recovery at Risk

European Markets Go Up as Global Stocks Keep Rising

European stock markets went up just like many others around the world. By 9:15 a.m. on April 29, Central European Time, Germany’s primary stock market, the DAX, had increased by 0.46%. The Euro Stoxx 50 increased by 0.33%. France’s CAC 40 went up a small amount, just 0.06%, and the UK’s FTSE 100 increased by 0.11%.

Stocks in other parts of the world also kept rising earlier in the day during Asia’s trading hours. At 5:30 a.m. Central European time, Japan’s Nikkei 225 was up 0.38%. Australia’s ASX 200 gained 0.96%. Hong Kong’s Hang Seng Index jumped 2%, and South Korea’s Kospi rose 0.63%. In the U.S., future predictions for stock prices were also positive. The Dow Jones was expected to go up by 0.12%, the S&P 500 by 0.16%, and the Nasdaq by 0.22%.

ALSO READ: US Markets Surge Following Trump’s Postponement of Tariff Plans

However, while stock markets were going up, the euro became weaker compared to the U.S. dollar. This occurred because investors started to feel less worried about risks. They felt this way because the trade fight between the U.S. and China seemed to be calming down. Since people are less interested in “safe” investments, some currencies have started declining. Currencies like the euro and Swiss franc lost value, and even gold prices dropped.

As of 5:46 a.m., the same day, Central European time, the euro had fallen by 0.37% against the dollar. The Swiss franc had also dropped 0.55% against the dollar. The price of gold also went down by one percent. It now costs $3,311 per ounce, having increased slightly on April 28.