Are you a college student who has been struggling to manage your finances? With our list of 10 best budgeting apps for college students, you can manage your money in a simple, accessible, and enjoyable way. As a college student, managing your finances can be challenging, especially when paying for tuition, textbooks, rent, and other daily living expenses.

Budgeting apps can be lifesavers irrespective of your financial situation—whether you’re just starting or looking to tighten your spending. They help you track your expenses, manage your income, and keep you on top of your financial goals. But with so many options available, how do you know which one to choose?

Here’s a list of the budgeting apps that can guide you in building smart money habits for life.

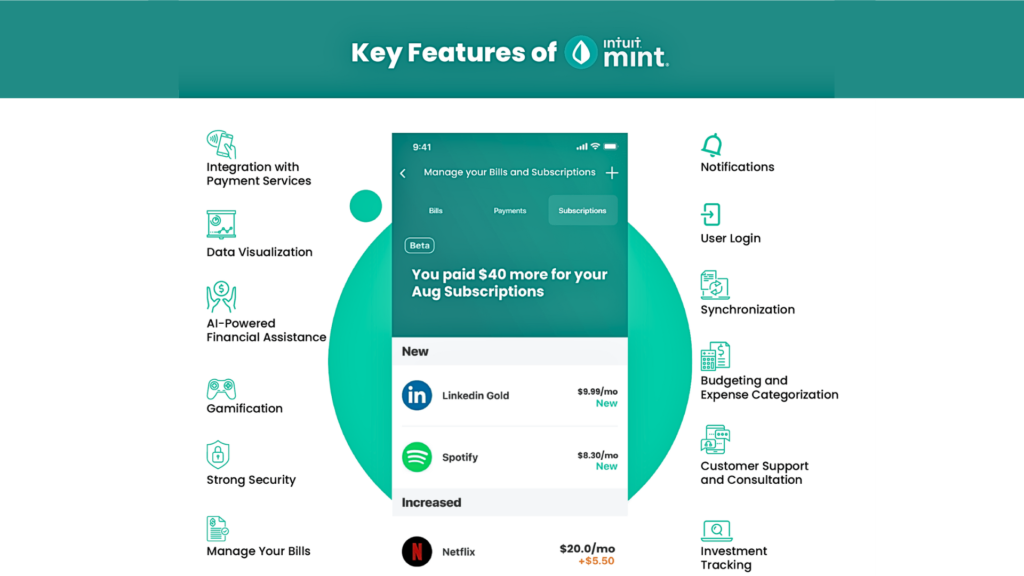

1. Mint

Mint is considered to be one of the best budgeting apps for college students. It’s user-friendly, can be linked to your bank accounts, and tracks your spending automatically.

With Mint, you can set budget goals, categorize your transactions, and get alerts when you’re close to overspending in a specific category. The app also helps you monitor your credit score for free, making it a perfect all-in-one tool for money management.

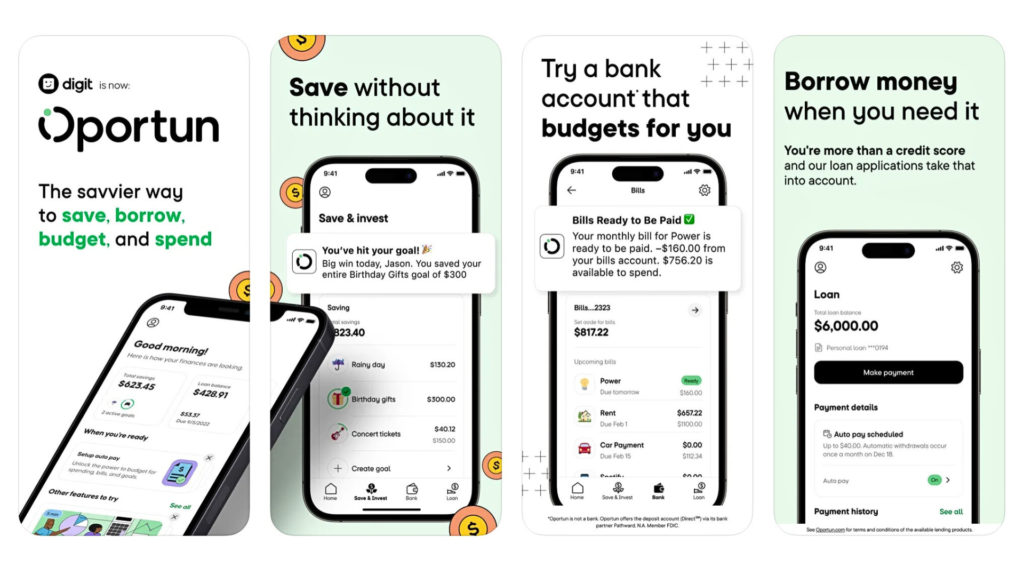

2. Oportun

Oportun, formerly known as Digit, is an excellent app for mindless saving because of its many savings features. With this app, you can set up automatic micro-savings and invest in one of its three preset portfolios, saving for short- or long-term financial goals, including retirement.

