Life tends to have more meaning and become more fulfilling for those always seeking to serve others and help them solve problems.

Dasha Kennedy was inspired to pursue a life of financial freedom. While doing this, Kennedy passed on the lessons she learned to her Facebook community. So far, Kennedy has helped about 62,000 people.

Liberating Yourself By Helping Others

So far, 32-year-old Kennedy, originally from Missouri, has done good for herself while emancipating other Black women.

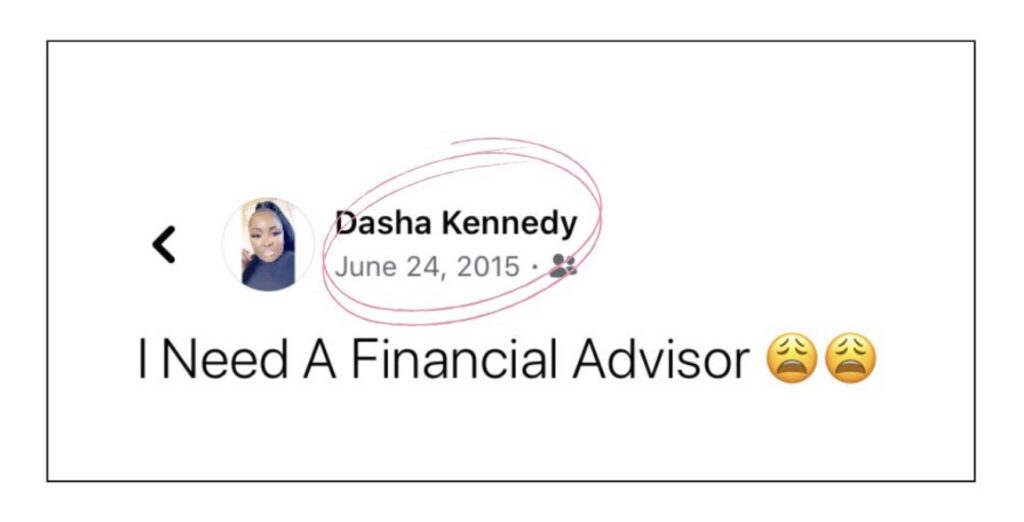

Her journey to financial freedom started in 2017 when she created a Facebook group called “The Broke Black Girl.” At the time, Kennedy’s Facebook group was just a platform for women to share their experiences with personal finance.

An Iteration of Small Actions that Yielded Enormous Results

Interestingly, the Facebook group with just a few members blossomed into a full-fledged community where women come to get relatable finance advice.

Kennedy has had a hell of a ride, personally. She did not expect something as simple as creating a Facebook group to have so much impact. Since then, this woman has boldly taken one action after another that has made her a success.

On a Financial Rescue Mission for Female Compatriots

According to Kennedy, she has heard many testimonies of women getting their finances right in the past seven years of creating that one Facebook group.

For example, some women have testified about how they initiated household budgets, how they are getting out of debt, and how they are paying off student loans, all thanks to the financial insights they gleaned from interacting with other women in the group.

How Financial Crisis Became a Rallying Point

Kennedy is quite happy with how well her Facebook sisterhood has turned out. With over 62,000 compatriots, the movement now looks like a mass movement against poverty and financial insecurity.

Kennedy said of the community, “To be connected because of financial hardship, and wanting to overcome that and bring other people with you, has been one of the most empowering things to me ever.”

Success Is Seldom a Product of Chance

However, Kennedy’s Facebook group’s success was not by chance. She had an early career in finance. She was 19 years old when she got her first job as a mailroom attendant at an insurance company.

At the time, Kennedy was fresh out of high school and decided not to go to college, probably because of strained finances.

Curiosity Fed this Cat

However, young Kennedy remained curious and open to learning while fulfilling her mailroom responsibilities at the insurance company. With time, she made an acquaintance with one of the company’s accountants.

Whenever Kennedy didn’t have much to do, her accountant friend would walk her through accounting problems and the core of the job.

Making the Most of Every Emerging Opportunity

Before long, Kennedy caught on, so much so that the lead accountant at the insurance company offered her a junior accounting role. As she learned more and proved her mettle on the job, more accounting responsibilities were assigned to her.

