It is unfortunate that while planning for retirement, many high-income earners who exceed their annual income limits set by the Internal Revenue Service (IRS) are unable to contribute directly to a Roth IRA retirement account. However, there’s a way around it, and it’s called the “Backdoor Roth IRA.”

This strategy has become an important tool for people looking to maximize their retirement savings in a tax-efficient way. This strategy allows people with high incomes to make indirect contributions. Plus, they can enjoy the tax benefits of a Roth IRA even if their income has passed the limit.

Backdoor Roth IRA: A Solution for High-Income Earners

The Roth IRA contributions are one of the biggest problems faced by people with high income. For 2024, those who earn more than $153,000 (or $228,000 for married couples filing jointly) in modified adjusted gross income (MAGI) are ineligible.

This means that they will not be able to contribute directly to a Roth IRA. This can be very discouraging to those who are looking forward to enjoying tax-free growth and withdrawals in their retirement age.

While it is still possible to have a traditional IRA, they are not as favorable as Roth IRAs in terms of tax benefits. This is because if your income is too high, the contributions to a traditional IRA may not be tax-deductible, and this is not very appealing.

However, backdoor Roth IRA is a way of avoiding such restrictions since those with high income can contribute to a Roth IRA indirectly but still fall under the rules governing retirement accounts.

Therefore, high-income earners can now contribute money into a Roth IRA without going over the set limit by opening a traditional IRA and then converting those monies into a Roth IRA. Then they will be able to enjoy tax-free growth, which can be very beneficial during their retirement.

How Does a Backdoor Roth IRA Work?

Step-by-Step Guide

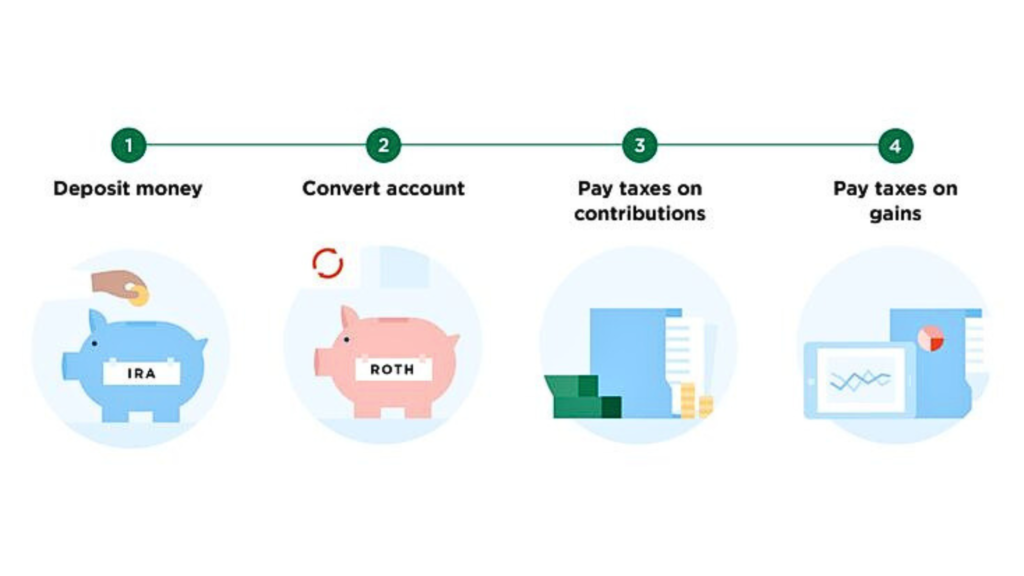

The steps on how to do a backdoor Roth IRA are very simple, but it is recommended that you follow the right procedures to avoid making mistakes.

- Open a Traditional IRA: The first step is to create a standard IRA account. You can do this with any financial firm that has retirement plans. Contributions made to this account will not be tax-deductible because of your high income.

- Make a Nondeductible Contribution: You can contribute up to $6,500 (or $7,500 if you’re over 50 years old) to a traditional IRA for 2024. This money will not be deducted since your income is too high to qualify for tax-deductible contributions.

- Convert to a Roth IRA: After making a contribution to a traditional IRA, you can then transfer the money to a Roth IRA. This conversion is the most important step in the backdoor Roth IRA strategy. Just bear in mind that even though the contribution itself will not be taxed during the conversion, any income that is earned on the contribution will be.

- File the Necessary Paperwork: When you do a backdoor Roth IRA, you will have to fill out the conversion on your taxes using the backdoor Roth IRA tax form known as Form 8606. This ensures that the IRS knows that you converted nondeductible contributions, which are excluded from income tax.

This process may seem simple, but it’s important to also understand rules like the backdoor Roth IRA pro-rata rule, which can make matters more difficult if you already have backdoor Roth IRA money left in traditional IRA.

ALSO READ: Maximize Your Retirement Savings With the “Bucket Strategy” to Reduce Taxes

What Is the Backdoor Roth IRA Pro-Rata Rule?