Additionally, you can get your first credit card with a $1,000 credit limit and personal loans for emergencies with affordable APRs. Opportun is fairly priced at $5 per month, and it offers a free 30-day trial to help you decide if it’s right for you.

ALSO READ: Top 10 Colleges for Financial Aid—Including One Ivy League School

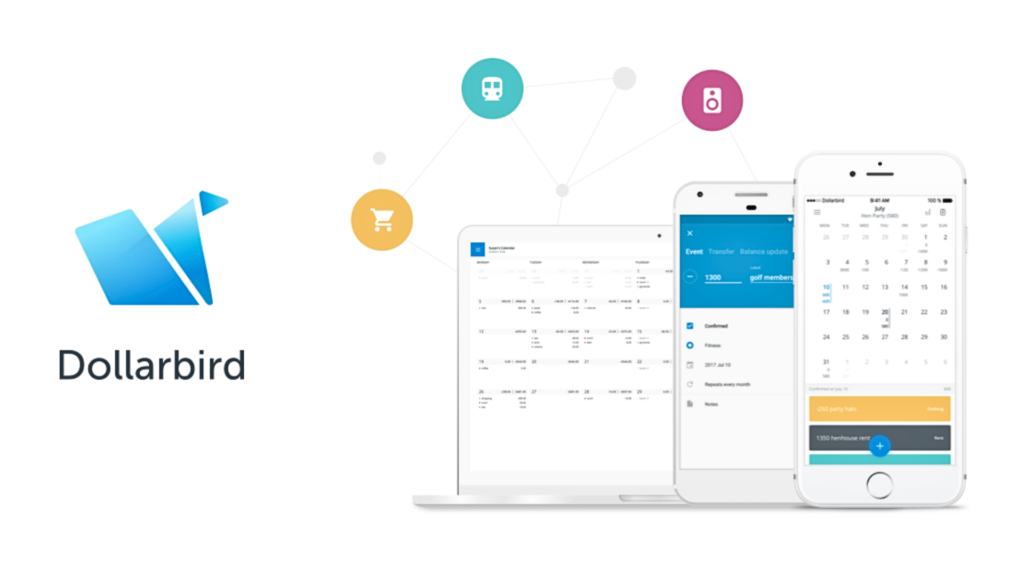

3. Dollarbird

Dollarbird is a unique budgeting app that tracks cash flow using a calendar system and gives you a dynamic view of your daily income and expenses. It is perfect for students with irregular incomes, as it helps them visualize when to spend.

The app costs $4.99 per month or $39.99 annually. It offers 20 calendars with syncing for up to three family members, making budgeting more collaborative.

4. Goodbudget

Goodbudget is the digital version of the old envelope budgeting system if you prefer to track your finances manually. You allocate money to virtual envelopes based on your budget categories (like rent, food, and entertainment) and manually record transactions as you spend.

Plus, the app syncs between multiple devices. So, for students who want a simple way to allocate funds and ensure they stick to their budget, Goodbudget is an excellent tool.

5. Qapital

If saving is your goal, Qapital is one of the best options. This app allows you to automate your savings based on the “rules” you set. For example, you can round up purchases to the nearest dollar and save what’s left or set goals like “save $5 every time I work out.”

This is a fun and interactive way for college students looking to build saving habits. It offers three priced subscription plans: the Basic plan for $3 per month, the Complete plan for $6 per month, and the Premier plan for $9.

6. Wally

Wally uses a pie chart to summarize your spending visually. It has built-in support for virtually all foreign currencies, making it ideal for international students. It also syncs with over 15,000 banks in 70 countries.

So, if you’re studying abroad for a semester or even pursuing a degree, you can continue to manage your budget, track foreign transactions, and convert currencies. Wally is one of the free budgeting apps for young adults. You can get the basic version at no cost, while the Gold version costs $8.99/month, $39.99/year, or a one-time fee of $99.99 for lifetime access.

7. Splitwise

Splitting bills with roommates can be tricky, especially if everyone has different schedules or financial situations. Splitwise makes it easy to share bills like rent, groceries, and utilities among friends or roommates.

The app calculates who owes what and keeps a running total, ensuring that everyone pays their fair share without awkward conversations. The basic version is free, and for more features, you can upgrade to Pro for $3 per month.

