It can be challenging to manage your personal finances, especially when some bills seem to be eating up your money faster than you expected. Numerous behaviors, whether regular ones or sporadic indulgences, frequently result in financial distress.

On the other hand, many wealthy people have been able to sustain their wealth thanks to basic yet comprehensive financial knowledge. Their modest lifestyle is a major contributing factor to that. Here are 10 spending habits that keep people financially weak.

Credit Cards

Using a credit card is similar to walking a tightrope. They’re essential, and if you’re prudent and financially sound, then you know what you’re doing. However, if you aren’t, using credit cards irresponsibly and taking advantage of their exorbitant interest rates will quickly lead you to lose sight of the many benefits.

It gets worse when you cannot make monthly bill payments. Avoid unnecessary spending to avoid a difficult financial journey.

New cars

Excessive spending on new cars can burden your finances because they quickly depreciate. Buying preowned cars instead is a better option because they appreciate less quickly.

You should avoid giving in to the attraction of new models, which can result in needless financial pressure. Instead, consider purchasing pre-owned vehicles and keeping them as long as they are dependable.

Unused Gym Subscriptions

A gym membership that isn’t used can drain your finances unnecessarily, especially when you buy multiple but don’t use them all. Prioritizing an active lifestyle is excellent, but piling up memberships without using them frequently could result in financial waste.

It’s a perfect example of spending too much on fitness options when you might get by with just one well-suited subscription. Although this expense might not seem like much initially, it can pile up over time and negatively affect your entire financial situation.

ALSO READ: 7 Legitimate Ways for Lazy People To Make Money

Buying the Newest Tech

Although the temptation of new technology never disappears, yearly upgrades and purchases are bound to drain your savings. Instead, stick with reliable technology rather than splurge on extravagant devices that would significantly strain you.

Of course, you are free to purchase additional devices, but you should consider whether you really need them and whether you can easily afford them. Some people even take out loans to buy new gadgets, which is a ridiculous move.

Skincare

Gen Z is known for overspending on skincare products, but this isn’t always necessary for good skin. You should be cautious about using a lot of expensive products and complicating your regimen. Instead, concentrate on a simple, skin-type-appropriate routine.

You can maintain healthy skin without breaking the bank by avoiding needless skincare expenses and sticking to necessities. This will free up cash for more important spending or future investments.

Too Many Clothes

Having excessive clothing, particularly designer or trendy items, might put undue strain on your finances. Rich people frequently support a minimalist wardrobe strategy, prioritizing lasting durability and quality above quantity.

Investing in classic, adaptable pieces instead of continuously pursuing fashion trends can facilitate building long-term wealth. Prioritizing a basic and practical wardrobe will help you reduce unnecessary clothing purchases and redirect your money toward more wise spending choices.

Gambling

Gambling can quickly develop into an expensive habit since many people fall into the false belief that it’s a fast way to get rich. Regretfully, a gambler’s chances of winning are rarely favorable.

This kind of behavior may result in severe financial losses and stress. It’s important to concentrate on wise, long-term financial methods that generate and sustain money over time, guaranteeing a more stable and secure financial future rather than chasing short-lived satisfaction.

Smoking

Smoking is bad for your money as well as your health. The cost of cigarettes can add up rapidly and is often overlooked in daily expenses. Many people advise giving up this expensive habit if you want to save a sizable sum of money over time.

People who stop smoking not only improve their general well-being but also their financial situation by redirecting money toward more rewarding and fruitful activities.

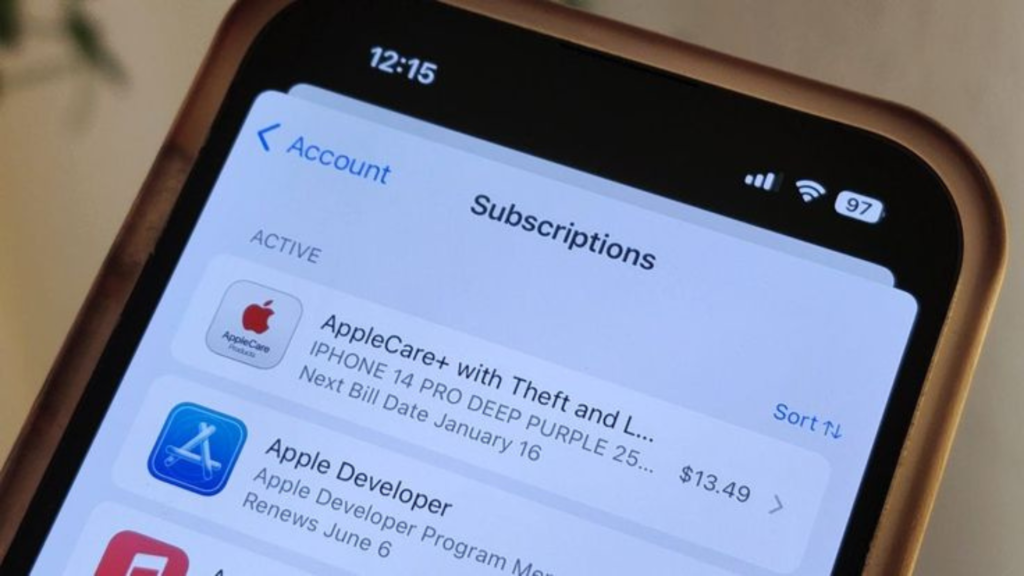

Unnecessary Subscriptions

Unnecessary subscriptions are a quiet drain on your money. Unused or underutilized subscriptions, like those for software, streaming services, or gym memberships, increase expenses over time.

It’s recommended that you assess and cancel unnecessary subscriptions to relieve the financial load. By doing so, you can ensure that your money is spent effectively and efficiently on investments, savings, or other significant expenses.

ALSO READ: Thousands of Families Set to Receive Increased Child Tax Credit

Frequent Pub and Bar Visits

Going to clubs and bars regularly can quickly strain your finances, particularly if you like premium drinks. An occasional visit is fine, but frequent visits can add up to significant expenses. One way to cut costs is to host parties at home or go on fewer outings.

Redirecting those dollars into savings or other goals in your life will help you ensure a better financial future. You can do this by reducing the number of bar visits and looking into other affordable socializing options.

The End

Making thoughtful spending decisions and knowing where your money is going are fundamental components of good money management. By recognizing and addressing frequent expenses that lead to financial troubles, you can regain control over your finances and strive toward financial stability.

To prioritize savings and reduce wasteful spending, start by tracking your spending, setting a budget, and making changes as needed. With discipline and smart planning, you can reach your financial objectives and create a more secure future.

You Might Also Like:

Did You Know Your Old Pennies Could Be Worth Thousands of Dollars?

These 6 Countries Are the Best and Cheapest To Live in Europe

Chinese Youth Are ‘Revenge Saving’ While Gen Z Globally Accumulates Debt

15 States With High Cost of Living To Be Avoided if You Are Single in the United States

Turkey Goes Off the Grey List of Global Financial Crimes Watchdog