A retired couple was concerned about what would become of their pension in the future, citing the recent volatility of inflation. To allay their fears, the couple approached a certified finance adviser for recommendations on preserving their financial freedom.

The couple laid out their financial profile to give the finance adviser an idea of their monetary standing and potential.

The Financial Profile of a Hardworking Senior Couple

The couple explained that they are both 60 years old, receive a combined annual pension of $145,000 and spend about $105,000. Most of their annual expenses go to maintenance, entertainment, and vacations.

The couple has investments worth roughly $1.5 million that yield moderate interest. They reinvest the dividends and set aside a tangible sum in long-term care insurance policies.

A Healthy Financial Plan That Sees the End From the Beginning

It is easy to see that this couple is trying everything they can to make their retirement as blissful as possible. They explain to the adviser that they are working towards stopping all their side gigs, which fund their medical premiums at 65.

By then, the couple expects to fall back on Medicare for health bills and the $10,000 monthly Social Security payouts. Their only concern is maintaining this lifestyle after retirement without worrying about inflation.

Resounding Commendations for Financial Acuity

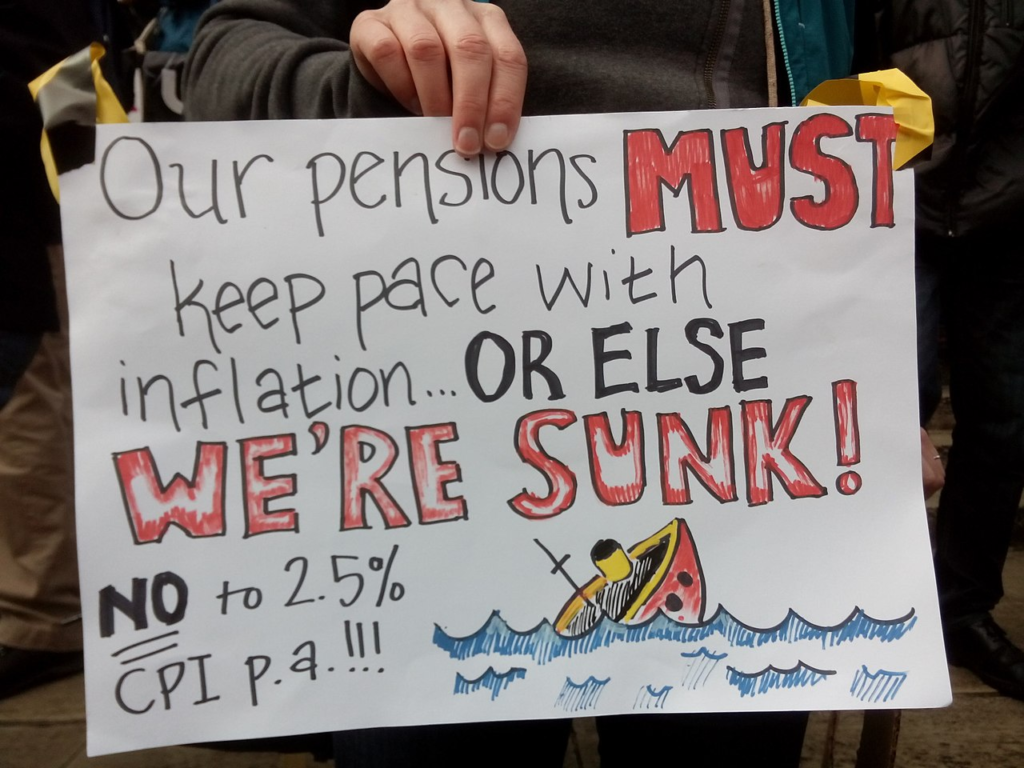

In response, the finance expert acknowledged the couple’s concern. He mentioned that the realities of rising inflation are so glaring that ignoring them would be foolhardy.

However, the adviser continued to run an endurance test on the couple’s financial shack in case of stronger winds. First, he reminded them that pension payments are usually inflation-adjusted.

Pension Inflation Adjustments Don’t Cut It, at Least for Now

Pension payment is usually increased by roughly 2% each year. However, the present inflation rate still leaves such pension increments in the dust. The consumer price index (CPI) rose to 3.3% in May, meaning workers’ earnings will be strained as the cost of goods and services increases.

Similarly, the inflation rate has swung around 3% for the past few months.

Keeping Above Water

Nonetheless, the adviser suggested that the couple are on good terms with Uncle Sam, as they have stayed ahead of the demons of financial insolvency. He also commended their ability to exploit compounding interest by investing up to $1.5 million.

In addition, he mentioned that the couple’s ability to keep expenses below their income has greatly helped.

