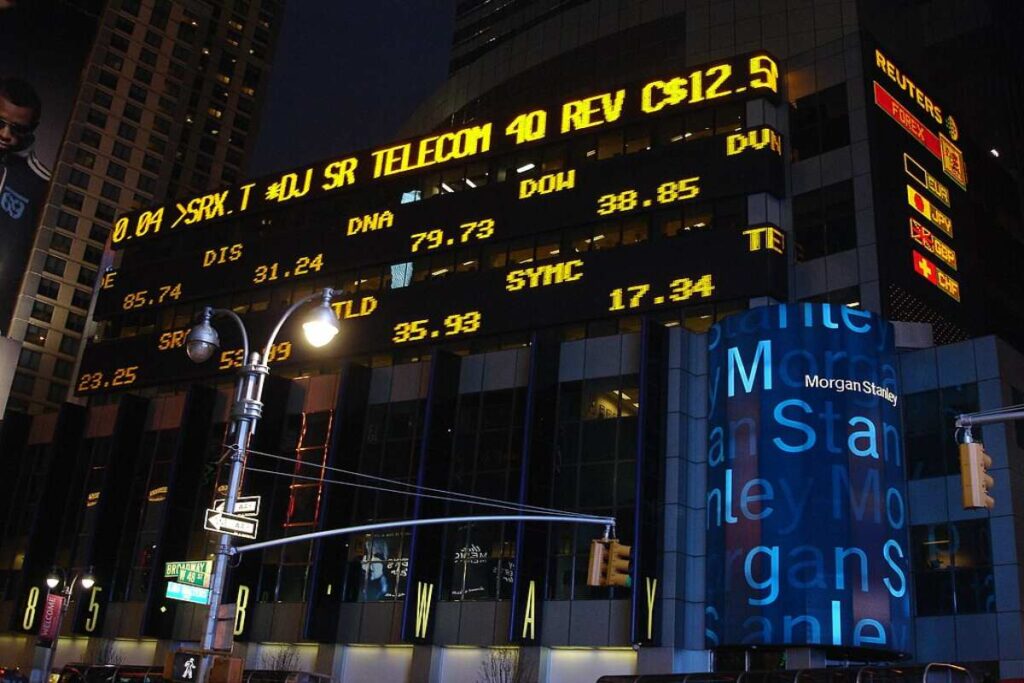

The American Bank, Morgan Stanley, has given its army of wealth advisors the green light to offer bitcoin ETFs to clients. The bank is the trailblazer with this initiative, as most financial institutions have prodded ETF transactions with a long stick.

Before now, it was against banks’ standard operational policy for affiliated wealth advisors to recommend ETFs to customers.

A Major Wealth Management Firm Approves Digital Asset Investments

Going forward, Morgan Stanley will support any financial advisor with the prospect of selling bitcoin ETFs to their customers. Financial advice is very important for ETF investments, so Morgan Stanley insists that their customers consult with their affiliate financial advisers.

So far, the bank has about 15,000 wealth advisors with which their clients can consult before buying bitcoin ETFs.

ALSO READ: Important Crypto Tax Rules for Every Investor as Bitcoin Surges by 50% in 2024

Volatility of Cryptocurrency Has Been a Recurrent Issue

Two lucrative exchange-traded bitcoin funds started trading in the first week of August: Fidelity’s Wise Origin Bitcoin Fund and BlackRock’s iShares Bitcoin Trust.

This new development is good news for cryptocurrency enthusiasts, as it has given digital currency credibility on various stock markets worldwide. Cryptocurrencies also received a major boost some years back when Tesla started accepting them as payment for their cars.

Bitcoins are Still the Most Popular Digital Asset

So far, bitcoin has surpassed other cryptocurrencies in popularity and adoption, and now, it is being endorsed by the largest wealth management firm in the world.

The US Securities and Exchange Commission ratified 11 different bitcoin ETFs in January. Bitcoin ETFs are investment vehicles that allow easier access for people who would love to own the currency.

