Learning that owning a credit card can be a great advantage may surprise you. Although many of us think of credit cards as a means to make purchases, they offer so much more than that. On the other hand, misusing a credit card could cost you a lot of money.

It could lead to severe consequences, like high debt and lowered credit scores. However, understanding the credit mistakes to avoid can save you from financial stress and help you build a healthy financial future.

Let’s explore the credit mistakes you must avoid and the actions you can take to ensure you use credit wisely.

Missing or Making Late Payments

A missed or late payment can immediately negatively impact your credit score, and multiple missed payments can have long-lasting effects on your creditworthiness.

How to Avoid This Mistake:

- Set up automatic deductions for due payments to ensure you never miss a payment.

- Use calendar reminders to remember payment deadlines.

- If you’re having financial troubles, contact your creditors before missing a payment. Many companies are willing to arrange a payment plan with you.

Maxing Out Your Credit Cards

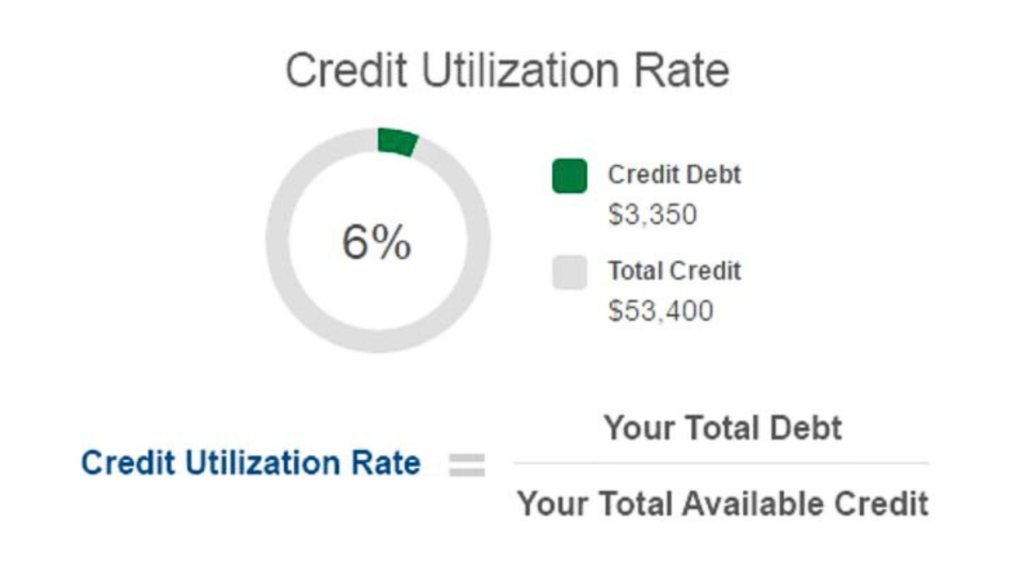

Maxing out your credit cards raises your credit utilization ratio (the percentage of your credit limit you’re using), which can lower your credit score. A high credit utilization ratio signals lenders to the possibility that you might be taking on more debt than you can handle.

How to Avoid This Mistake:

- Don’t let your credit card debt exceed 30% of your credit limit.

- Always pay off your credit card balances in full every month.

- If you can’t pay off the complete balance, reduce it as much as possible before your statement closing date.

ALSO READ: Why Did My Credit Score Drop for No Reason?: Top 9 Possibilities

Applying for Too Many Credit Cards in a Short Time

Applying for too many credit cards at once can lower your credit. Every time you apply for a new credit card, the lender makes a hard inquiry, which can lower your credit score by a few points. Also, lenders may interpret multiple credit inquiries as a sign that you’re in financial trouble.

How to Avoid This Mistake:

- Space out your credit card applications to reduce the number of hard inquiries on your credit report.

- Only apply for credit cards that meet your specific needs.

- Monitor your existing credit and avoid creating new accounts unless necessary.

Closing Old Credit Card Accounts

Closing old credit card accounts you no longer use may seem like a good idea, but doing so will lower your credit. Here’s why. The age of your credit history makes up 15% of your credit score, so closing an old credit card account can shorten your average account age.

How to Avoid This Mistake:

- Keep your old credit card accounts open, even if you don’t use them regularly.

- Use the card occasionally for small transactions and pay them off in full to keep the account active.

- If you are tempted to spend, keep the card in a safe place or freeze it in ice (literally).

Not Keeping an Eye on Your Credit Report

Monitoring your credit report to spot mistakes like identity theft or fraudulent accounts opened in your name is essential. Errors on your credit report can lower your credit score, and the longer they go unnoticed, the more damage they can cause.

How to Avoid This Mistake:

- Review your credit report annually or more frequently. You’re entitled to a free credit report from each central credit bureau (Equifax, Experian, and TransUnion) once a year.

- Look for irregularities, such as unrecognized accounts or incorrect late payments, and dispute anything that looks wrong.

- You can also use credit monitoring services to get alerts if there are any significant changes to your credit report.

Carrying a Balance

A common misconception is that carrying a balance on your credit card from month to month will boost your credit score. It only results in paying more interest without any positive impact on your credit score. Paying your credit card bills on time and maintaining a low credit utilization rate raises your credit score, not taking on more debt.

How to Avoid This Mistake:

- Pay off your balance in full each month to avoid interest charges.

- Use a credit card payment calculator to determine how much interest you’ll pay if you carry a balance over time.

- Avoid spending more than you can afford to pay off at the end of the month.

Ignoring Your Credit Utilization Ratio

Your credit utilization ratio represents the amount of credit you use compared to your total available credit. A high credit utilization ratio can negatively impact your credit score, as it tells lenders you depend on credit.

How to Avoid This Mistake:

- Keep your credit utilization below 30%. If your credit limit is $10,000, you should try to use no more than $3,000 at any given time.

- If your utilization is too high, make additional payments or increase your credit limit.

- Consider spreading purchases over a few cards to keep your utilization low on each one.

ALSO READ: What Is Considered a Good Credit Score?

Not Having a Budget to Manage Credit Card Spending

It is easy to overspend on credit cards when you don’t have a budget. Overusing credit without a budget can lead to overwhelming debt and make it difficult to pay off balances.

How to Avoid This Mistake:

- Create a monthly budget for your income, expenses, and savings goals.

- Only use credit cards for things you can pay off within your budget.

- Consider using cash or debit cards for extra spending to avoid exceeding your budget.

What Are the Benefits of Using Credit Cards?

A good credit history opens doors to favorable interest rates on loans, mortgages, and even car insurance. As you’ve understood the credit card mistakes to avoid, using them responsibly will help you enjoy rewards like cash back or travel points.

Other benefits of using credit cards include:

- Using credit cards regularly and responsibly will help you build your credit history and raise your credit score.

- Earning rewards for your spending with credit card rewards programs

- Compared to debit cards, credit cards often offer better protection against fraud.

- You get to enjoy the convenience and flexibility.

- Enjoying peace of mind with credit card purchase protection and insurance.

- Getting emergency assistance when you need it.

Managing your credit effectively is essential for maintaining financial stability. By avoiding credit mistakes like missing payments, maxing out your cards, and carrying unnecessary balances, you’ll be well on your way to building a healthy financial future.