Sentiments can easily sway a company’s stocks, and Tesla was not immune to any of these in 2024. However, the company’s woes don’t seem to have ended in the 2024 fiscal year.

The Question on the Lips of Most Investors Is, “Is Tesla Struggling?”

In the first month of the year, Tesla’s Stock value crashed by roughly 12%, prompting analysts to suggest that 2024 would be rough for Elon Musk’s company.

The Question on the Lips of Most Investors Is, “Is Tesla Struggling?”

After these first signs of distress, investors started doubting the company’s future prospects. However, to reassure shareholders, Musk shared that Tesla was soft-pedaling production volume to ramp up its development of next-generation vehicles.

So, company executives affirm that TSLA’s slow performance in 2024 is a product of the turbulence caused by transitioning between two growth waves.

ALSO READ: Corporate Client Cuts Ties With Tesla After Elon Musk Backs Trump

2024 Is Tesla’s Stress Test and Will Determine Its Future Performance

In yet another stress test, brokers dropped the target price of TSLA stocks later in the year. For example, Barclays marked down the company’s unit stock price from $250 to $225.

However, probably in a bid to de-escalate the situation, Barclays analysts say the target price reduction is nothing of the norm. They suggest it is just a cloudy day for Tesla, which would fizzle away in no time.

Musk Wants to Control Tesla’s AI Ventures

Musk also caused a stir sometime in March after a thread of his posts on X went viral. Musk was commenting about his reservations about the company’s involvement in robotics and AI.

Apparently, Musk does not support the adventure if he does not have 25% voting control within Tesla. He said this would give him just enough influence to guide the company’s AI program without overstepping his bounds.

Tesla Investors Think Musk Is Overstepping His Bounds

Many have classified Musk’s comments on X as investor blackmailing. In one of those posts, the CEO is recorded as having threatened Tesla board members that he would proceed to start an AI company outside the EV maker if he refused the 25% voting right.

However, there have been widespread variations in shareholders’ reactions to Musk’s demands. So far, investors widely dissent, while only a few try to empathize with the CEO’s point of view.

Musk Requests are Considered Investor Blackmailing

Some investors suggest Musk is being downright unreasonable with his demands for TSLA shareholders.

For example, TSLA investor Ross Gerber said, “Now he seems to be blackmailing the TSLA shareholders, saying he won’t build stuff for us unless he gets another $30 billion.” He then pointed out the lack of justification for a $30 billion pay package for a CEO who is already $150 billion rich.

Tussle for Influence Within Tesla

In addition, Gerber suggests that Musk’s thirst for more control over TSLA is unfounded because the CEO has friends and relatives as key board members. So, he basically controls the Tesla board.

Multiple owners of Tesla’s cyber truck have also written negative reviews. Overall, the company sold less than 370,000 vehicles in Q1 of 2024.

Situation Report in Q2 Got Worse

The situation worsened for Tesla in Q2 of 2024. The electric car maker’s report on Q1 earnings made several investors reconsider their financial allegiance. In the first quarter alone, TSLA stock prices dropped by roughly 30%.

Next, several other issues started cropping up. The supply chain for some major components started to fail, and there was also a case of arson at the Berlin Gigafactory, slowing down production considerably.

Why is Tesla Struggling?

When TSLA’s Q2 2024 earnings were made public, they revealed that year-on-year profits had dropped by 45%. In a bid to make up for the sour times, Tesla embarked on a major cost-cutting spree and even laid off about 10 percent of its global workforce.

The New York Times suggests that the company’s top challenge is the emergence of competitors, like BYD, with cheaper electric cars and sluggish consumer demand.

Why is Tesla’s Stock Price Crashing?

Wall Street analysts consider TSLA stocks among the worst performers in 2024, and the company’s challenges are not far-fetched. For one, the global pricing of EV cars has started to plummet since other mass-producing competitors emerged on the scene.

In addition, the EV maker’s operating costs went up by 39%. No one needs to elaborate on the damning implications of rising costs and dwindling sales.

Is Tesla in Trouble Financially?

At one point, the Model Y was the best-selling car on the planet, supplanting the much cheaper and durable Toyota models. However, the narrative has changed in 2024.

Bullish Wall Street folks believe TSLA’s woes are only short-term and that the company will pull out of the waters. They suggest that TSLA will likely bounce back with the introduction of its robotaxi and self-driving software updates.

ALSO READ: Zeekr, Chinese EV Maker, Claims Its New Battery Outpaces Tesla in Charging Speed

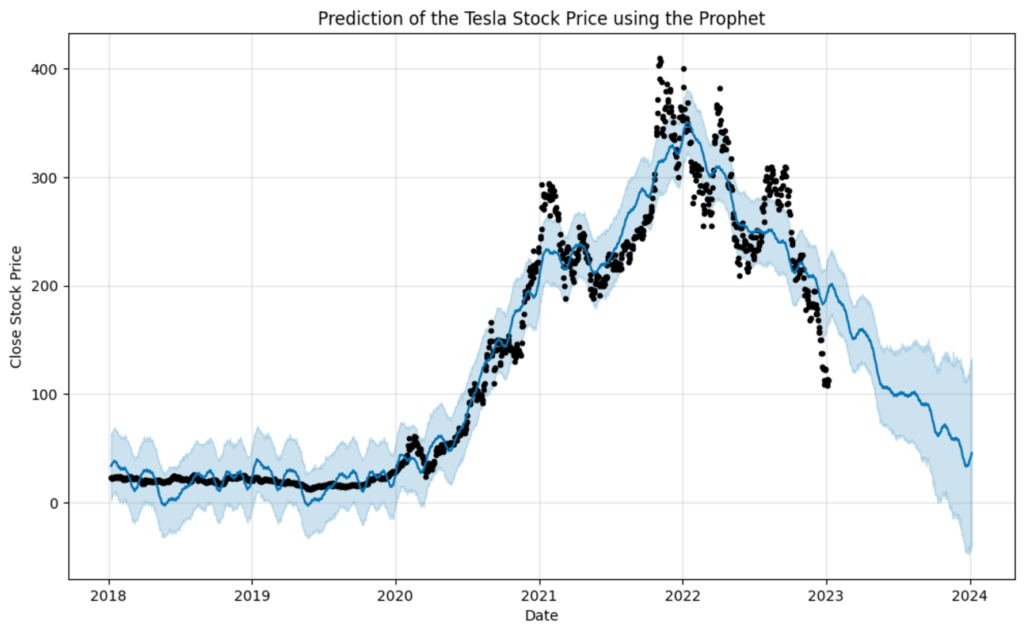

What is the Stock Price Forecast for Tesla in 2025?

Various Wall Street analysts and brokers have been projecting what will become of Tesla stocks in 2025. Bullish entities, like StoskScan, are optimistic and feel prices will eventually climb to 555.41.

On the contrary, WalletInvestor was bearish with its projections, estimating prices will linger around 128.96 and suggesting the stock could fall further to 115 in 2025. Time will tell in which direction the buck will swing.

You Might Also Like:

Walmart Ends Major Partnership, Leaving Customers Frustrated

Walmart Gives Hope Against Possible U.S. Recession Following Home Depot’s Grim Warning

Wizz Air Introduces $550 ‘All You Can Fly’ Annual Subscription Pass

World’s Largest Steelmaker Warns of an Imminent Industry Crisis Worse Than 2008

Starbucks Awards Incoming CEO Brian Niccol $85 Million in Cash and Stock as He Leaves Chipotle