Your credit score is just as important as your credit card balance. Not only does it show your creditworthiness, but it can also cause you to lose out on opportunities if you’re not careful.

While many people obsess about their balance, experts believe that the same energy should be put into maintaining a great credit score. Your daily living might just depend on it.

What Is a Credit Score?

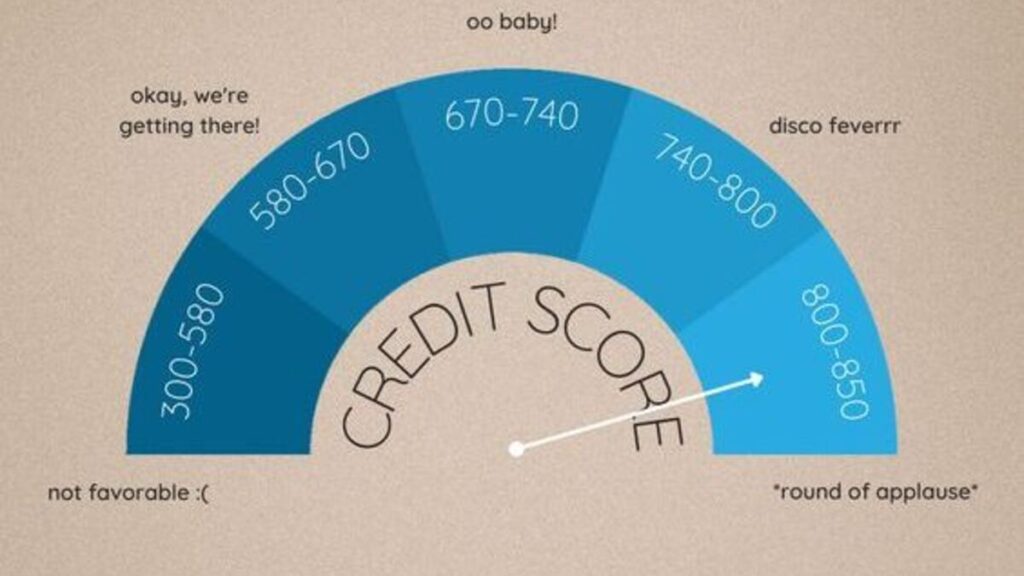

Everyone with a credit card has a credit score, a three-digit number that usually ranges from 300 to 850. These numbers represent your credit risk or, simply put, your chances of paying your bills on time.

Before creditors and lenders want to approve your account for something like a new mortgage, they consider your credit score. This helps them to decide whether to approve your application or not.

What Does a Low Credit Score Mean?

People with high credit scores get much better offers than those with lower ones. They get the best rates when applying for loans, mortgages, and even insurance because lenders trust they will pay their bills on time.

However, those with low credit scores are not trusted. They usually pay higher interest fees, and sometimes, they don’t even qualify for credit at all. Sadly, this causes people to miss great financial opportunities and deals.

What Is the Ideal Score?

It is quite tricky to tell what an ideal credit score is, thanks to how financial institutions operate. However, a couple of experts have a range that most credit agencies follow. According to them, you have a poor credit score if your score is between 300 and 579.

You’re on the fair side if it’s between 580 to 669. A good credit score starts from 670 to 739, and a perfect one is from 740 to 799. An exceptional credit score ranges from 800 to 850.

ALSO READ: Tips for Requesting a Lower Minimum Payment on Your Credit Card

What Is the Average American Credit Score?

Fair Isaac Corporation, FICO, was the pioneer company that developed the credit score method. According to the company, the average American has a score of 717. Therefore, if you have a credit score that is higher than that, you are officially above average in the country.

While you might not get the best offers with this credit score, you will not get the worst ones. This credit score is even considered “good” by most people, even experts.

Getting the Best Deals

In addition, one does not need to be in exceptional standing to get the best offers from companies. According to Ted Rossman, a senior industry analyst who works for Bankrate, you don’t need to have a credit score of 800 and above to get the best deals.

You are good to go once your score is about 740 or 750. You can get the best auto loan deals in that range. However, you would need between 760 and 780 for mortgages to get great offers.

Optimizing Your Credit Score

It can be done if you’re looking for ways to optimize your credit score because you’re almost at a good stand. According to Rod Griffin, the senior director of consumer education and advocacy for Experian, people do not need to panic if they are below the average credit score.

One can work toward optimizing one’s credit score over time to achieve a detailed figure that can give them the best deals on the market.

How To Optimize Your Credit Score

According to several experts, there are a couple of ways to increase or optimize your credit score. Some are easy to do, while others are harder and require more work. If you have a financial advisor or someone who can help you with your finances, it is also a great idea as they would have better insight and provide better guidance to you.

Here are other ways to help you raise your credit score to a good standing.

ALSO READ: How Tax Credit Payment Played Out and Its Potential Modalities in the Future

Make Sure You Check Your Credit Report

According to Griffin, the first thing to do if you’re worried about your credit score is to know what is causing it to be low. You can only know this after checking your credit report. If you visit AnnualCreditReport.com, you can access your reports from all credit agencies in the country.

Then, Rossman recommends checking your history to see what exactly is causing your low score. Numerous errors on your account could also be reflected negatively.

Fixing Any Errors

If you find any errors in your report, it should be easy to fix them after reporting to the proper channels. Do not leave them, as they will only continue to pull your credit score down over time. Therefore, make sure any errors in your report are fixed and you don’t have any mistakes on the report.

Concerning errors like wrong late payment dates, they can also be easily fixed by contacting the appropriate channels in the credit company.

Risk Factors

After getting your score and report from FICO or other agencies, Griffin says you should also get a list of “risk factors” affecting your score the most. Addressing these factors will help you build a better credit score. Late payment is one of the biggest risk factors for a low credit score.

Even if it’s only a few days, constantly falling behind on payments greatly affects your credit score. So, you should avoid that. Also, make sure you pay attention to your credit utilization ratio.

Adding Good Information to Counter the Bad

If you already have a bad credit card history affecting your score, it is not the end of the world. You can offset it by adding some good information to your report.

Rossman recommends signing up for a service that can expand what will get counted in your credit report and add the bills you know can give you good credit. These include on-time payments of phone bills, utilities, and rent.

Boosting Your Score With Someone’s Good Score

Rossman also advises using the card of a parent or spouse with a good credit score as an authorized user. This way, you can piggyback off their good payment history and access better deals you would not have gotten if you stood alone.

Therefore, Rossman and Griffin believe that a bad credit score can be changed to a good standing. All you have to do is be intentional and not “passive” about fixing it.

You Might Also Like:

This Man Married His Wife Because of $100,000 and Regrets It

Should Americans Be Worried About the Longterm Integrity of Their Retirement Plans?

1975 Dimes Could Be Worth Half a Million Dollars, but There Are Things To Look Out For

What Could Cause a Potential Drop in Social Security Cost-of-Living Adjustment in 2025?