ALSO READ: 5 Clever Strategies to Save Money on Back-to-School Supplies

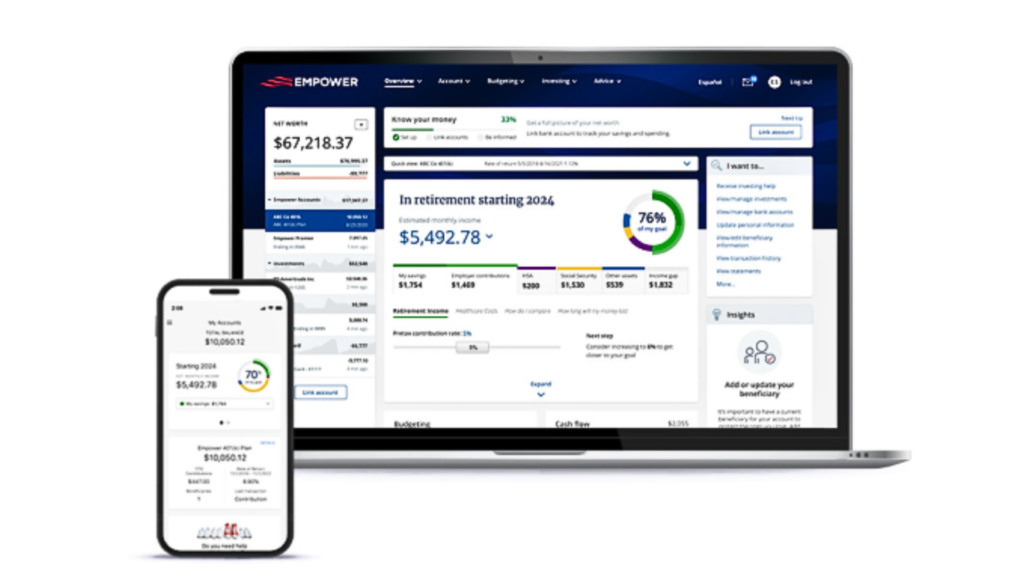

8. Empower

If you’re looking for the best budgeting apps for college students focusing on saving and investments, consider Empower, formerly Personal Capital. With Empower, you can access a high-yield savings account paying 4.7% APY.

The free dashboard allows you to see your full financial picture and track your net worth, whether you have $100 to millions of dollars saved or are already getting a head start on your retirement.

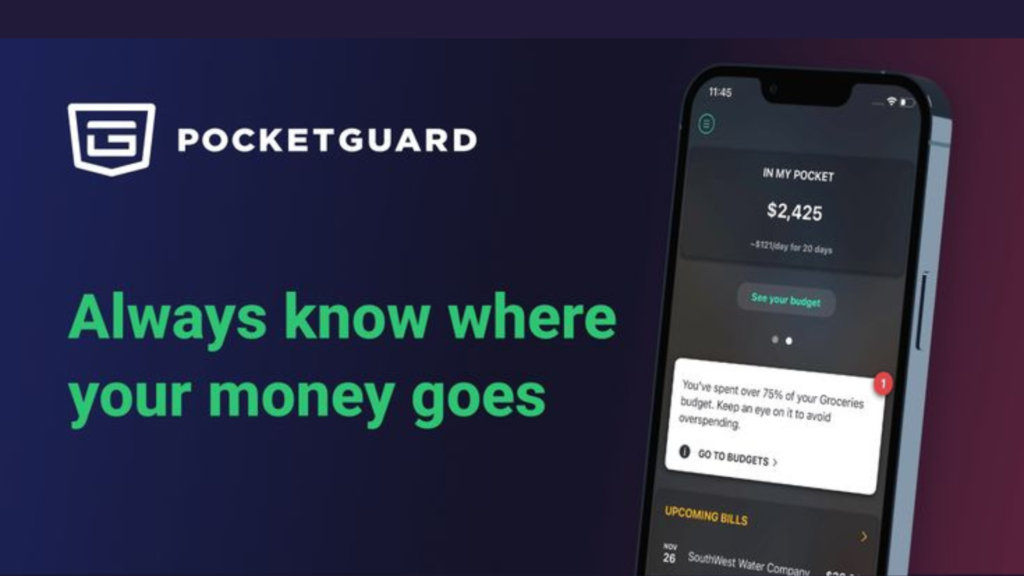

9. PocketGuard

PocketGuard is an excellent choice for students who want a simple option. It links to your accounts, tracks your spending, sets spending limits, and lets you know how much “pocket money” you have left after deducting expenses, savings targets, and necessities.

PocketGuard makes it easy to stay budget-conscious without getting overwhelmed by complex features. It’s one of the most practical student budget apps available for managing educational and personal expenses.

10. Albert

The Albert app offers to do everything a college student would need to manage their finances. Like many of the best budgeting apps for college students on this list, you can link all your bank accounts to Albert. This allows you to see your account balances and net worth.

It helps you track recent bills and expenses, shows your spending patterns, and notifies you of suspicious activities. For additional features, you can sign up for the Genius subscription, which costs $14.99 monthly.

Tips for Sticking to Your Budget in College

Sticking to a budget in college can feel like hard work. But it’s absolutely possible with the best budgeting apps for college students and the following quick tips.

Here’s how:

- Look for Student Discounts: Ask about a student discount whenever you make a purchase, and make sure you have your ID ready.

- Avoid Impulse Purchases: Stay within your spending limits to avoid blowing your budget on unnecessary items.

- Track Your Spending: To stick to a budget, you need to track every penny you spend, whether it’s with pen and paper or an automated system.

- Use Coupons: Feel free to look for coupons or promo codes when shopping online. They will help you save some money.

When choosing the best budget app for young adults, you must consider what matters most. All of the budget apps we’ve elaborated on will provide a simple way to stay budget-conscious, track your spending, and prioritize saving money. If you stick to them, your future self will thank you.