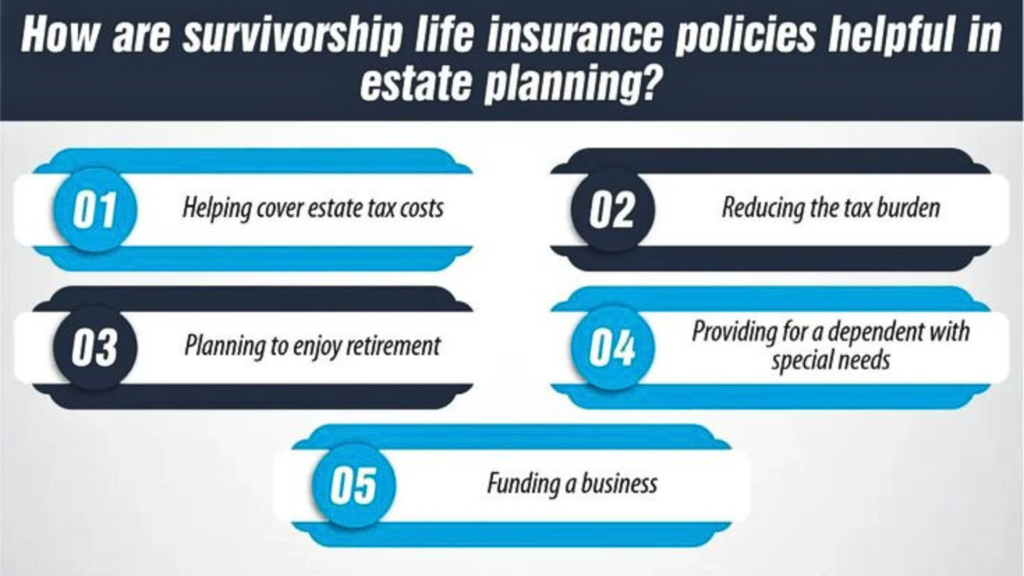

Learning that life insurance can be a beneficial estate planning tool may surprise you. This might lead you to wonder, “How are survivorship life insurance policies helpful in estate planning?”

Survivorship life insurance, also known as a “second-to-die” policy, covers two people and pays out a death benefit only after both have passed away. This type of insurance has been popular among wealthy couples trying to reduce the tax burden on their successors.

However, it can also serve as a valuable estate planning tool, meeting various financial needs. Estate planning is essential to managing your financial future and ensuring that your assets are passed down according to your wishes.

In this article, we’ll explore how survivorship life insurance policies are helpful in estate planning, their benefits, and how to include them in your estate plan.

Understanding Survivorship Life Insurance Policies

It’s important to understand survivorship life insurance policies and how they function. Unlike regular life insurance policies, which pay out a death benefit after the death of a single insured individual, survivorship policies cover two people—usually a married couple. The payout from this policy only happens after both individuals have passed away, making it unique in its purpose and timing.

Survivorship life insurance policies are mainly used for estate planning and wealth transfer. They efficiently cover estate taxes, provide for beneficiaries, and ensure that significant assets like businesses or property can be passed on without liquidation. Wealthy families often use them to protect family-owned companies from being sold off to pay estate taxes.

ALSO READ: Grandchildren Find Out that Their Grandma’s House Has Been Sold Only After Her Passing

Does Life Insurance Get Included in an Estate?

One common question in estate planning is whether life insurance proceeds are included in the taxable estate. The answer depends on ownership. In essence, if the insured owns the policy, the death benefit will generally be included in the estate. This can lead to a significant tax burden for beneficiaries, especially if the estate value exceeds the federal exemption limit.

However, survivorship life insurance can be structured differently. Since this type of insurance policy is often owned by a trust, this helps keep the proceeds out of the taxable estate.

This structure secures the death benefit from estate taxes. It ensures that the funds are distributed according to the trust’s terms, providing flexibility and control over how the inheritance is handled.

How Are Survivorship Life Insurance Policies Beneficial for Estate Planning?

Now, the main question is: how are survivorship life insurance policies helpful in estate planning? Survivorship life insurance policies can be a valuable tool in estate planning, especially for families who are concerned with wealth preservation and legacy planning for several reasons:

1. Covering Estate Taxes

One of the most significant benefits of survivorship life insurance is its ability to cover estate taxes. Large estates can be subject to federal and sometimes state estate taxes, which can be as high as 40% of the estate’s value.

Without sufficient liquidity, this can be a significant financial burden for surviving family members. However, a survivorship life insurance policy can provide a source of funds to pay these taxes, preserving the value of the estate for the surviving beneficiaries.

2. Creating Liquidity

Creating liquidity in the estate is another essential function of survivorship life insurance. Dividing or quickly liquidating estate assets, like property or businesses, can be difficult. The insurance policy ensures there is enough money available to pay for things like debts, taxes, and final estate settlement costs by providing a lump-sum payment upon the second spouse’s death. This allows other estate assets to be transferred intact without requiring a rushed sale.

3. Protecting Beneficiaries

In some cases, families may want to protect specific beneficiaries, like children with special needs or heirs who may not be ready to handle a large inheritance. The proceeds from a survivorship life insurance policy can be directed into a trust, which can be managed according to the policyholder’s wishes. This gives the beneficiaries more flexibility over how and when the money is given.

4. Lower Premiums

A survivorship life insurance policy can offer lower premiums than two individual life insurance policies. Since the payout only happens after the deaths of both policyholders, the insurance company’s risk is reduced, allowing for more affordable coverage. This cost-efficiency makes it a desirable option for couples looking to maximize their estate planning without breaking the bank.

5. Avoidance of Probate

The death benefit from a survivorship life insurance policy is paid directly to the beneficiaries, bypassing the probate process. This can help avoid the probate’s time and cost and ensure that the assets are divided according to the policyholder’s wishes.

ALSO READ: 6 Financial Errors Rich People Avoid To Sustain Their Wealth

How to Include Survivorship Life Insurance Policies in Your Estate Plan

Including survivorship life insurance in your estate plan involves several steps. Every step helps tailor the policy to meet your specific needs and goals.

- Establish Your Estate Planning Goals: Determine what you want to achieve with your estate plan, like providing for heirs, reducing taxes, or supporting a charity.

- Consult With a Financial Advisor: Seek professional advice from a financial advisor to understand how survivorship life insurance fits your overall plan.

- Determine the Appropriate Amount of Coverage: Choose the coverage amount that best suits your estate’s needs and goals.

- Choose the Right Policy Type: Select a policy that best suits your situation, whether it’s whole life, universal life, or another type.

- Review and Update the Policy: Review your policy regularly to keep it updated to reflect changes in your estate, tax laws, and personal situation.

Ultimately, survivorship life insurance policies are helpful in estate planning and offer many benefits for people looking to protect their estate and provide for their heirs. So whether you’re planning for the future of a business, property, or other substantial assets, survivorship life insurance can help you secure a financial legacy without burdening your heirs with unnecessary tax obligations.