Traders in the U.S. stock market expect Nvidia’s shares to change significantly when it announces its earnings. The value of the company’s shares could change by more than $300 billion.

Their expectations come from how the shares’ options are priced. The data shows that traders expect Nvidia’s stock to increase by about 9.8% after the earnings report, which is a much more significant change than usual.

What Are Nvidia’s Results?

Nvidia recently announced its earnings report for the second quarter of 2024, showing a positive financial performance. The world’s most dominant artificial intelligence chipmaker reported an impressive revenue of $13.5 billion.

This amount is two times more than it made during the second fiscal quarter of the previous year. The main cause of the increased revenue is its data center business, which was boosted by the growing demand for AI chips.

The company’s income also significantly increased to $6.9 billion from the $2.37 billion it made last year. This strong performance in the market shows Nvidia’s dominant position in the AI chip market. As a result of this, its stock is experiencing a significant increase.

Currently, Nvidia is worth about $3.11 trillion. A 9.8% change in its stock price would be an estimated $305 billion. This change would be one of the biggest expected stock moves in U.S. stock market history.

The change is bigger than the total value of 95% of the major companies in the S&P 500, including big names like Netflix and Merck.

ALSO READ: JetBlue Shares Surge 12% Following Surprise Profit and $3 Billion Aircraft Spending Deferral

How Many Shares Are Outstanding in Nvidia?

According to the most recent report from Nvidia Investor Relations, Nvidia has $24.85 billion in outstanding shares.

This shows the exact number of shares issued and presently held by shareholders. These outstanding shares include those held by institutional investors, real investors, and Nvidia’s employees.

Nvidia’s Performance in the Stock Market

Nvidia’s recent performance has had a significant effect on the stock market. The company’s stock has significantly increased by about 150% this year, making up about one-quarter of the S&P 500’s 18% gain for the year.

Steve Sosnick, the chief strategist at Interactive Brokers, said, “The company alone has been a huge contributor to the overall profitability of the S&P 500. It is the Atlas holding up the market.” This means Nvidia plays a significant role in keeping the market strong.

U.S. traders are more concerned about missing out on a significant increase in Nvidia’s earnings. They are less worried about losing money if the company’s stock price drops instead. A few traders think there is a 7% chance the stock would increase by more than 20%. They also believe there’s only a 4% chance it will drop by more than 20%.

This expected move, big as it is, is partly because Nvidia’s stock has been very unpredictable. Compared to other large companies, Nvidia’s stocks have been much more volatile. This volatility can be seen in how the company’s options are priced. Although traders are uncertain, they are also hopeful about how Nvidia will perform, especially with how AI becomes more critical.

ALSO READ: Citigroup Smashes Second-Quarter Expectations in Both Profit and Revenue

What Does Nvidia Do?

Nvidia is a leader and plays a significant role in the technology that powers entertainment and advanced computing. Nvidia makes advanced computer chips, which are also known as AI chips. Before the company started making AI chips, it was best known for creating graphics processing units (GPUs).

GPUs are used to make video games with high-quality images and animations. As time passed, the company expanded its work and included important areas like artificial intelligence (AI). The GPUs they create now help computers learn and manage decisions, an essential feature for technologies like intelligent robots and self-driving cars.

Nvidia also does more than gaming and AI; the company’s technology is also used in data centers. Data centers are extensive facilities that store and manage large amounts of data. GPUs help the data centers speed up data processing, speed up specific tasks like data analysis, and make running AI programs more efficient.

Who Is the Largest Shareholder of Nvidia?

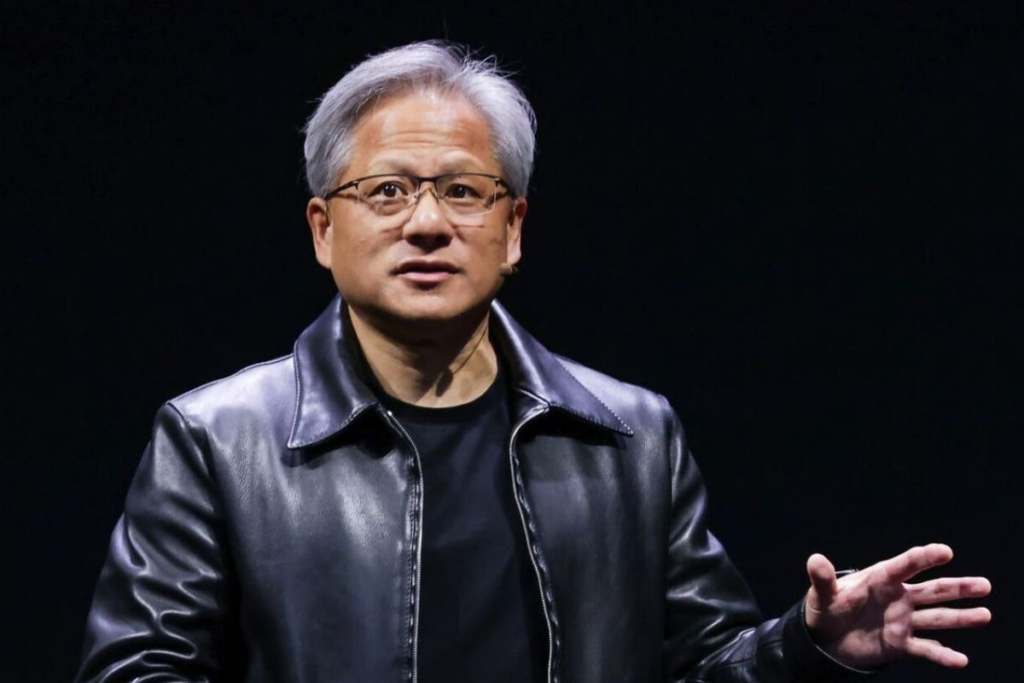

As of this writing, Jensen Huang, the company’s co-founder and CEO, is the largest shareholder of Nvidia. He owns millions of shares and holds the majority of the company.

Apart from individual shareholders, some institutional shareholders also hold significant shares in Nvidia. For instance, Blackrock and The Vanguard Group are among the major institutional shareholders. Each of these shareholders owns a large percentage of Nvidia’s outstanding shares. Institutional investors are big financial organizations like banks or investment companies.

In most cases, institutional investors buy large amounts of a company’s stock on behalf of their clients, which can include pension funds and mutual funds. Because they own so many shares, institutional investors have a lot of influence over the company’s decisions, making them some of the most powerful shareholders in a company.