Are Bitcoins Too Expensive? Invest in Bitcoin ETFs Instead

Approved cryptocurrency exchange-traded funds, like Bitcoin ETFs, are cheap alternatives to buying the actual digital currency. One unit of Bitcoin currently costs $60,484.90. Meanwhile, Bitcoin ETFs can be purchased for as low as $0.000325 per (ETF/USD).

The infinitesimally small value of bitcoin ETFs indicates its unpopularity on Wall Street. Bitcoin itself has suffered the many consequences of negative reviews from reputable finance figures like Warren Buffett and Jamie Dimon.

Wall Street Is Not Warming Up to Cryptocurrency

These negative reviews explain why most of the major wealth management firms on Wall Street are dragging their feet on endorsing Bitcoin ETFs to their clients. So, Morgan Stanley’s announcement is indeed a bold step.

Advisors affiliated with other major wealth management firms still forbid their financial advisers from pitching emerging ETFs to their clients. However, clients that insist on this investment route can only do so through a third party.

Major Wealth Management Firms Lay Embargo on ETFs

Wells Fargo, Bank of America, JPMorgan, and Goldman Sachs are some of the major firms still enforcing the no-ETF embargo.

However, Morgan Stanley seems to be aiming to exploit an underpopulated market for major wealth management firms. It is almost as if they see potential in ETFs, which the other financial firms are oblivious to.

ETFs, By Popular Demand

An anonymous internal source suggests that Morgan Stanley initiated the new ETF policy in response to widespread demand for financial products. Thus, they are probably trying to secure a significant portion of the emerging market for digital assets while simultaneously satisfying their clients.

Nonetheless, Morgan Stanley has included a caveat in the rollout of bitcoin ETFs. Their wealth advisors recommend that clients only invest in digital assets if they have a minimum net worth of $1.5 million. This wealth base will help the client tolerate any risk that may ensue in holding the digital asset.

What Makes Morgan Stanley Different From Other Banks?

Morgan Stanley’s banking activities revolve solely around investments in different shades and forms. This bank is also multinational, with its tentacles spreading to 41 countries and boasting about 75,000 employees.

Their investment choices are a function of the specialty of their financial advisers and the exploitation of the latest advances in data analytics, machine learning, and artificial intelligence to make investment decisions.

Can You Buy Bitcoin Through Morgan Stanley?

Morgan Stanley is not a direct vendor of Bitcoins, meaning it is not a cryptocurrency exchange, nor does it run Bitcoin ATMs. However, it does offer two-spot bitcoin exchange-traded funds (ETFs) for its wealthy clients.

So, with evidence of a financial portfolio exceeding $1.5 million, clients can approach any of the bank’s 15,000 wealth advisors for details on what to do to invest in Bitcoin ETFs.

What Is Unique About Morgan Stanley’s Wealth Management?

Morgan Stanley’s wealth management strategy focuses on wealthy families and individuals. It saves affluent folks, particularly those with first-generational wealth, the hassles involved with setting up a reliable family office.

However, this wealth management firm provides bespoke services to its clients based on the complexity of their financial portfolio. In addition to gourmet financial services, they equally offer legacy services through wealth advisors that afford clients insights into the best financial decision at the right time.

ALSO READ: Important Crypto Tax Rules for Every Investor as Bitcoin Surges by 50% in 2024

What Is the Minimum Investment for Morgan Stanley’s Private Wealth Management?

Clients don’t necessarily need to be ultra-wealthy to take advantage of Morgan Stanley’s private wealth management services, particularly those who want to use the bank’s investment capabilities.

However, according to a breakdown of minimum investments for major private wealth management firms, clients will need a minimum of $250,000 to invest through Morgan Stanley.

You Might Also Like:

These Silicon Valley Billionaires, Founders, and Investors Are Rallying Behind Kamala Harris

This Expert Tip Is the Best Way To Cut Your Wedding Guest List

Here’s What the Failed Expanded Child Tax Credit Means for Families in the US

A Shuttered Power Plant in Michigan Could Pave the Way for More Nuclear Energy in the U.S.

‘The Summer Job Is Back’: Teens Join the Workforce Amid Higher Wages and Perks From Employers