Some Advice to Further Shore Up the Financial Portfolio

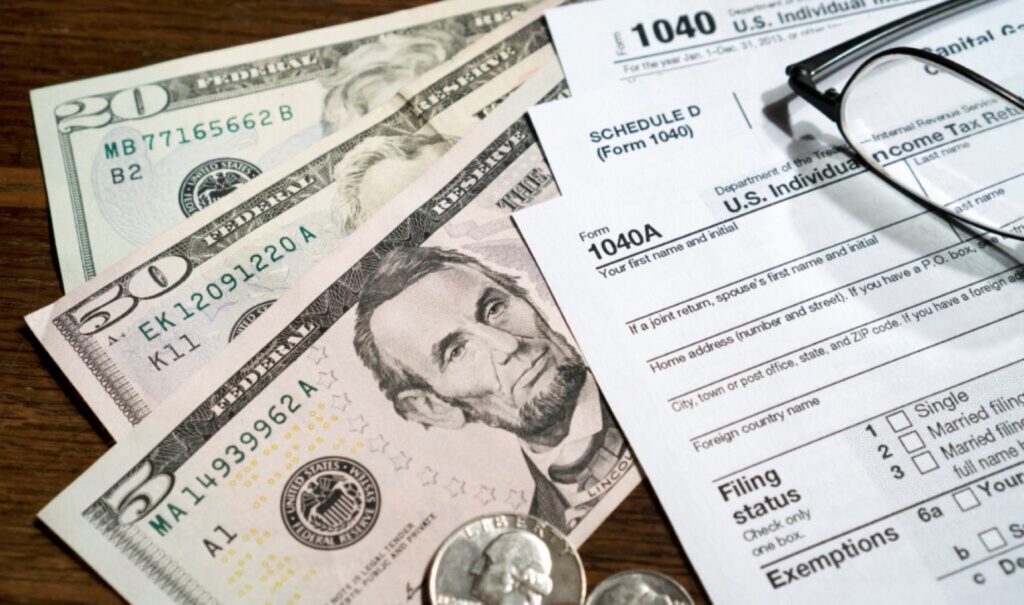

Next, the adviser laid out some recommendations to improve their financial standing. First, he suggested taking the post-expense surplus of their cash inflow and placing it in a more stable investment portfolio.

Alternatively, they could put the funds in a high-yielding savings account. So far, the interest on the savings account has outmatched the inflation rate, so they have nothing to fear. However, just like inflation, interest rates also fluctuate.

Emergency Savings Account to the Rescue

The adviser also suggested that the couple use the five more years before their full retirement to set up an emergency savings account. He said that account would serve as a financial buffer when the couple stops earning from side gigs.

An emergency savings account is a stash of at least six months’ worth of savings. However, retirees can save more if their financial allowances permit.

Practice Delayed Gratification With Social Security Benefits

Delayed gratification is beneficial not only for young people who are still building their nest eggs. If they play their cards right, it could also benefit retirees.

The adviser also told the couple to be strategic about when they start drawing their Social Security benefits. He means they should hold off on drawing their benefits until full retirement to earn delay credits.

How to Get 100% of Your Social Security Benefits

To convince the couple about the plausibility of the delayed credits theory, the adviser ran a quick analysis by them. In the US, the full retirement age (FRA) is 67. So, a senior citizen can start drawing their Social Security benefits after their 65th birthday. However, they won’t get 100% of what they are owed.

Summarily, senior citizens are better off waiting till FRA and could keep working those side gigs to support themselves till then.

ALSO READ: Save for a Relaxing Retirement in these 5 Cities on the West Coast

Get Information on Social Security Benefits Right

The adviser points out that the couple probably needs to be more informed about their expectation of receiving a monthly Social Security payout of $10,000. He explains that according to the Social Security Administration (SSA), the maximum payoff at FRA is $3,832 monthly.

At 70, the same SSA pegs the maximum payout a senior citizen can earn to $4,873. Check the SSA website if in doubt.

Glean As Much Juice As Possible From Your Active Years

Finally, the adviser added that the couple could dust off the last shred of their inflation fears by confirming with their insurance provider that the policy is inflation-proof.

Some insurers hike their premiums slightly to adjust their long-term care policies for inflation. The advice is for them to brave the extra cost and reap the benefits in posterity.

You Might Also Like:

What Could Cause a Potential Drop in Social Security Cost-of-Living Adjustment in 2025?

California Develops New Controversial Tax Model for Drivers

Billionaire Jeff Bezos Gives a Simple Tip for a Successful Future

Here’s How Much Carl Weathers Was Worth

Maximize Your Retirement Savings With the “Bucket Strategy” to Reduce Taxes