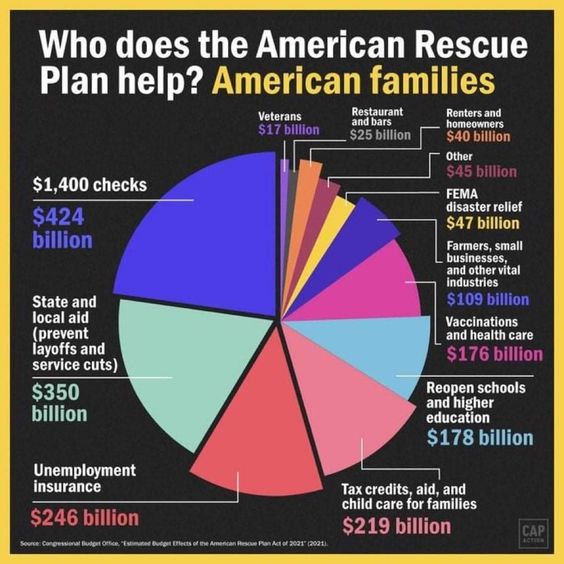

One thing is undisputable about the American Rescue Plan, the IRS’s brainchild: beneficiaries received their first tranche of monthly payments on July 15, 2021.

Come 2024, there will be fresh excitement about the commencement of similar payments. The question is: “Should Americans wait to receive another tranche of poverty-alleviating payments from the IRS?”

The Reincarnation of 2021 CTC Payments

There is no denying that the IRS announced in May 2021 that they would initiate a monthly payment to eligible families as part of an expanded Child Tax Credit (CTC) scheme.

Before its 2021 launch, the American Rescue Plan projected that it would benefit about 39 million households and lift roughly 88% of minors in the United States out of poverty.

The American Rescue Plan Was a Palliative

The preliminary announcement made during the launch of the American Rescue Plan in 2021 made it clear that children younger than 6 years old would receive a total of $3,600 between July and December of that year.

Likewise, children between ages 6 and 17 would receive $3,000 during the same period. According to the Implementation Team for the American Rescue Plan, instituted by the White House, the intervention was a way of helping Americans recover from the economic reverses that followed the COVID-19 pandemic.

Eligible Families Indeed Received Non-refundable CTC Payments in 2021

In 2021, households received their CTC payments through credit cards, paper checks, and direct deposits. The ebb of information about these payments is particularly high because they usually occur between July 15 and December 15.

However, before getting their hopes too high, families need to check the CTC Update Portal to ascertain their family’s eligibility.

Things Are Not the Same Anymore

Unfortunately, upon visiting the portal, the conspicuous message that greets visitors read: “This is an archival or historical document and may not reflect current law, policies, or procedures.”

Likewise, a similar disclaimer on the same page affirms that the American Rescue Plan is solely for 2021. The CTC payments are not likely to be in effect in 2024.

What Do We Make of the Noise About Redeeming Our CTC Payments in 2024?

So, the next thing that may cross the mind of an average American is: “What is all these viral claims about a Tax Credit Payment in 2024?” We didn’t have to search too far to get an answer.

It turns out that the trail, at least online, goes back to a recent Facebook post from June 9.

Fake News Spreads Like Wildfire

The original viral post is no longer accessible but suggested that a 2024 tranche of the CTC payments would commence on July 15. The post read in part: “CTC Monthly Payments 2024 from the IRS are expected to go into impact beginning on July 15, 2024, for all eligible individuals.”

Facebook users excitedly shared the post about 100 times, and soon, similar versions surfaced on other social media platforms.

The Investigative Team at USA Today to the Rescue

USA Today has taken a bold step to call out the viral claim for the falsehood that it represents. One, the 2021 CTC payments were made to parents, not directly to children, as the viral post claimed.

According to USA Today, the second falsehood is the affirmation that the program would run in 2024.

CTC Payments May See the Light of Day in 2025, Not 2024

While Biden’s 2025 budget proposes to bring back the American Rescue Plan as part of the nation’s expenditure for that fiscal year, the concerned facilitators do not mention it officially.

For example, the IRS website does not mention anything about running the poverty alleviation program in 2024. Again, the only source cited by the viral post is an unreliable domain domiciled in India.

Tax Experts Have a Go at the Pie

According to Lisa Greene-Lewis, a tax expert affiliated with TurboTax, “There were advanced payments for tax year 2021 under the American Rescue Plan, but those COVID relief provisions expired.”

Greene-Lewis also explained that the CTC payments were a one-off scheme that ran from July 15 to December 15, 2024. There are no provisions for such non-refundable palliatives in 2024.

The House and the Senate Need to Be in Alignment

The director of The Tax Institute at H&R Block, Andy Phillips, also clarified that Congress would have to pass a bill before a scheme like the American Rescue Plan could go into effect in 2024.

In fact, the House passed a bill in January to increase the established refundable child tax credit. However, the proposal was jettisoned by the Senate.

Some Tax Credits Are Still in Effect, But Not CTC

While the American Rescue Plan’s non-refundable payments are no longer in force, parents can still take advantage of non-refundable tax credits of up to $2,000 per dependent child.

However, parents don’t receive checks or direct payments for this credit. Instead, the amount the family qualifies for is deducted from the owed payable tax.