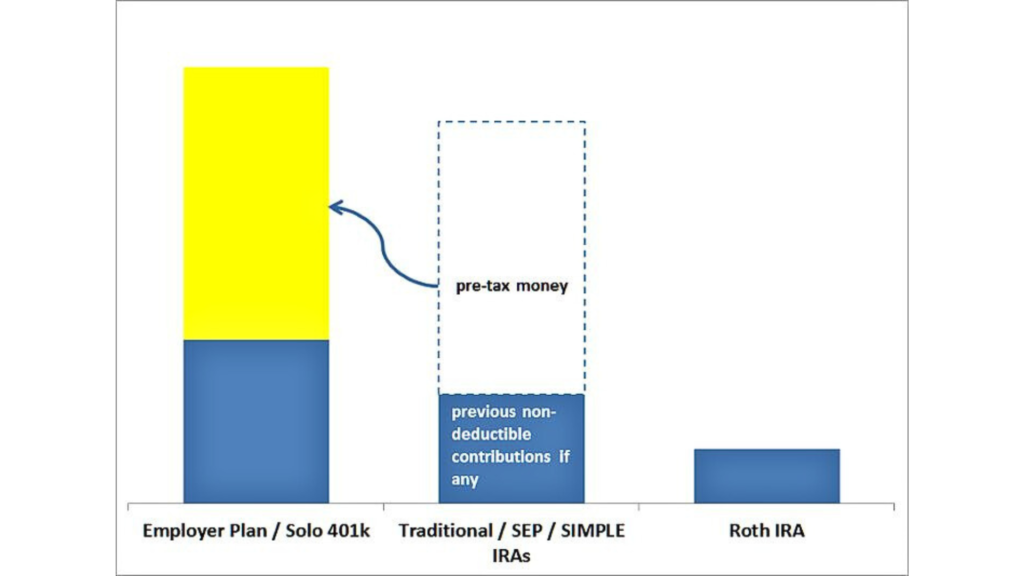

The backdoor Roth IRA pro-rata rule is one important rule that people with high incomes need to be very mindful of when setting up a backdoor Roth IRA. This rule states that when you convert funds from a traditional IRA to a Roth IRA, the IRS considers all of your traditional IRA assets when determining the taxable portion of the conversion.

For example, if you have both deductible and nondeductible contributions in your traditional IRA, the pro-rata rule directs that you convert an equal portion of both types of contributions, not just the nondeductible ones. This could lead to an unexpected tax bill if a large portion of your traditional IRA contributions were tax-deductible.

Imagine you have $10,000 in nondeductible contributions and $50,000 in your traditional IRA. If you decide to convert $10,000 to a Roth IRA, the IRS would follow the pro-rata rule and consider only 20% of your conversion (based on the ratio of nondeductible contributions) tax-free, while the remaining 80% would be taxable.

The pro-rata rule therefore makes it important for you to plan carefully before opening a backdoor Roth IRA. In order to avoid the limitations of this rule, some high-earners choose to “clear out” their traditional IRAs by transferring pre-tax contributions into an employer-sponsored 401(k).

Backdoor Roth IRA Limits and Deadlines

There are limits and deadlines associated with the backdoor Roth IRA, and you need to be aware of them. For 2024, the annual contribution limit to a traditional or Roth IRA is $6,500 (or $7,500 if you’re over 50 years old). This limit applies whether you use the backdoor Roth IRA method or you contribute directly to a Roth IRA.

Additionally, there’s an important deadline to always bear in mind. The backdoor Roth IRA deadline is usually the same as the deadline for filing taxes for the relevant year.

This means you have until April 15, 2025, to finish a backdoor Roth IRA for the 2024 tax year. Because you could risk missing out on the opportunity to maximize your contributions for a particular year if you wait too long before you act.

If you’re planning to take advantage of this strategy, it’s best that you act early and make sure you have all the necessary paperwork and documents in order—including Form 8606, which tracks the conversion and allows the IRS to know that the contribution was nondeductible.

ALSO READ: Researchers Find That 79% of Americans Who Take This Step Won’t Run Out of Money in Retirement

Factors to Consider for When a Nondeductible IRA May Not Be Worth It

For some high-income earners, a backdoor Roth IRA may not always be the best choice. In cases where someone already has a huge amount of pre-tax money in a traditional IRA, the backdoor Roth IRA pro-rata rule can result in a higher-than-expected tax bill, thereby reducing the effectiveness of the strategy.

Furthermore, if the conversion amount is relatively small and the tax impact of the conversion is high, the future tax-free growth in a Roth IRA may not justify the current tax loss.

You might also wish to explore other retirement savings alternatives, such as contributing to a taxable brokerage account or contributing to other retirement savings programs, such as 401(k), which has higher contribution limits.

Why Taxable Brokerage Accounts May Be a Better Option

Taxable brokerage accounts might be a more favorable and flexible way for high-income earners to save for retirement. Even though these accounts don’t offer the same immediate tax benefits as a Roth IRA, they come with their own set of advantages.

Taxable brokerage accounts have more flexibility because there is no restriction on income or contribution. Furthermore, money in a taxable brokerage account is available for use at any time and does not attract penalties, as is the case with money in retirement accounts.

For this reason, taxable brokerage accounts are a useful tool for both long-term investments and short-term objectives. A taxable brokerage account might be a better option for you depending on your financial objectives, especially if the pro-rata rule makes a backdoor Roth IRA conversion less appealing.

For those who are able to open a Roth IRA and contribute money into it through the backdoor method, the tax-free growth and withdrawals in retirement make it a good option. While high earners face limitations when it comes to direct Roth IRA contributions, the backdoor Roth IRA provides a possible solution.

Making the most of your retirement savings is important for achieving a comfortable future, regardless of whether you choose the backdoor Roth IRA or consider other options like taxable brokerage accounts.

You Might Also Like:

Ken Griffin Citadel Hedge Fund Navigates Volatile August, Securing a 1% Gain for Wellington

Cooper Union Tuition Restoration for Upcoming Graduating Seniors

Chase Bank Acknowledges Viral ‘Glitch’ Encouraging Check Fraud Attempts