Data Communications Company (DCC) recently embarked on a smart meter investment estimated to cost £130 million ($165 million). However, the ruling of the UK’s Office of Gas and Electricity Markets (Ofgem) is that of cost disallowance.

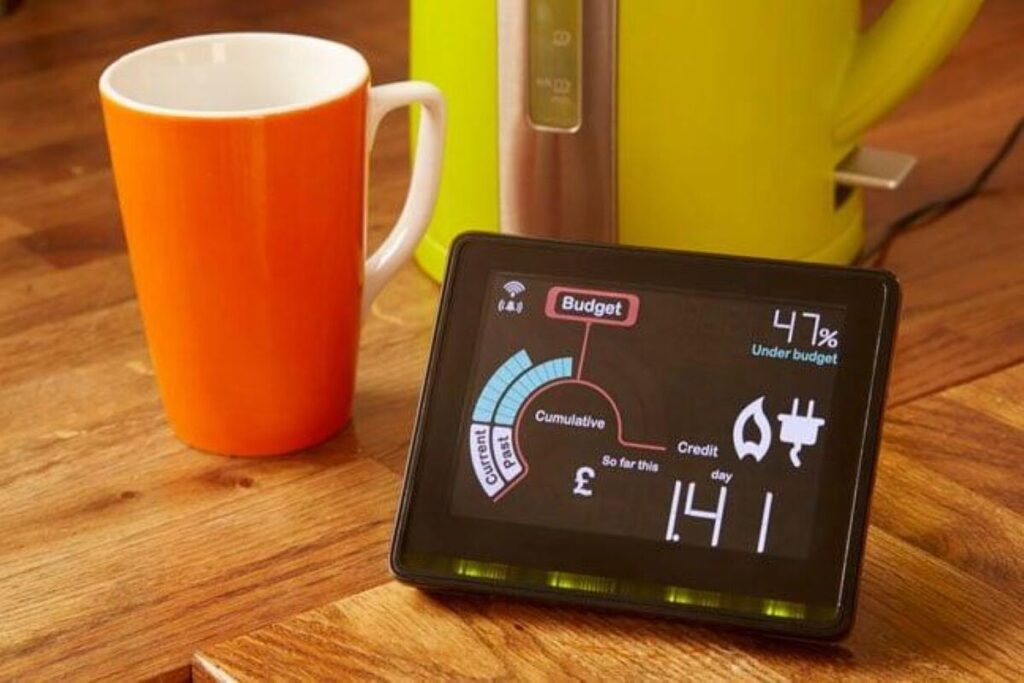

Ofgem always breathes down DCC’s neck to ensure regulatory compliance. In addition, the Capita-owned energy communications company is a sort of ombudsman between energy consumers, suppliers, and regulators. Overall, the goal of the DCC platform is to forecast internal and external costs of consumers’ energy consumption. In addition, the smart meter project ensures energy efficiency and utility cost savings.

Regulator Criticizes Over-Reliance on External Consultants

The UK energy regulator cites DCC’s overreliance on external contractors as responsible for its inefficiency on the smart meter project. The UK’s smart meter project is widely criticised, and Ofgem is out to ensure that DCC delivers high-quality service.

In early November 2024, Ofgem launched an official document that borders on regulatory compliance on pricing of DCC’s services.

ALSO READ: Energy-efficient home Wisconsin Can Now Earn Up to $14,000 in Federal Energy Rebate

Breakdown of Disallowed Costs for 2023/24

In the Ofgem’s price control document, the regulator highlights some aspect of DCC’s spendings, standing and proposed, that it intends to disallow. For example, Ofgem disallowed some internal costs for DCC’s 2023/24 fiscal year, amounting to a total of £17 million ($21.5 million). In addition, the regulator also struck out planning inefficiencies (about £6.1 million) and contract staff salaries exceeding the default benchmark.

On the other hand, the total disallowed external cost was roughly £8.5 million. This amount covers projects conducted with no clearcut goal or merit (£3.4 million) and the accompanying sunk costs (£2.5 million).

Projected Cost Disallowances for 2024/25 and 2025/26

Ofgem has also been magnanimous enough to state that the cost disallowance will not end in the 2023/24 fiscal year. Consequently, the UK regulator is looking to disallow some additional costs in the 2024/25 and 2025/26 fiscal years.

DCC’s total internal costs to go under the regulatory axe in the next two fiscal years is estimated as £72.3 million ($92 million). Likewise, the communications company will have to let go of £30.9 million ($39 million) within the same timeframe.

