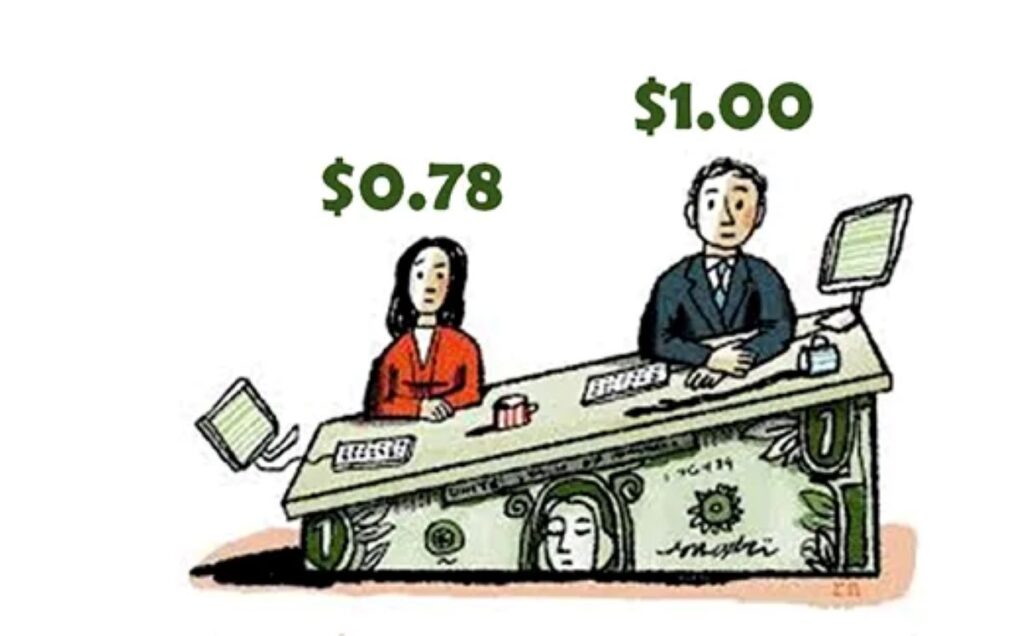

At the moment, women tend to feel the first impact of any economic crisis, all thanks to their financial fragility. Indeed, research has established that about 59% of women are barely trying to get by financially, living paycheck to paycheck.

There is also a widespread consensus that women are at a financial disadvantage. This narrative is not limited to the workplace alone, according to gender equality agitators.

Storms Don’t Last Forever

However, the flagging financial realities of women are not likely to last for long, at least not in the United States. This is because a huge wave of generational wealth transfer is about to sweep through the country, and women will likely become managers of a large portion of it.

A 2020 study by McKinsey reaffirms this financial projection.

A Bumper Spike in Wealth Index

The McKinsey study suggests that women in the United States controlled about $10.9 trillion in assets as of 2020. However, that value is about to increase by $68 trillion by the turn of the new decade.

Analysts are projecting that the economic realities of the US may change slightly when this wealth transfer materializes.

Will the Shift in Wealth Affect the Stock Market?

Finance experts agree that women tend to manage money differently than men. So, at the onset of wielding the wand of such enormous wealth, the women controlling it may take up a financially conservative poise.

However, over the long run, they are more likely to seek out financial advisors to help them attain their financial goals.

Women All the way

Research has found that this great transfer of wealth disproportionately benefits women, irrespective of the perspective of analysis. That is, wealthy husbands leave assets for their wives, or fathers leave investment portfolios for their children.

The foreboding question is whether the next generation is comfortable taking the baton.

When Generational Cycles Play a Good Hand

However, some other schools of thought are optimistic about how the great wealth transfer would play out. For example, Stacy Francis, the CEO of Francis Financials, has something optimistic to say about the anticipated wealth transfer.

She said, “It’s an unprecedented time in history that is giving women an opportunity to put themselves in a financially secure position.”

How the Shift May Affect the Average Woman

But don’t take Francis’ word for it because some studies have equally highlighted some ways in which the great wealth transfer would benefit the womenfolk.

For example, there are suggestions that when the bulk of American wealth changes hands, the pay disparity between men and women may subside.

An End of the Income Disparity?

By the time these wealthy women take over the stocks of some of the most influential organizations in the US, they may push for the reduction of the 20% difference in the pay of men and women.

Likewise, organizations may begin to introduce women-friendly policies, which would make the ‘maternity penalty’ more bearable for working women.

Women Deserve More, Or Don’t They?

Most female financial experts, like Francis, argue in favor of these organizational reforms. They say the average working woman exerts herself way more than her male counterpart.

It doesn’t end there; research also suggests that women usually have longer life expectancies than men. Therefore, a woman would have to squeeze out more savings from her already lean income to build a retirement fund.

A Final Respite

With all the analyzed odds, pro-women financials think women should earn more than they do. Likewise, there should be some allowance that helps working women bear the extra burdens they have to carry.

According to Kelly O’Donnell, chief client officer at Edelman Financial Engines, “The statistics are sobering…The math tells us it’s harder for women because they will live longer and have less.”

Calling the Financial Shots In the Largest Economy

However, by 2030, many wives will inherit the fortunes of their boomer husbands, and daughters will mop up the wealth of fathers in the same age group.

Financial analysts have calculated the wealth, sitting and waiting to change hands at the said time, to be approximately $68 trillion. This would be the largest transition of its kind in world history.

Reaping the Labor of Another

The massive wealth transition is largely possible because baby boomers seem to have spent most of their active life, and even old age, compounding wealth.

Mark Mirsberger, a certified public accountant, says of baby boomers, “It’s a generation that has accumulated a greater percentage of wealth than any other generation ever has.”

Expanding Minds to Take In Possibilities

Francis only hoped the concerned women would make the most of the wealth available to them. According to her, doing so would open many doors to financial security for women.

She also acknowledged that financial institutions and advisors will play a great role in helping women manage their wealth.

Financial Giants With Little Guides

However, Francis is by no means underestimating women’s financial capabilities. According to McKinsey’s 2020 study, the number of women who make household financial decisions has steadily increased. Likewise, most women tend to change the family’s financial advisor soon after their husband’s passing.

These are all sheer indications that women are improving their financial literacy and coming up to the task.

Have a Template to Build Upon

Maggie Wall, head of diverse growth markets at Citizens, also says that women who inherit the windfall of wealth will need financial advice. Nonetheless, Francis insists that the women also have to do their homework.

These women would have to coordinate their goals and assets, retirement plans, what to leave behind for family, etcetera. Ironing out such details is necessary before placing your portfolio in the hands of a financial advisor.