As billionaire investor Warren Buffett has recommended innumerable times, compounding wealth is the key to accumulation.

So, young workers can rewrite their retirement fate by mindfully saving right from the early days of their careers. It will save them many woes in later years, and the initiative has many benefits.

Pension Versus 401K

Unlike the fixed withdrawals from workers’ salary accounts, which are the bedrock of pension savings, the 401K leaves the workers with the choice of how much to save.

So, a worker can decide to start saving big early, and another may choose to spend all of their earnings. That is the almost indifferent liberty that the 401K affords.

Government’s Concern Over Post-Retirement Poverty

According to a February 28 report by the Health, Education, Labor, and Pensions Committee of the US Senate, more seniors are living in poverty than ever recorded.

The report states that approximately half of Americans close to retirement age have no savings to fund their livelihood after halting involvement in active employment.

A Retirement Crisis Is Upon Us

Interestingly, Americans know the bleak realities of retirement for the average senior citizen. In a poll by the National Institute on Retirement Security, 79% of Americans admit the existence of a retirement crisis.

That figure is up from the institute’s 67% in 2020. Likewise, 55% of Americans are worried that they are likely to find themselves in financial trouble after retirement.

Early Is Best to Compound the Interest on Savings

However, during the February 28 Senate hearing, financial experts testifying to the report’s credibility have proffered some fixes for the retirement crisis. According to them, the tips will work best for young workers as they can leverage the fact that they still have many years ahead.

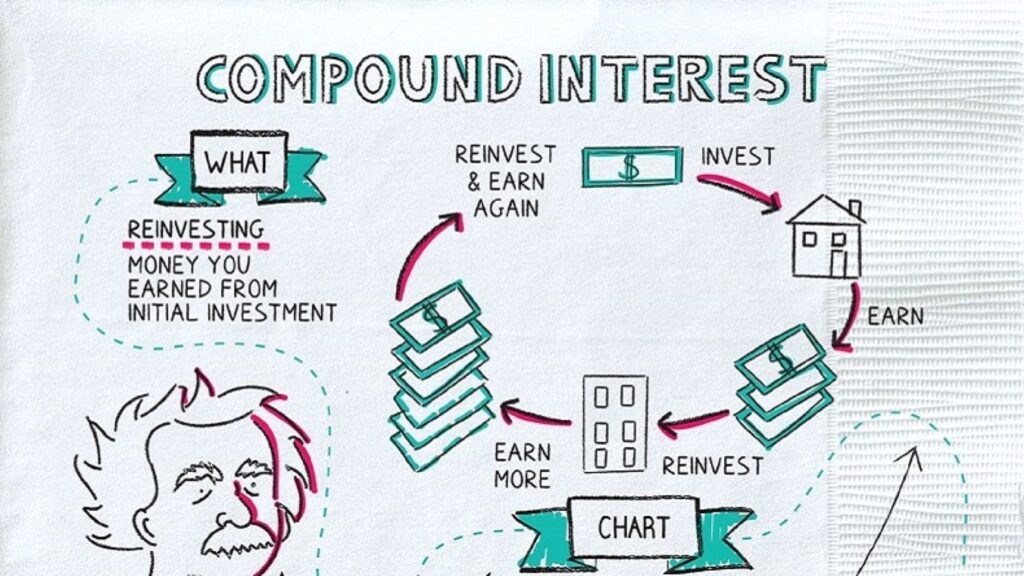

According to experts, compound interest is the key to financial freedom in retirement.

Go Long With Ease, Or Sprint and Gasp Heavily

Albert Einstein is acclaimed to have called compound interest “the most powerful force in the universe.” Experts suggest that with more time at hand, young investors can invest less aggressively and still get tangible results in the long run.

On the contrary, aged investors may have to scrip, save, and invest all their life savings to achieve similar results.

Seeking Expert Opinion On Retirement Security

Compound interest can work wonders with meager resources when it has time as a surplus complement. Dan Doonan, the executive director at the National Institute on Retirement Security, was present at the Senate hearing.

He said, “Starting earlier obviously makes the math work better.” So, this implies that compound interest has the backing of credible experts as a way out of penury in retirement.

Informing Youths About the Benefits of Saving Early

So far, there have been multiple proposals from federal Senators on how to help retirees have enough funds to fall back on during their senior years. In other instances, the lawmakers are trying to ‘catch them young’ with bills encouraging young folks to start saving early.

For example, the Helping Young Americans Save for Retirement Act has reduced the participatory age for workplace retirement schemes from 21 to 18.

Babies Can Have Retirement Savings

Likewise, a team of Democrat lawmakers sponsored the 401Kids Savings Act. The bill makes it legal for parents to open a savings account for their newborn child. In addition, the federal government will provide support for such children, particularly those from low-income and moderate-income families.

By age 18, the minor will be allowed access to their savings to fund their education, launch a startup, or purchase a home.