After six years of working at the insurance company, Kennedy became a senior-level accountant.

Always Looking for Ways of Making Better Leverages

Not long after, Kennedy took her career to the next level as an insurance counselor at a bank. In this new role, she got to interact with several bank customers one-on-one, offering them advice about their personal finances.

However, after a while on the job, Kennedy noticed a trend in the pool of people coming to her office with their financial baggage.

Financial Freedom for the Black American Woman

Most of the distressed people who passed through Kennedy’s office for financial counsel were women and Black Americans. This got her thinking about how she could help that community, even before they get wound up in a financial mess.

According to Kennedy, the major problem is the lack of awareness about financial tools and their benefits.

Small Financial Tools and Their Big Emancipating Results

Some women, for example, don’t know how to budget or cut back on expenses where necessary. The best most people in this niche know to do is to spend as they earn.

Of course, organizing an elaborate financial literacy program for all its customers would be outside the bank’s purview; its ledgers would bear the brunt.

Banks Can Do Little About the Customers’ Financial Education

The best the bank could have done was to set up a counseling office like the one manned by Kennedy. Unfortunately, women of Black American ancestry are worst hit by the financial crisis because of a lack of financial literacy in such families.

To make matters worse, black families earn less than whites. The Pew Research Center states, “At the median, blacks earned 65% as much as whites in 2016.”

Financial Caps for the Average Black Family

The odds are stacked against the average Black American family and even more telling on the matriarchs in such families, particularly those with a single income source or single parents.

According to Kennedy, she knows from personal experience what a Black working person’s financial realities look like. It usually involves making efforts to get by, not building a nest egg or amassing generational wealth.

Buying Back Time and Marking Down Challenges

Before starting the Facebook group, Kennedy had returned to college and graduated from Lindenwood University. She had also gotten married and mothered two sons.

However, things were not as rosy as she wanted them to be. Yes, she was better off than many people, but around that time, Kennedy was going through a series of challenges that put a lot of strain on her personal finances.

Navigating the Financial Implications of Major Life Crises

Just a month before starting the group, Kennedy had just had her second child, was nursing a broken foot, gearing up for a divorce, and lost her dad. These crises did not limit their impact on her emotions alone.

In the aftermath of this major financial storm, Kennedy mustered her wealth of knowledge on personal finance to dig herself out of the hole.

Letting Down Your Guard Before a Community of Like Minds

However, she cataloged how she navigated the financial crises, using the Facebook group as a journal. Kennedy knew that whatever challenge and insight she shared would definitely help some people.

That was how the Facebook group came into being and how Kennedy came up with its unique name.

The Obstacle Became the Way

Kennedy shared that life crossroad by saying, “That’s how I identified where I felt I was in my life. I felt like I was broke, I really didn’t understand what to do with my finances, and I knew that there were more women who can identify to that, as well.”

Not long after, “The Broke Black Girl” group took off with a handful of followers.

From a Kitten to a Behemoth

In the first month of its inception, the group boasted only a few hundred members. However, news of its impact soon spread like wildfire. Women started telling their girlfriends about this group, which has greatly helped their finances.

Not long after, the group was also featured in the local news. Today, the group boasts a membership of about 79,000.

