Do you earn $100k and wonder, “How much house can I afford with a $100k salary?” It may seem like a simple question, but there are a few things you need to consider, like your credit score, down payment, interest rate, debt-to-income ratio, monthly debt obligations, and lender’s requirements.

Buying a home as an aspiring homeowner is one of the most significant financial decisions you will ever make, and knowing how much house you can afford is essential for your budget and future financial security.

In this guide, we’ll explain in detail how to calculate the price range of homes you can afford and offer useful tips for investing wisely.

Navigating Homeownership on a $100,000 Salary

According to a recent PYMNTS/LendingClub survey, 49% of people earning $100,000 or more still live from paycheck to paycheck. This is true even though $100,000 is a good salary and is much more than the national median household income of $80,610 (most recent U.S. Census Bureau population survey data for 2023).

Even with a $100,000 income, buying a home can seem challenging, considering the recent high inflation and rising mortgage rates. But it’s not impossible. Here are some guidelines to help you determine how much house you can afford.

Begin With the 28/36 Rule

The 28/36 rule is the most commonly used guideline for determining how much house you can afford. This rule is a simple way to decide whether or not you’re financially ready to take a mortgage.

28% Rule

According to the first part of the 28/36 rule, your monthly housing expenses—which include your mortgage, property taxes, and homeowners insurance—should not exceed 28% of your gross monthly income. With your $100k annual salary, you shouldn’t spend more than $2,333 monthly on your mortgage and other related housing expenses.

36% Rule

The second part of the rule states that your total monthly debt payments, which include your housing expenses, car loans, student loans, and credit card payments, should not exceed 36% of your gross income—a $100,000 salary amounts to roughly $3,000 per month.

By abiding by this guideline, you can ensure that your mortgage payment won’t leave you financially drained and unable to manage your other monthly bills.

ALSO READ: Millennial Homebuyers: Challenges, Key Stats, and Expert Tips for Homeownership

Determining Your Home-Buying Budget

After applying the 28/36 rule, the next step is to create a more accurate home-buying budget. Several key factors can influence how much house you can afford, and having a $100,000 salary can open up many possibilities. These factors include:

1. Credit Score

Your credit score plays a significant role in determining the mortgage interest rate for which you’ll qualify. A higher credit score can earn you a lower interest rate, meaning you’ll be able to afford a more expensive home.

However, a lower credit score could lead to a higher rate, reducing the amount you can afford. If your credit score is below 700, you may need to focus on improving it first before buying a house.

2. Down Payment

The size of your down payment will also affect how much house you can afford. Making a larger down payment reduces the amount you need to borrow and can lower your monthly expenses. Ideally, aiming for a 20% down payment would be best to avoid PMI (Private Mortgage Insurance).

For example, a 20% down payment on a $400,000 home would be $80,000. If you can’t afford that, smaller down payments—like 10%—are also possible, but they come with the additional cost of PMI.

3. Loan Terms and Interest Rates

Another critical factor is the term of your loan. Most buyers prefer a 30-year mortgage since a 15-year loan might be short-term but require higher monthly payments. On the other hand, interest rates also vary, so you need to compare rates and get pre-approval from lenders to know what interest rate you’ll qualify for.

Other factors include the location of the house, your Debt-to-Income Ratio (DTI), and other financial obligations.

How to Calculate the Home You Can Afford

Now that we’ve covered the essential factors, let’s get into how to calculate “how much house can I afford with a 100k salary in 2024”. Here’s a simple breakdown:

Step One: Calculate Your Monthly Income

Start by determining your gross monthly income. A $100,000 annual salary is about $8,333 each month before taxes and deductions.

Step Two: Use the 28/36 Rule

Next is to apply the 28/36 rule. As explained earlier, try not to spend more than 28% of your gross monthly income, about $2,333. This is the highest amount you can pay monthly for housing, including homeowners insurance, property taxes, and mortgage.

