It appears that since Donald Trump’s win in the 2024 election, the hedge funds hanging on to bets against Tesla Inc. have lost billions of dollars as they feel the fallout of the special bond between Trump and Elon Musk.

Indeed, hedge funds shorting Tesla have suffered incredible losses, totaling over $5.2 billion, as the electric vehicle (EV) manufacturer’s stock continues to defy market expectations. Since Elon Musk’s strategic moves and the company’s performance drive stock growth, short sellers who bet against Tesla have consistently found themselves in challenging times.

Despite ongoing doubts about the EV market’s resilience, especially in the face of economic uncertainty and changing energy policies, Tesla stock has repeatedly outperformed, leaving hedge funds bleeding from high financial risks.

Musk’s Endorsement of Trump Spurs Stock Rally

Tesla CEO Elon Musk has emerged as Trump’s biggest billionaire fan. Musk’s endorsement of Trump for the 2024 election first raised speculation about Tesla’s fate, and this pushed some investors to hedge their bets on Tesla in anticipation of potential regulatory benefits.

The EV sector is likely to experience unprecedented changes if green policies are modified under another Trump administration, and Musk’s support for Trump could further boost the company’s position in the U.S. market.

In light of this, Trump’s favor toward American-based businesses could strengthen Tesla’s market position even more, as we’ve seen in the past week. Now that Trump is the president-elect, Musk’s alignment with him will potentially provide him with a regulatory advantage.

We might see lower production costs and support from national policymakers. This could lead to even greater financial risk for hedge funds shorting Tesla, making it harder to achieve profit potential on bets with a bearish outlook against the company.

ALSO READ: How Elon Musk’s Endorsement of Trump Might Have Backfired

Musk’s Financial Backing of Trump and the GOP

Even though Musk’s political views have always been unpredictable, his financial backing of Trump and the GOP has boosted Tesla’s stocks among investors. Musk has used his position as the richest person in the world to fuel Trump’s campaign, making him one of the biggest donors to the US 2024 election.

Musk’s endorsement of Trump could translate into favorable policies and more government contracts, especially for space technology, defense, and infrastructure technology projects Musk’s other businesses, like SpaceX, are involved in.

Musk’s potential financial backing of Trump represents an added risk for hedge funds engaged in hedge fund activity centered on Tesla. Tesla’s stock could gain even more momentum in this case, benefiting from investor confidence and policy protections.

Hedge funds’ market strategies may also need to adapt quickly if Tesla becomes a key player in future government projects or receives federal grants, which could further limit the returns of short positions.