A Group that Cultivates Financial Mindfulness

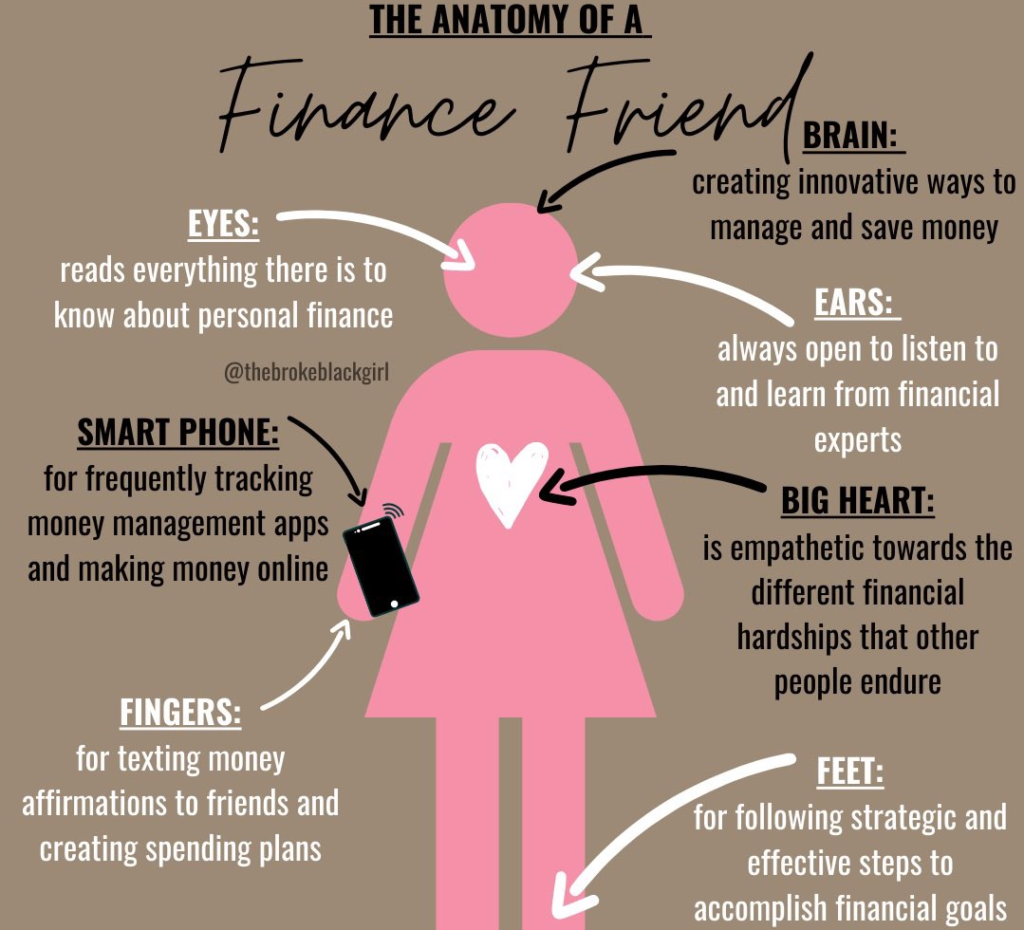

Activities and conversations on the Facebook group are moderated by a team of six admin members, Kennedy inclusive. The group is still very much active, with members receiving a daily dose of financial tips and insights.

However, there are some core financial guardrails around which the group’s conversations revolve. One such guardrail is what the clan calls the “money minute.”

Keeping Up With the Benjamins

The “money minute” involves each group member setting aside a convenient weekly time to monitor their finances. This they do by checking bank accounts, budgeting, honoring obligations, and asking for help when necessary.

Kennedy further explained that the sisterhood would also discuss whatever financial trend is trending and relate it to their individual lives.

From Facebook Curator to Public Speaker and Financial Consultant

After noticing the Facebook group’s unexpected success, Kennedy launched a website with a similar theme and name. The site helps Kennedy market her personal brand as a finance coach and public speaker.

Her financial services transcend sharing her wealth of knowledge with corporate employees and individuals who request a personal consultation.

When Your Side-service Becomes a Full-time Job

Kennedy shared that nine months into starting The Broke Black Girl, she has morphed from a nine-five-er to an entrepreneur. That’s how successful her little service to humanity turned out to be.

Kennedy admitted that she would never have thought of helping out women—particularly Black ones—if not for that lovely accountant at her first job. That woman saw the potential in her and flamed the embers.

An Early Career Human-springboard

So, Kennedy naturally felt compelled to pay it forward to other struggling women and those who lack the opportunity to gain access to basic financial literacy.

“I was young, a fresh set of eyes, and eager to prove myself. She had every reason not to want to help me succeed, yet she did it anyway,” Kennedy said of the accountant who gave her career an initial boost.

A Sisterhood for Pro-Financial Literacy

The group has become more like a community as the members rally around to help one another become financially responsible.

For example, some members go shopping together to prevent spontaneous buying. So far, Kennedy’s only regret is that her dad did not get to witness how much her creation has impacted lives.

A Haunting Regret

According to Kennedy, she didn’t think much of the group, so informing her dad about it was not on her priority list.

However, Kennedy wished she informed him about it before his passing. Overall, she’s sure her dad would be very proud if he saw how much she has achieved.