Lockheed Martin announced in mid-August that it would be buying out Terran Orbital. The defense giant’s goal is to salvage what’s left of the ailing spacecraft manufacturer by making Terran Orbital private.

The deal will have Lockheed Martin paying about $450 million as the enterprise valuation. As of March, Lockheed Martin’s initial bid to acquire Terran Orbital was $600 million.

An Acquisition Spread Out Into Phases

There are multiple components to the buyout deal. First, Lockheed Martin will acquire Terran Orbital’s outstanding shares at a knock-off price of 25 cents per unit.

In addition, the acquirer will pay off all outstanding debts of the ailing Terran Orbital. Finally, a seed of $30 million will be made available to keep the spacecraft manufacturer running until the agreement’s modalities are finalized.

ALSO READ: Boeing’s New Outsider CEO Ortberg Assumes Leadership: He Is Starting on the Factory Floor

Salvaging What’s Left of a Budding Spacecraft Company

Before setting the acquisition deal in motion, Terran Orbital shares went for 40 cents on the stock market last week. The privatization deal became inevitable due to the spacecraft manufacturer’s precarious situation.

As of July’s end, Terran’s debt was about $300 million, and the company had a cash reserve of less than $15 million. So, to prevent an entire implosion, the company had to give Lockheed’s offer a shot.

Terran Orbital Will Officially Become a Part of Lockheed Martin By Year End

The buy-out deal between Terran and Lockheed is projected to be finalized by the fourth quarter of 2024. Before Terran became financially distressed, Lockheed was its largest customer.