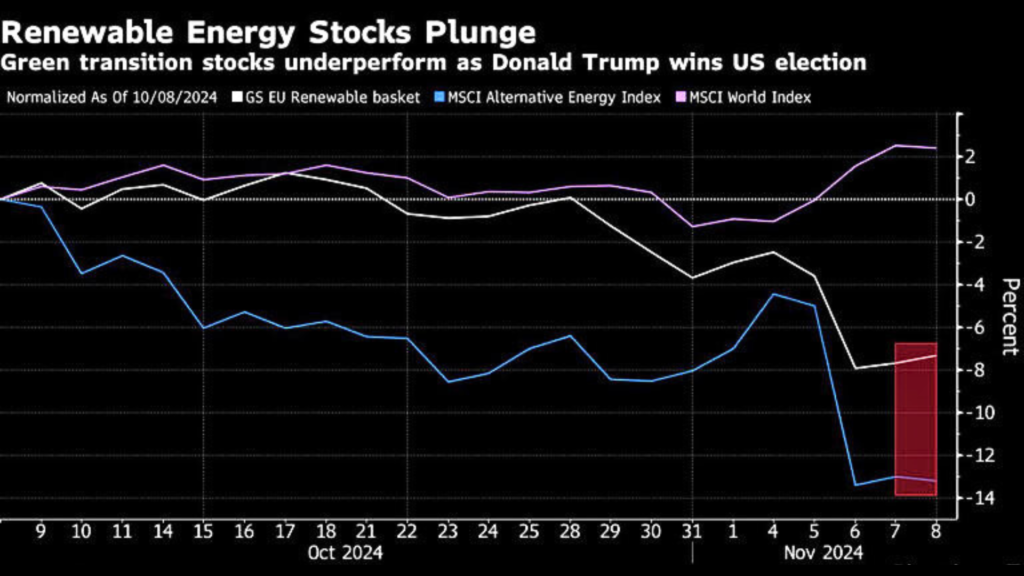

Impact of Trump’s Win on Green Energy Stocks

The news of Trump’s November 5th presidential election victory shook US markets. Renewable stocks from wind to solar started to tank, given the fears that Trump will fulfill his promise to cut clean-energy incentives. However, Tesla’s performance stands out compared to other stocks in the green sector.

So, if Trump were to support Musk’s business initiatives, Tesla might be treated favorably, which could boost the value of Tesla’s stock further, making hedge fund strategies shorting Tesla even more ineffective.

Tesla may be relieved of some of the restrictions currently placed on automakers due to the anticipated reduction in environmental regulations under Trump’s administration. While other companies might find adjusting to less supportive government policies difficult, such a regulatory environment might give Tesla room to maneuver and innovate.

Musk’s Potential Influence on Trump’s Administration

With Trump’s victory, Musk’s support could have an even more significant impact beyond Tesla’s business strategies and broader governmental policies. Given Musk’s influence on business and technology, his endorsement could allow him to contribute to the Trump administration once he regains power.

Aligning with the president-elect now lines Musk up for a position of political influence, as Trump has made it clear that he’s planning to reward loyalists. This could extend Musk’s influence over key economic policies, especially those impacting renewable energy, EV credits, and tech infrastructure.

For hedge funds shorting Tesla, Musk’s political involvement would mean navigating an even more complicated risk environment. If Musk can influence policies that affect Tesla and the broader EV sector, it could limit hedge funds’ potential to profit from stock volatility. Given Musk’s possible influence over regulatory issues, Tesla’s growth rate may continue to rise, forcing short sellers to struggle with compounded losses.

Tesla Outperforms Broader EV Sector Amid Market Headwinds

Tesla’s impressive performance in the EV market continues to challenge the investment strategies of hedge funds that bet against it. In 2023, the EV sector faced multiple headwinds: high production costs, fluctuating lithium prices, and tighter government policies on electric vehicles.

However, Tesla outperformed established and emerging EV manufacturers, making things even more difficult for hedge funds short-selling Tesla stock.

Part of this outperformance comes from Tesla’s brand appeal and position in the premium EV market. As other EV companies experience financial strain, Tesla’s adaptability in production and distribution has allowed it to maintain high equity trading volumes.

Several financial giants, including Citadel Hedge Fund, have faced difficulties with Tesla’s continuous outperformance. Their bearish outlook on the stock has translated into billions in unrealized losses, with Tesla turning out to be far more resilient than initially anticipated.

ALSO READ: Corporate Client Cuts Ties With Tesla After Elon Musk Backs Trump

Speculations on Tesla’s Future Amid Potential Policy Changes

Hedge funds shorting Tesla may find themselves in a difficult situation, as the political landscape could shield Tesla from some market pressures. These funds must regularly review Tesla’s stock performance, especially if Musk gains policy influence. If these speculations are accurate, short-selling Tesla may become less feasible, causing hedge funds to rethink their investment strategies entirely.

With hedge funds suffering from substantial losses, Tesla has become a prime example of the dangers of shorting stocks that defy traditional market expectations. Although shorting Tesla presents a profit potential, it is also considered dangerous due to the high costs of waiting for the stock to drop.

Hence, the story of shorting Tesla warns about the limits of predicting stock movements in today’s volatile and interconnected market. In the end, the conditions involving short selling, hedge fund activity, and Tesla’s strong market position suggest that Musk’s influence and Tesla’s innovation may continue to present challenges for hedge funds betting against them.