Debt is one of the major problems small business owners face. The challenge of managing business debt not only limits the business’s ability to grow but also affects the mental health of some business owners. If you’re in this position, a debt consolidation loan is one solution you should consider.

But how do you consolidate business debt?

This is a common question for entrepreneurs seeking to streamline their debt repayment process and reduce financial stress. We will explain everything you need to know about consolidating business debt, the types of consolidation options available, and the pros and cons. By the end of this article, you will better understand the debt consolidation process and be able to make informed decisions regarding budgeting, debt management, and financial planning.

Understanding Business Debt Consolidation

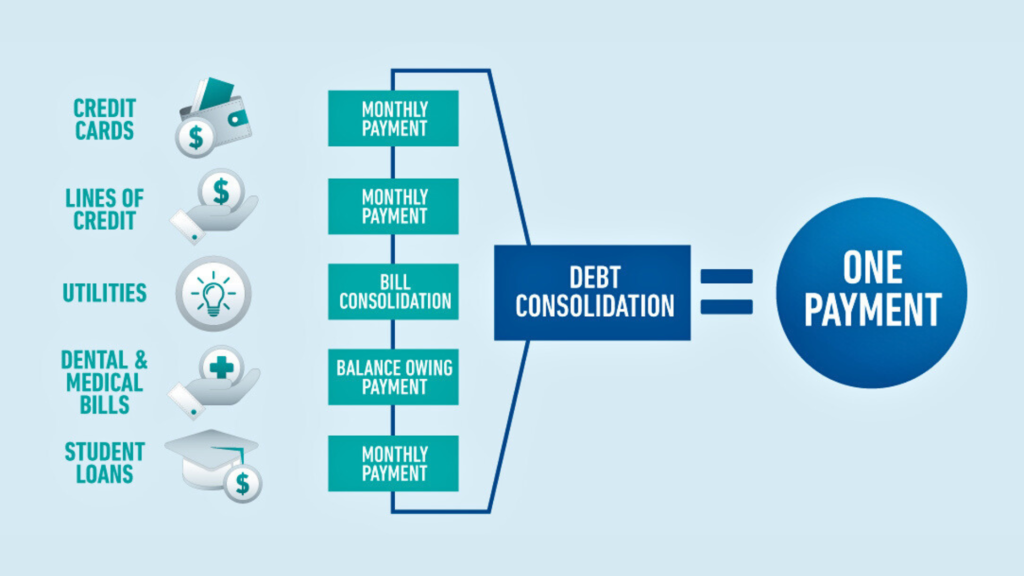

Business debt consolidation involves combining different debts into a single loan or line of credit to reduce monthly payments, secure lower interest rates, and facilitate repayment. This strategy is useful for businesses with multiple high-interest loans or credit card balances that are difficult to manage.

Consolidating debt can improve cash flow and make it easier to keep up with repayments. But it’s not always the best option for every business, so it’s important to consider the potential benefits and drawbacks before making a decision.

How Business Debt Consolidation Works

Business debt consolidation involves taking out a new business loan, known as a “debt consolidation loan,” to pay off multiple debts your business owes. When you use the loan to pay off old debts, you “consolidate” (combine) them into one loan account.

Here’s how it usually works:

The business owner first calculates all the business debt, the total amount owed across all business loans and credit accounts, including interest rates, terms, and monthly payments. Then, they search for loan options and compare which lender offers favorable terms.

Banks, credit unions, or online lenders could offer loan options. After the business owner chooses a lender, the lender approves the loan and pays off the existing debt, leaving the owner with one loan to manage.

Afterward, the business owner begins managing a single monthly debt payment, often with a lower interest rate. Occasionally, consolidation loans may extend the repayment period, lowering the monthly fee, but may result in more interest over time.

ALSO READ: Credit Card Refinancing vs Debt Consolidation: Meaning, Differences, and Benefits

When To Consider a Business Consolidation Loan

Debt consolidation is a helpful tool; timing is critical if you want a business consolidation loan. Here are some signs that it might be the right time to give it a try:

- High-Interest Payments: If high interest rates make reducing the principal balance on your loans hard, then you should consider consolidating into a lower-interest option. The interest rate on the consolidation loan will be lower than what you usually pay.

- You Have Multiple Loans: If you’re finding it difficult to manage different due dates, interest rates, and terms because your business has multiple loans or credit accounts, consider a business consolidation loan. It will combine everything into a single loan and help reduce the number of accounts/monthly payments you manage.

- You’re Experiencing the Pressure of Cash Flow: If high monthly debt payments prevent you from reinvesting in your business, debt consolidation may help ease the pressure of cash flow.

- When Tracking Payments Appears Difficult: If keeping track of several monthly payments takes a lot of time and leads to missed or late payments, consolidation can help simplify your finances.

Types of Business Debt Consolidation Loans

There are different types of business debt consolidation loans available. They are:

Traditional Loans

Banks and credit unions are usually the first stops when businesses want to consolidate their debt. Banks and credit unions often offer favorable loan terms and lower interest rates for established businesses with a good credit history, but they can be challenging to qualify for. Additionally, many banks may not accept you unless you have an excellent credit history, a positive cash flow, and a business that has been operating for at least two years.

SBA Loans

The U.S. Small Business Administration (SBA) loans are low-interest loans with favorable terms available through authorized lenders and backed by the government. However, these loans require excellent credit scores and lots of paperwork. Also, the approval process can be challenging and take a long time to qualify for.

