Kids are curious bundles of joy, and their personality tends towards familiar trends and activities around them as they grow.

Parents don’t have to be stupendously rich to nurture a wealth-creation mindset in their kids. Likewise, there are ways of ingraining financial responsibility in their way before they hit adulthood. Let’s hear what experts say about this parenthood and child development phase.

Child Finance 101

Buying things for our kids and providing for all their material needs may be a no-brainer, even though many parents winch about how expensive this can be.

However, something else that leaves some parents scratching their heads is teaching their kids to make independent financial decisions through allowances. The questions come nudging: “When is the appropriate time to start giving my kids an allowance, how much, and what should be the guiding rules?”

Going Easy While Imparting Useful Lessons

Teaching delayed gratification and saving habits can be trickier at a young age for kids who already know the joy of unwrapping gifts under the Christmas tree.

So, lessons about money and financial responsibility would have to come to a toddler in manageable bits. Dishing out such lessons in the right way may be difficult for parents who do not seek the appropriate guidance.

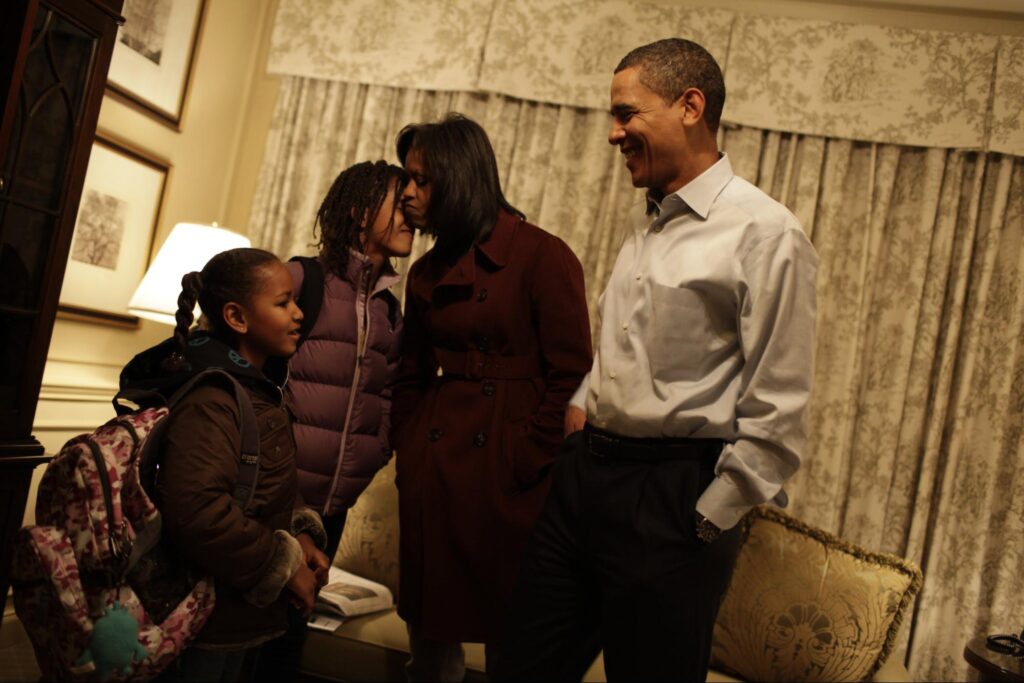

How the World-Famous Parents Did It

However, we have learned from some prolific parents that there is no one-size-fits-all approach to giving kids an allowance. For example, Berkshire Hathaway CEO Warren Buffet required his kids to help around the house to earn an allowance.

Mariah Carey gave her kids allowances only as compensation for doing their chores. Before Obama’s girls hit their teenage years, it was said that they got an allowance of just $1 weekly.

The Right Motives for Giving Kids Allowance

When learning the right approach to giving allowances, parents’ goals should go way beyond frugality and wealth accumulation. In addition, it pays future dividends if they teach their ward the benefits of generosity, irrespective of how little their allowances might be.

Financially literate parents know how important it is to start early prepping their wards for a successful future.

Teach Your Kids Financial Literacy Like a Pro

However, parents don’t necessarily have to be wealthy, nor do they need to be financial experts, to teach their children the ropes of money management. Another thing is that financial lessons for the kids need not be regimented.

Instead, make it as fun as possible; you don’t want your kids to develop an attitude of dread or disgust towards the concept of earning money.

Let’s Hear From the Expert

Financial planner and author of Beyond Piggy Banks and Lemonade Stands, Liz Frazier, shares several tips on how parents can use allowances to teach their kids financial independence.

On the question of when to start giving children allowances, Frazier’s advice is “as early as possible.” And in reality, there’s no fixed age to it.

What Age Is Appropriate To Start Giving Allowances?

According to Frazier, though she recommends starting as early as possible, don’t give a child dollar bills when they don’t even know what they are. The best thing to do at such pre-accountability ages is to open a savings account for them.

However, when they notice that you buy things in exchange for a certain green bill, often stored in your wallet, they get inquisitive and ask questions.

Accommodate Inquisitions But Set Boundaries

Frazier suggests that those first inquisitions about money are good cues of when to start giving your kid an allowance. However, she cautions against digital financial facilities with them at a tender age.

Kids of kindergarten age tend to appreciate tangibles better than abstract concepts. So, they are better off with cash than credit cards or digital tokens.