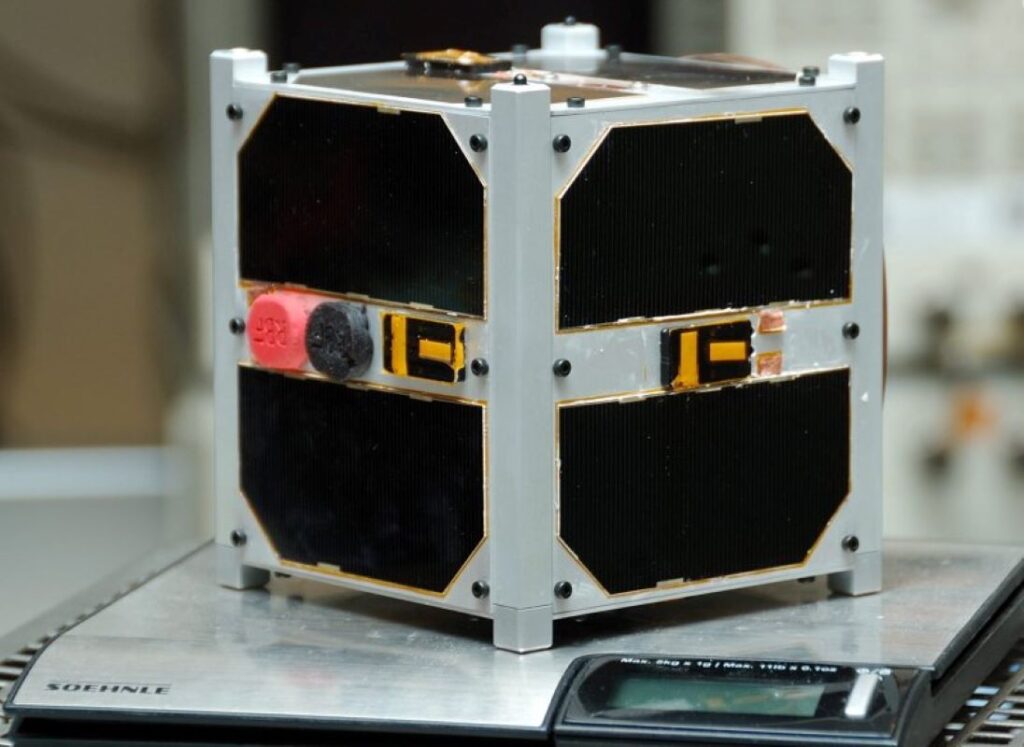

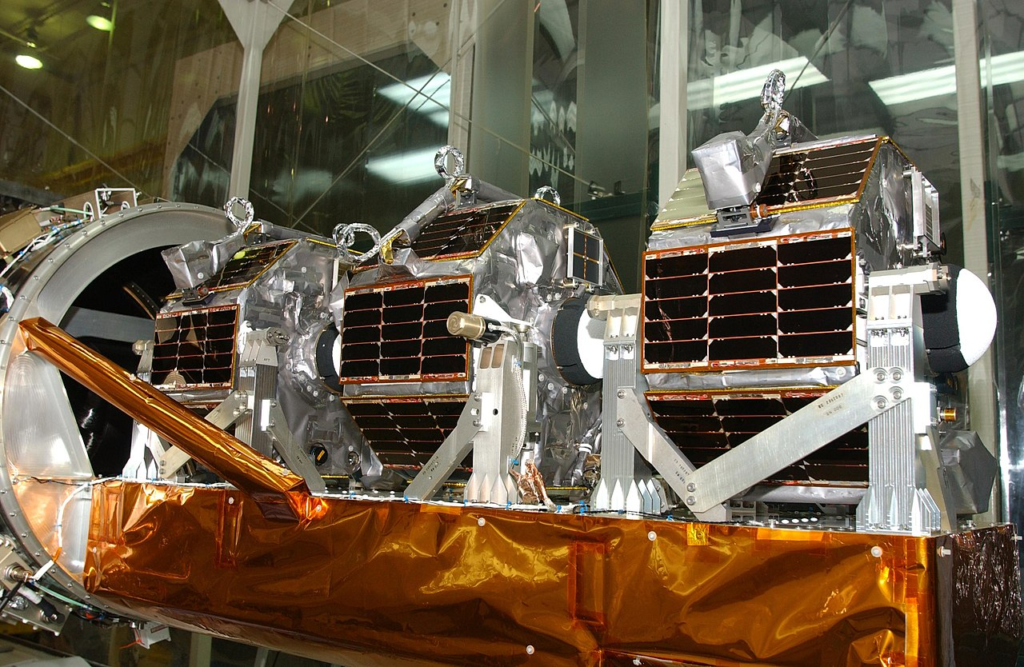

The smallsat startup company built satellites for public and private use in its heyday. Terran was responsible for building tracking and surveillance satellites for the Space Development Agency.

The Two Companies Are Birds of a Feather

The acquisition deal between Terran and Lockheed would be the first for the defense giant. Unlike the smallsat builds of Terran, Lockheed Martin is more accustomed to building large specialized satellites for the U.S. government.

However, the acquisition of Terran has raised suspicion that Lockheed is about to venture into the smallsat market. Interestingly, Lockheed has indicated that Terran will remain a private and independent entity that services its traditional industry.

Terran Orbital Is a Great Investment

Terran also has a subsidiary, PredaSAR, specializing in synthetic aperture radar for geomapping and remote sensing.

Robert Lightfoot, president of Lockheed Martin Space, explained his company history with Terran by saying, “We’ve worked with Terran Orbital for more than seven years on a variety of successful missions.” It obviously takes a company that understands the capability of the smallsat startup to embark on such an uncertain acquisition.

A Synergistic Merger to Further Space Technology Development

Lockheed Martin is already warming up to integrating the Terran team into its various operations. Lightfoot suggests that Terran’s strategic plans align with those of Lockheed Martin, which is why they are motivated to proceed with the acquisition deal.

Lightfoot also highlighted the benefits of the collaboration, saying, “Our customers require advanced technology and even faster product development.”

The Two Entities Are Enthusiastic About the Outcome of the Merger

Likewise, Terran Global’s higher-ups are excited about the prospects of merging with Lockheed Martin. Terran CEO Marc Bell expressed optimism about the merger, saying the acquisition “will open new opportunities for growth and innovation, and we couldn’t be more excited about the future.”

Terran Orbital is a young startup that went public in 2022. Lockheed Martins was one of its first investors, seeding the venture as far back as 2017.

Did Lockheed Martin Buy Terran Orbital?

While the deal to buy Terran Orbital has not been set in stone, Lockheed Martins has made its interest in acquiring the smallsat company public. Indeed, the ball has been set rolling for the negotiation and complete takeover of the satellite and spacecraft manufacturer.

The formalities involved in the acquisition deal are expected to be finalized by the fourth quarter.

How Much Debt Does Terran Orbital Have?

According to a filing by Terran Orbital in the third week of August, the company has a debt burden of about $300 million. It also has a cash reserve of less than $15 million, which is hardly enough to keep the company’s operations going.

So, Terran has accepted Lockheed Martin’s takeover conditions despite the latter offering $450 million against the $600 million proposed in March.

What is the Goal of Terran Orbital?

Terran Orbital services a peculiar niche of the space and earth exploration industry. Though specialized in small satellites, the company offers its clients expertise in satellite design, launch, and on-orbit maintenance.

Terran avails commercial, private, and government entities services in the highlighted specialty.

ALSO READ: Advisor Recommends Seizing Stock Market Deals Now—Here’s What You Should Know

How Many Shares Does Terran Orbital Have?

According to Terran Orbital’s latest financial report, the company has 203,477,086 outstanding shares. However, a recent report by Stock Analysis pegs the company’s outstanding shares to 204,360,000 units.

Increases in share numbers, as in Terran’s case, are a product of the splitting of normal stocks and share buybacks.

You Might Also Like:

Why Walgreens and CVS Are Struggling — and Their Plans to Turn It Around

Harris Advocates for Expanded Child Tax Credit of Up to $6,000 for Families with Newborns

China’s Bond Market Intervention Signals Growing Concerns Over Financial Stability

Goldman Sachs Lowers U.S. Recession Odds to 20% Following Retail and Jobs Data

Incoming CEO Brian Niccol Faces the Challenge of Fixing Starbucks’ Mobile App Issues