Business Lines of Credit

A business line of credit is like a credit card that allows you to obtain funds in your account and withdraw them as needed, which can be used to pay off debts in increments. With this option, interest rates can be higher, and it often comes with variable interest rates, so you can pay interest on the amount you owe. It can be a flexible option, as it is highly accessible. It can also help build your business credit score.

Private or Alternative Lenders

If you are not qualified for a traditional or SBA loan, you might want to look into private lenders. Private lenders offer a quicker approval process and a more convenient way to obtain business consolidation loans. They can be more flexible as they offer terms that might suit smaller businesses or those with unique needs. However, these loans may come with higher interest rates.

Steps To Consolidate Business Debt

The process of consolidating business debt takes time. As a business owner, you need to take your time to research, evaluate, and set up meetings with different lenders so you can get it right. If you rush the process, you might leave your company in a worse state than when you first started. So make sure to follow these steps to get it right:

Step 1: Calculate Your Debt

Before choosing a new loan, you must calculate how much debt you must consolidate. Begin by listing all existing debts, including interest rates, credit cards, lines of credit, balances, and payment due dates. You can also use a debt consolidation calculator to help you.

Step 2: Check Your Credit Score and Financial Health

Knowing your credit score and evaluating the financial health of your business can help you determine which consolidation options you qualify for. If you’re wondering if you can consolidate business debt with bad credit, yes, it’s possible, but the better your credit score, the better your chances of qualifying for an affordable loan.

Step 3: Research and Compare Lenders

Finding a lender shouldn’t just be about finding the funds, but finding the funds from the right lender and finding a loan that will work for you. Search for lenders who specialize in business debt consolidation loans and who answered all your questions. Also, research and compare requirements needed to qualify, such as interest rates, terms, prepayment penalty, and related costs.

Step 4: Gather All Necessary Documents

The lender will thoroughly review your business’s accounts and records before approving you for a loan. So before you talk to a lender, make sure to gather the following documents: your business plan, business financial statements for fiscal year and year-to-date, 2-3 years of business tax returns, 6 months’ worth of bank statements, and 6 months of statements for your loans, credit cards and lines of credit.

Step 5: Apply for the Business Debt Consolidation Loan

Once you’ve chosen a lender, you’ll need to apply for a debt consolidation loan formally. This process may require you to fill out a lot of paperwork, and if the underwriter requests more financial records like tax returns, balance sheets, and proof of income, you could also need to submit them.

If you’re approved, you might not get the funds immediately. Depending on the lender, it may take a few days, a month, or longer. So, in the meantime, make sure to pay off any debt due on your old debt accounts.

Step 6: Pay Off Old Loans

When you take out a consolidation loan, the new lender might transfer the funds straight to your creditors to settle the debt. Before applying, you can ask whether this is an option.

If it is an option, be ready to give the lender details about your debt accounts, including account numbers, once your loan is approved. If it’s not an option, use the new loan to settle your outstanding debts as soon as you get the funds.

Step 7: Develop a Repayment Plan

Lastly, create a budgeting plan that accounts for your new loan payment and ensures enough funds are available for timely payments. An emergency fund can also protect your business from unexpected expenses and ensure that cash flow disruptions won’t affect debt payments. Living within your means can also significantly affect your ability to repay debt.

ALSO READ: How To Get Out of Business Debt in 7 Steps

Pros and Cons of Business Loan Consolidation

The following are some of the main pros and cons of business loan consolidation:

Pros:

- Pay Off Debt Faster: One of the main benefits of consolidating is settling all your debt faster.

- Lower Interest Rates: A business loan consolidation allows you to secure a lower interest rate, saving you money over time.

- Easy to Manage: It helps reduce the number of accounts or payments you manage rather than juggling multiple due dates. It also reduces the risk of missed payments.

- Improve Your Credit Score: Consolidating debt and a single loan payment can improve your payment history and business credit score.

Cons:

- You Could Pay More: While some business debt consolidation loans might lower your monthly payments, the terms may also mean it will take longer to pay off. You might end up needing to pay more interest throughout the loan.

- Fees and Penalties: Some lenders may charge origination fees, prepayment penalties, or other costs associated with consolidation loans.

- Risk of Falling Back into Debt: Without a solid budgeting plan, businesses may risk taking on new debt even after consolidating existing balances.

- High credit score: These loans require a high credit score. You likely need to have good business or personal credit to qualify.

Available Business Debt Consolidation Tools

Consolidating business debt can be facilitated using several financial tools and services. Here are some options to consider:

- Debt Management Software: Businesses can manage debt more efficiently by using software solutions to keep track of budgets, payments, and expenses.

- Credit Counseling Services: Professionals can offer credit counseling advice on debt consolidation. They will also evaluate your financial situation and help you negotiate with creditors.

- Debt Consolidation Calculators: These online tools allow businesses to estimate monthly payments, interest savings, and repayment timelines based on different consolidation loan options.

- Automated Payment Systems: Setting up automatic payments can help businesses manage their monthly payments and avoid late fees.

Now that you know how to consolidate business debt, this financial move will hopefully help you simplify debt repayment, lower monthly payments, and improve cash flow.

For a successful business loan consolidation, you should consider applying savings strategies like reducing operational costs, renegotiating supplier contracts, or downsizing where possible.

Implementing these savings strategies, living within means, and negotiating with creditors are essential for long-term economic health, debt management, and financial planning. Finally, embrace income generation strategies and build an emergency fund to help your business succeed financially, even when unexpected expenses arise.