How Much is Too Much for a Kid’s Allowance?

Frazier shared her personal experience with her five-year-old daughter. She started with $5 weekly for the young girl. Albeit, the allowance came with a caveat.

Frazier provided her daughter with three jars: one for donations, the other for savings, and the last one for her little personal expenses. The catch is that Frazier’s daughter is responsible for how much goes into the three jars every week.

Teach Them Financial Responsibility

To this end, Frazier does not think kids’ allowances should be a fixed rate. What she does instead is to peg her kids’ age to their weekly allowance with a simple template relatable to her toddler.

Meaning at age six, she earns an allowance of $6, in that order. Growing their allowance helps increase their sense of responsibility.

Be Dynamic About How Much You Give

Not every family can afford to give their five-year-old a $5 allowance per week. It becomes even more unfeasible if the family has a quadruplet.

Parents can start with whatever they can afford for their wards; so far, they endeavor to increase it a bit at the turn of each year. As mentioned earlier, it is not about how much but about passing on key financial literacy lessons.

Help Your Kid Grow Enthusiasm About Finance

Nonetheless, communication is vital between parents and their kids, and young folks do not deserve anything shoved down their throats. Itching to try out Frazier’s three-jar system already? Then, do well to build their enthusiasm by chatting with them first.

What to discuss? The goals and timelines of this new responsibility you are about to vest on the young chap.

Show Your Kid How To Side Step Financial Diaherrea

The discussion part is vital as we want the child to get used to setting financial goals. We want to teach them how to hold money down and expend it meaningfully and effectively.

So, help them understand that money in the “expense” jar can be spent on something fun, like a chocolate bar when shopping with Mom.

More On the Three-jar System

The “savings” jar is for bigger and planned purchases like a Lego set; while the “donation” jar goes to a cause or charity they are enthusiastic about.

Also, timelines need to be set for these expenses. Parents can tell them that money from the “expense” could be spent within a month of receiving the allowance and donations made at an interval that works best for them.

The ‘Work for Allowance’ Question

Frazier shares her financial wisdom about having your kids work for their allowance. She suggests it is an excellent ploy to encourage kids to work when allowances are offered. However, it has to be done strategically.

A child could be frugal enough to save so much and then decide to stop doing chores with the “I have enough money” excuse.

Don’t Use Allowances as Compensation for Doing Chores

Frazier advises compensating wards for doing their chores. However, this should be added to the baseline allowance.

This will help kids enthusiastically participate in chores because compensation is not statutory but based on the parent’s whim. So, the kids get a flat rate allowance to play the monopoly of financial independence and occasional tips for doing their chores exceptionally well.

Allowances as “Rod and Carrot”

Parents often ask if it is okay for them to use their kids’ allowances as part of a reward and punishment system in the home. So, Frazier advices against such systems.

On the contrary, she advises, “The big thing with allowance is you want to make sure that it’s always positive, consistent, and dependable.” So, no to punitive vibes.

Help them Cultivate a Healthy Relationship With Money

It would be ill-advised to give kids allowances when they make good grades and withdraw them when they are involved in a misdemeanor.

Helping kids understand the neutrality with which money yields to its handlers is such an important goal that we cannot allow the dissonance of filial conflicts to rob them of it. So, please keep the allowances steady.

How to Get Your Kids Interested in Financial Literacy

Some kids may care less about learning to save, but once they set their eyes on that big fluffy doll or bucket of ice cream, they want to buy it. Parents need not be discouraged when they find themselves in this kind of situation.

Frazier recommends that parents symbolize and celebrate the financial milestones of their kids.

Root On Your Kid, Every Step of the Way

If they manage to save $20, throw a mini party at the dinner table and offer them a cupcake or ice cream. Sometimes, all your child needs for a super boost of enthusiasm is acknowledgment from their parents.

Frazier also recommends that “If you’re going to buy a bagel or coffee, try paying in cash so your kids can see, Oh, it does cost actual money.”

Allowance for Teenage Kids

Right after adolescence, Frazier believes it is high time for a child to move from receiving allowances weekly to getting them monthly. Doing this will foster more responsibility, although parents still have to set expectations for them lest they veer off course.

For their monthly allowance, set expectations that come with natural consequences if unattained. For example, encourage them to save for a new pair of shoes.

When It’s Time to Get a Bank Account

At some point, teenage kids will get the hang of digital transactions, probably even better than their parents. That marks the right time to get them a bank account and a debit card.

One of the parents should go with the child and have the banker give them a brief orientation about the banking facilities available to them.

When Your Kid Receives a Large Gift, Way Larger Than Their Allowance

So far, your kid doesn’t play the national lottery, which we doubt any parent would encourage. Hitting a jackpot is not likely. Nonetheless, they can receive tangible sums as gifts.

Frazier recommends that the parents help the child maintain the three-jar system. Not by imposition, but by auto-suggestion, help them see a reason not to splurge it all.

Mastering Personal Finance Doesn’t Have to Be a Struggle

This trend of urging them on with the “save, share, spend” mantra should continue as children grow. The ultimate goal is to ingrain that habit in them and make it effortless.

According to Frazier, by the time children get their first paycheck, it is already second nature to put some away. This ensures that a financially literate child will have a cordial relationship with money in adulthood.