Americans would no longer have the financial incentive to leave their jobs. During a call with reporters on Wednesday, ADP chief economist Nela Richardson said that any lingering signs of the pay benefits from the “Great Resignation” are a thing of the past.

On Wednesday, the ADP’s monthly payroll data was released, and it showed the yearly wage growth for workers changing jobs. The data showed that the wage growth fell to 7.2% in January. It is the slowest pace of growth since May 2021. However, workers who stuck to their jobs saw wages rise by 5.2% in January, the lowest since August 2021.

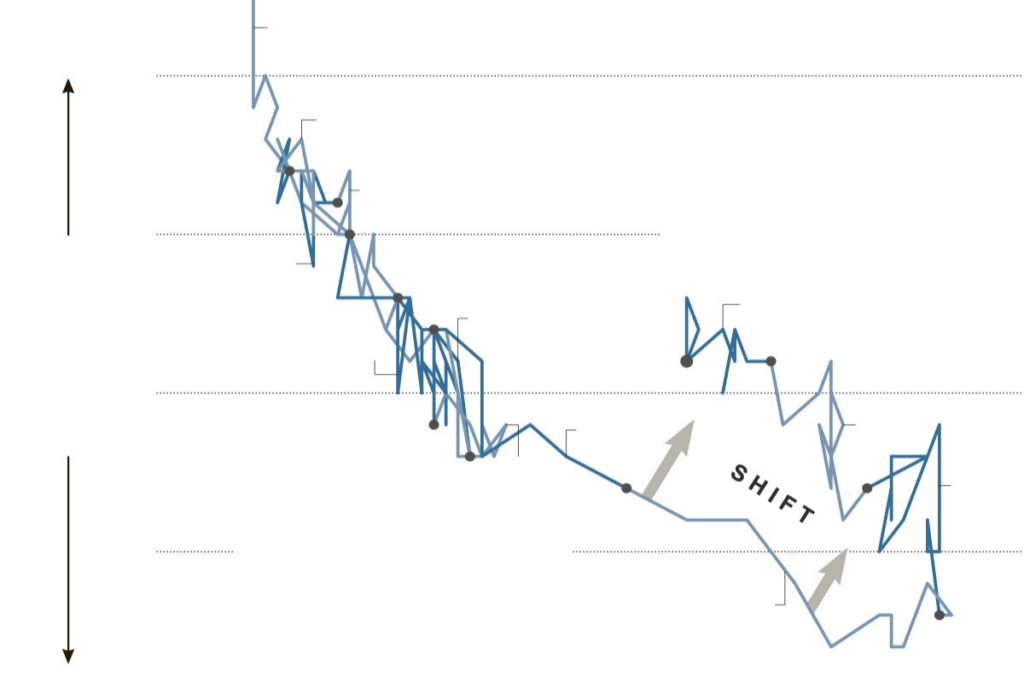

What all of this means is that the gap is closing. For example, when post-pandemic job switching was at its peak, the gap was more than seven percentage points.

Nela Richardson said, “You’re seeing solid pay growth, not supercharged pay growth like we saw before.”

The increased pay of people changing jobs comes as a result of layoffs from several significant organizations piled up at the start of the year. These layoffs are not always shown in economic data. This is because they are not showing up enough to point out an outright decline in the labor market. However, there are enough to show a probable warning sign for workers about the shifting state of the labor market

JOLTS reports ( The latest Job Openings and Labor Turnover Survey) indicated that the rate at which citizens left their jobs (quits rate) did not change. It remained at 2.2%. The rate dropped from the 3% level that was seen in 2022.

This 3% level is the highest on record. However, it remains in line with the levels recorded before the pandemic. Economists closely watch the rate of quits, as increased rates are seen as a sign of faith among workers.

The rate of employment increased slightly for the month. Nonetheless, the director of North American economic research at Indeed, Nick Bunker, indicated that the three-month rolling average of hires as a percentage of employment is now below the levels that were seen before the pandemic struck.

Nick Bunker wrote in a blog post on Hiringlab.org, “If hiring continues to lose steam, the moderation of the labor market will become more painful as workers have a harder time finding work.”

However, many economists see the decrease in wage growth as an encouraging sign for the Federal Reserve in its fight against the continuous increase in the price of goods and services. The indications of a more challenging environment to find jobs are merely a return to normal in the general labor market.

It is evident that there are still major aftereffects of the lockdown, and Federal economists are still working through the disruptions. On Wednesday, The Employment Cost Index

(ECI), a closely monitored wage indicator, grew by 0.9% compared to the prior quarter in the last three months of 2023.

Capital Economics deputy chief US economist Andrew made a statement. Hunter stated that the increase is the slowest quarterly increase seen in the ECI in two and a half years. According to Andrew Hunter, this indicates that the Fed should be on track to cut interest rates soon.