Savings On Auto Pilot

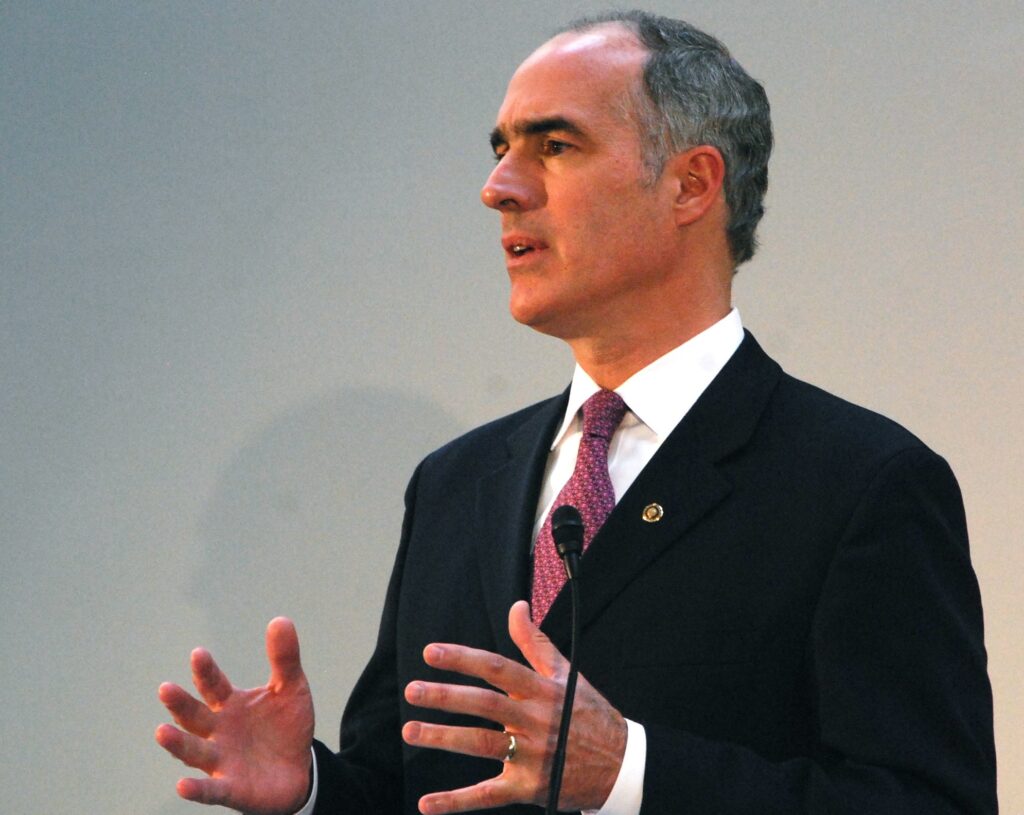

Senator Bob Casey of Pennsylvania was the prime mover of the 401Kids Saving Act. He suggests that starting a savings account at birth is like putting a retirement fund on autopilot and allowing market forces to compound the interest.

In a statement, Casey said, “Starting to save at birth also means families can put the market to work for them, leading to compound savings and greater assets later in life.”

Better Late, But Best Early

In 2023, research by the Aspen Institute discovered that a savings account initiated at birth has the potential to accumulate up to $473,000 at retirement. This will give the individual less financial strain compared to someone initiating their retirement savings at 32 or after college.

However, experts suggest that, where possible, multiple solutions should be deployed to curb the retirement crisis.

How About Auto-enrolling Young Workers for Savings

It may be unconstitutional to force parents into open savings accounts for their babies. However, the president of Nationwide Retirement Solutions, Eric Stevenson, proposed an auto-enrollment for everyone at age 21.

All such initiatives would improve the livelihood of Americans at retirement and have a ripple effect on the national economy and GDP.

Don’t Wait for the Herd Syndrome

However, despite lawmakers’ efforts to pass bills that would encourage young Americans to save, the goal can still be achieved without the laws. Those legislations are intended to merely motivate and provide a conducive environment for young savers.

Pending the passage of these bills, young workers can start an individual retirement account, even without any federal law prompting them to do so.

Roth IRA to the Rescue

Retirement fund experts are also trying to sensitize savers about the benefits of Roth IRAs, which are individual retirement accounts that can be funded with tax-free dollars.

However, the Roth IRA puts a cap on how much workers can contribute to the account. Investors less than 50 years old can contribute no more than $7,000. Likewise, relatives and guardians of a young person can fund the account on their behalf.

Start Saving Today!

The chief benefit of a Roth IRA is that the account holder can withdraw the funds tax-free and without any accruing penalties. However, five years after the first deposit is made, savers are eligible to withdraw their funds. However, the crowning clause states that the saver needs to be 59.5 years old to access the savings.

Therefore, there is no opposition to the idea that early savings can help address the national retirement crisis.