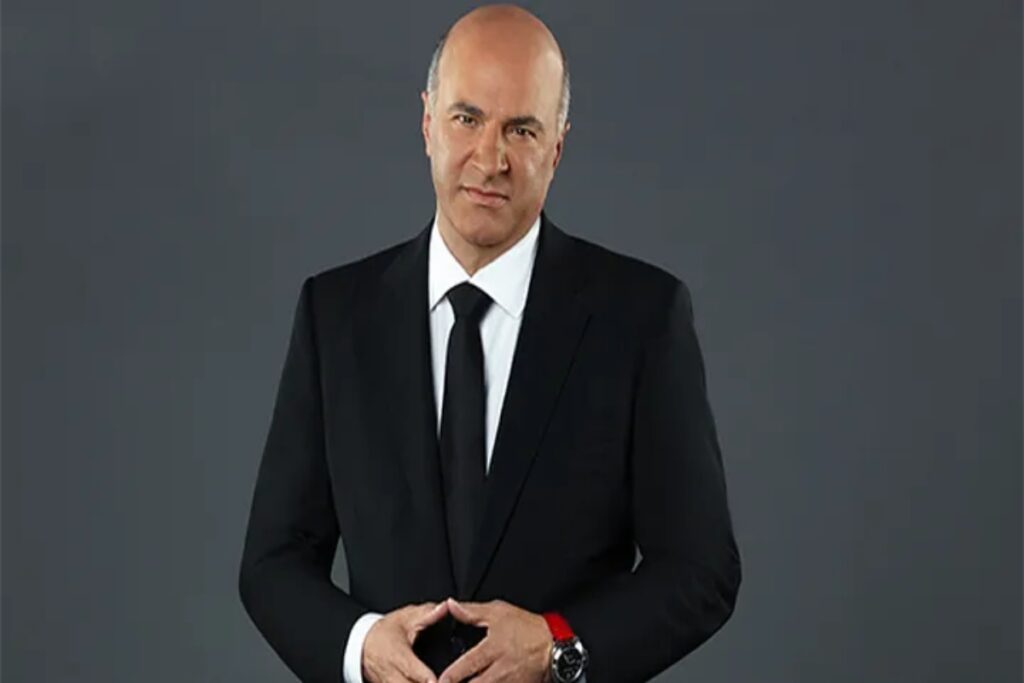

During a recent one-on-one chat with Kevin O’Leary, he admitted that budding entrepreneurs and random people would often ask him how he manages family members who are overly dependent financially.

O’Leary admits the sensitivity of such a situation that potentially puts a financially free individual at odds with their family if not handled cautiously. So, let us look at some tips that the billionaire recommends.

How to Deal With Loan Requests From Family Members

O’Leary would later explain that he has had to deal with situations where family members would reach him for financial assistance. Over the years, the billionaire has developed a strategy that dampens the tension during such filial interactions.

O’Leary claims that he has perfected this playbook over the years and is the best anyone could ever recommend.

Turn Down Loan Requests, Give Gifts Instead

O’Leary suggests never lending anyone money. By all means, give gifts, but always outmaneuver every loan request, particularly from family members. So, when a relative asks for a loan, nicely turn down the request and follow up with a gift that serves as a safety net for hard feelings.

For example, if someone asks for a $200,000 stimulus to seed their new business venture, respectfully but firmly refuse. Next, offer to give them a gift of, say, $60,000 instead.

Giving a Gift That Comes With a Caveat

The high point of this exchange, according to O’Leary, is to make the family member understand, in explicit terms, that the gift coming from you to them is a one-time thing. They cannot exploit that route anymore after you’ve given the gift in place of the requested loan.

According to O’Leary, he makes sure to arrive at an unofficial agreement that the family member would never return for more bailout, nor should they ever bring up the gift in the future.

ALSO READ: Earn $10K/Month and Build Real Estate Wealth Without a Mortgage by Flipping Fixer-Uppers

Even Corporate Organizations Struggle to Recoup Loans

Kevin O’Leary prefers this playbook because he understands how difficult it can be to get a family member to make good on a loan that you have issued in good faith. He pointed out that he learned that lesson from experience, not once or twice.

Save yourself and the relative involved from the trouble of seared emotions by giving a generous gift when they ask for that loan. However, the fine print of the exchange is that they will never return for such a loan in the future.

Expect Some Backlash When Standing Your Ground

O’Leary admits that some family members often criticize this method, which may make you seem cold. However, he stands by his guns, saying that criticism is way better than enduring a strained relationship with family due to an unpaid loan.

Furthermore, O’Leary proceeds to give four reasons why his recommendation is best for handling loan requests from family members.

Money is an Explosive Deal-Breaker and Could Tear a Family Apart

Research shows that one of the common reasons couples dissolve their marriages is financial rift. We must not ignore the fact that money matters and significantly influences the trajectory of our relationships.

O’Leary clarifies that his extended family, like every other person’s, keeps getting bigger. Likewise, do their financial needs. So, no financially sane individual should drive himself into insolvency by being a yesman.

Don’t Run Yourself Into Financial Insolvency

Interestingly, in a scenario where you try to please everyone in your family by dancing to their financial tunes, it is still not insurance for the cordiality of your relationship. Basic economics tells us that human wants are insatiable, meaning the probability of them returning for more bailouts is ‘1.’

So, stop the rat race of trying to make everyone happy. You are not the ice cream man, and filial bailouts are not sustainable.

Rid Your Family Member From Any Traces of Entitlement

Saying no to family members could be the greatest help you could offer them in a lifetime. O’Leary said he learned from his mother that entitlement is one of the deadliest plagues of all time.

Once a family member gets the impression that they never have to take a risk and that their wealthy relative is always there to fall back on, they decline into financial rot. Often, this makes it difficult for them to be financially responsible.

ALSO READ: The Dynamics and Cost of Living in a Tiny House

Some Battles are Personal

Your wealth is earned freedom, and the best thing you can do for your family is help them fight for financial emancipation. However, recurrent loans and bailouts are lazy shortcuts for hypothetical money warriors.

So, encourage your family members to build their entrepreneurial grit rather than hunting for bailouts at every available opportunity. They should learn to amass wealth, not for greed but for financial freedom.

Secure Your Financial Freedom By All Means

O’Leary recommends not living under the dictates of demands by people and things that seek our attention. Your financial freedom is something to be guarded jealously.

O’Leary claims that this approach to wealth management is most obvious in how he manages his time. According to him, time is the most valuable asset of a financially free individual.

Testaments of the O’Leary Playbook to Filial Loans

O’Leary said the principle of not giving handouts to family has helped his immediate family to replicate financial freedom. According to him, his children have ventured off into different facets of careers and are doing well for themselves.

O’Leary claims that the major reason for his children’s success and financial independence is that he instilled in them the idea that the best route to achieving financial freedom is getting in the arena and tugging it out by yourself.

You Might Also Like:

A Detailed 2024 Review of AmeriHome Mortgage

How Much Does a Mortgage on a $500,000 House Cost?

Earn $10K/Month and Build Real Estate Wealth Without a Mortgage by Flipping Fixer-Uppers

The Dynamics and Cost of Living in a Tiny House

Comparing The Average Savings Between Baby Boomers, Gen X, Millenials, and Gen Z