DCC’s last reported costs is probably responsible for the regulatory crack down. In the latest report, the communications company amassed a total cost of £684 million ($868 million). The internal costs in the quoted sum is a 57% increment relative to that of the previous fiscal year. Overall, DCC’s reported cost increased by 15% year-on-year.

For the sake of fairness, Ofgem has included a clause in the price control document that translates as openness to compromise. Basically, if DCC comes forward with credible justification for some of the axed costs, Ofgem would review its stance.

Delays and Budget Overruns in UK Smart Meter Rollout

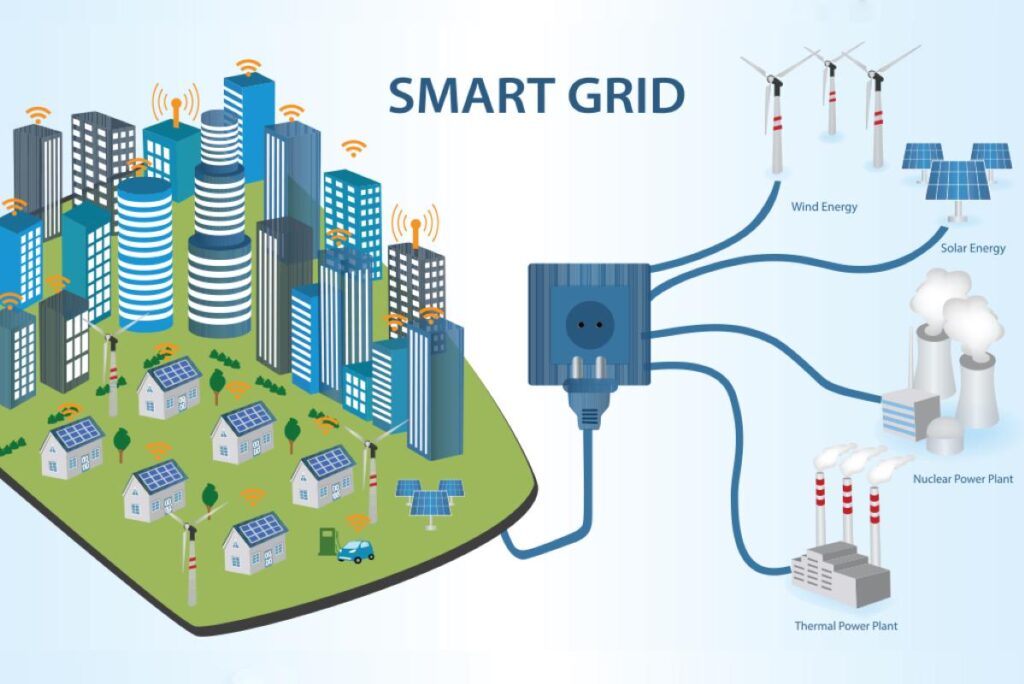

In 2023, UK’s National Audit Office (NAO) discovered that energy suppliers were far behind on the adventurous smart meter project. The project cost £13.5 billion ($17 billion) of taxpayer money. Unfortunately, the smart grid technology project is still 57% short of completion, despite having overshot its fist deadline by four years.

The report made available by the UK’s public spending watchdog estimated that energy consumers enjoyed £56 annual utility cost savings thanks to the energy infrastructure modernization. That amount averages a monthly utility cost savings of approximately £5.

Smart Meter Project Timeline Extended Multiple Times

The UK government, in 2012, gave energy suppliers a marching order to roll out smart meters by 2019. However, the deadline for the unveiling of the fully smart grid technology has been shifted on three different occasions. First in 2020, then 2024, the current deadline is 2025 and no one knows if this looming deadline for energy infrastructure modernization is feasible.

In February 2023, the UK government opted to intervene, through consultation, to help expedite the installation of the smart grid technology. The goals of the intervention are energy efficiency, consumer engagement, real-time data monitoring on energy utilization, renewable energy integration and prompt energy demand response.

ALSO READ: A Shuttered Power Plant in Michigan Could Pave the Way for More Nuclear Energy in the U.S.

Future Outlook: DCC License Renewal Expected by 2040

The UK government decided to back this smart meter project not particularly for investment returns. Rather, real-time data monitoring of energy consumption would help the authorities recognize the lapses in energy supply. In cases of energy deficits, renewable energy integration can be adopted for demand response.

DCC’s smart meter technology makes real-time data monitoring possible for energy suppliers. With a smart meter installed energy suppliers cut physical consumer engagement to the barest minimum. Similarly, it is expected to cut operational costs and increase investment returns. For businesses or homes that generate green energy, the smart meter equally allows renewable energy integration of such bespoke systems.

According to NAO, DCC’s operating license is held by Capita and is subject to conditional renewal in 2040.