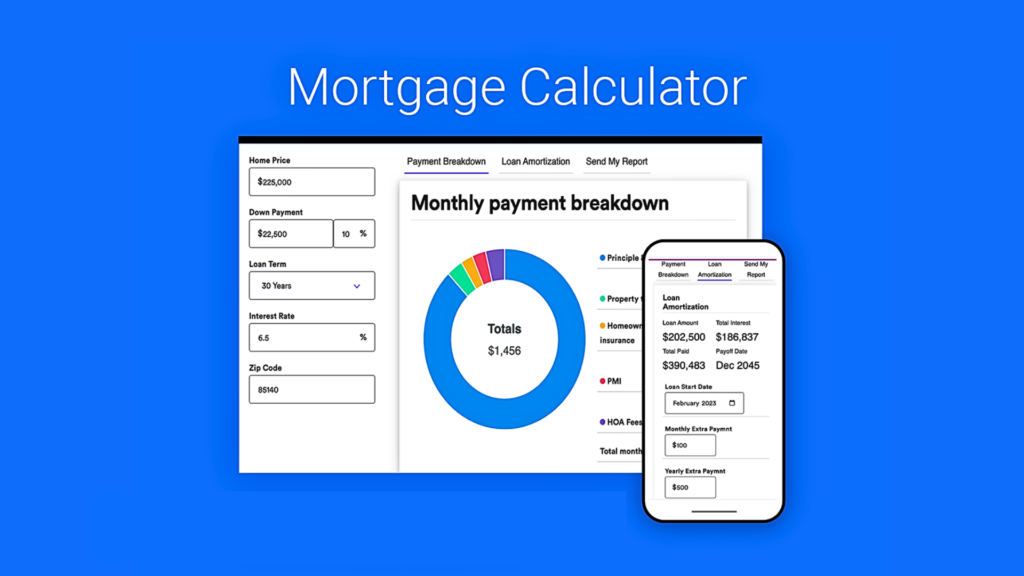

Step Three: Use a Mortgage Calculator

You can use an online mortgage calculator to help estimate the loan size you can afford. Input the following:

- The desired loan amount.

- Interest rate (based on your credit score and lender’s offer).

- Term of the loan (usually 30 years).

- Down payment amount (aim for at least 20% if possible)

To understand better, here’s an example:

The loan amount for a $400,000 home with a 20% down payment would be $320,000. If you lock in a 4% interest rate, your monthly mortgage payment would be approximately $1,528. If you add taxes and insurance, you’re likely near the $2,333 monthly payment target.

Step Four: Consider Other Debts

Don’t forget to include other debts in your calculations, like credit card payments, car loans, and student loans. Your monthly debt payments shouldn’t exceed 36% of your income, or about $3,000 for someone earning $100k.

ALSO READ: How Much Does a Mortgage on a $500,000 House Cost?

Tips for Buying a House on a $100K Salary

Buying a house with a $100k salary puts you in a solid financial position, but it’s still essential to follow some smart strategies to get the best deal possible.

- Focus on Affordability: Even if you qualify for a mortgage to buy a more expensive home, do not overspend. You should save for emergencies or, better still, try to live within the 28/36 rule guidelines.

- Improve Your Credit Score: Your credit score will heavily influence your mortgage interest rate. So, if it is below 700, take your time to improve it before considering buying a home. You can start by paying down debts and ensuring you don’t miss any payments.

- Shop Around for Lenders: Different lenders offer different mortgage rates with diverse requirements and terms. Make sure to compare rates and get pre-approved with multiple lenders to see which one is the best fit for you.

- Consider the Location: Your ability to afford a home will also depend on the location. The cost of living and home prices are much lower in some places than others. If you’re willing to move to a more affordable area, you may be able to afford a bigger or nicer house.

- Don’t Forget Additional Costs: Besides the mortgage payment, you’ll also need to budget for closing costs, homeowners insurance, and private mortgage insurance (if you’re putting down less than 20%). Include these in your calculations when buying a home because they can add up quickly.

How Much House Can I Afford With 100k Salary: Making the Right Decision

Buying a house is a major financial decision, and figuring out how much house you can afford with a 100k salary is essential. By following the above guidelines, you can ensure you’re making a sound investment. Finally, taking the time to calculate the home you can afford will surely set you up for success in your home-buying journey.