Learning how to manage money is an important skill for teenagers, and budgeting apps can help make this easier. With the right app, teenagers can keep track of how to spend money and how to save, and they can also learn good money habits.

Are you trying to find apps that can help your kids or teens learn how to handle their money? If you are, there are many options; however, picking the best one for your child can be challenging. In this article, we will explore the best budgeting apps. We will also explain how they work and show you key features to watch out for when choosing the right budgeting app for your teen.

Benefits of Budgeting for Teens

Money and budgeting apps are great tools to help your child track their spending. It can also help them understand where their money goes. These apps can help your child budget and learn how to manage their money better.

Beth Zemble, an expert in financial education at GoHenry, once said that while there are many ways to teach kids about money, the most important lessons are teaching them the value of money and how to make wise spending decisions.

Using money apps can make it easier to talk to kids about money using real-life examples. Not only will a parent be able to show their kids why budgeting is important, but it can also help them decide if their child is ready for the next step, which is a prepaid debit card. It is all about financial literacy for kids.

ALSO READ: 8 Tips To Stay Budget-Conscious

How Do Budgeting Apps Work?

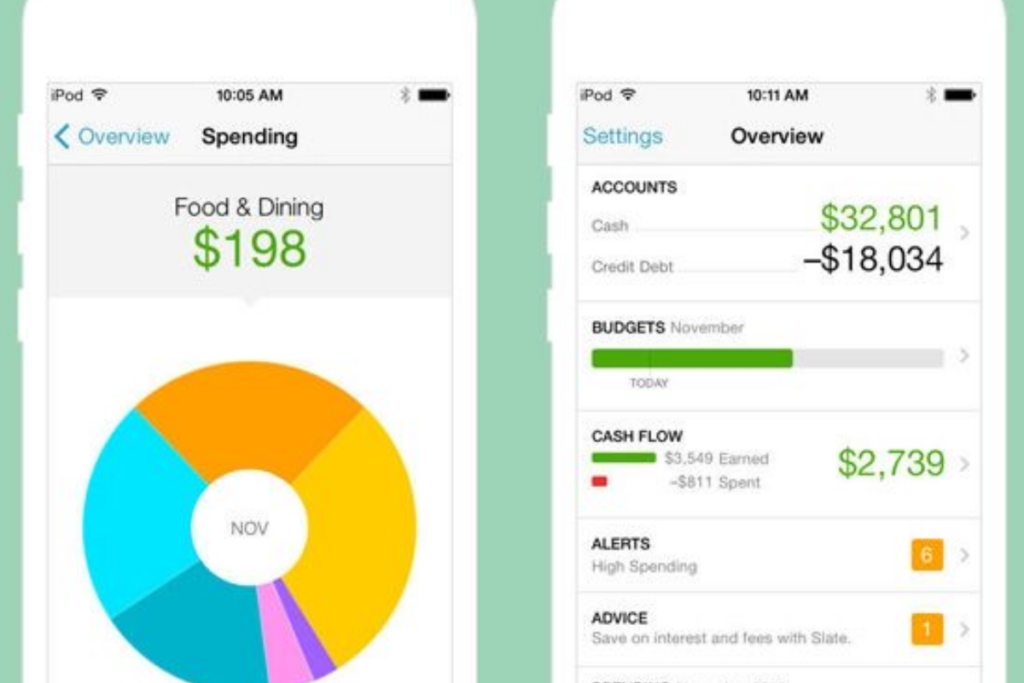

As a parent or guardian, a budgeting and money app is a tool you can use on your phone to help kids learn how to manage their money. These apps have many uses, which include keeping track of pocket money, watching how much kids spend, setting money aside for savings, and organizing everything.

Money apps are a fun and easy way for kids and teens to handle or manage their money better. Here is how these apps usually work:

- The budgeting or money app can be connected to a bank account and automatically shows the money the user has spent.

- These apps can allow users to enter transactions manually.

- The app sorts every amount spent into categories. This way, children can see where their money is going or how it is being spent.

- As a parent, you can set budgets and track how close your child’s progress is towards meeting their saving or budgeting goals.

One of the best things about these budgeting apps is that they help kids see how much they are spending better than if they were doing it manually. The apps can also show spending habits a child might not have noticed. They will help them discover areas where they need to cut back on spending and find more ways to save more money.

ALSO READ: How to Save Money: 13 Simple and Effective Tips

Best Budgeting Apps for Teens

The following are eight of the best money apps for kids under 18:

1. GoHenry

GoHenry is a service that helps teenagers become smarter with money. This budgeting app offers a debit card and an app designed to teach kids how to manage money safely. The app has several fun features, like videos and quizzes.

These phone features make learning about money, saving, and budgeting very interesting. It allows parents to set rules on how their kids use the card, and they get instant alerts when their kids spend money. The app will enable users to set savings goals and set up automatic pocket money payments.

2. Gimi

Gimi is an app that helps parents and their kids manage pocket money and teaches teens how to handle money. Teenagers can watch their virtual piggy bank fill up weekly when they get money. The app helps parents and their kids work together to learn three important things about money. These lessons include how to earn money, save it, and spend it wisely.

3. iAllowance

iAllowance is an app that helps parents give their teenagers pocket money when they finish their chores. With the app’s help, parents can remind their kids to do their tasks. Everyone in the family can see updates from the app on different devices.

As a parent, you can also print out reports to see how well your child is doing with their house chores. However, it does not hold any real money, so you still need to give them the cash in person as a parent. There is no debit card included with this app either.

4. Pigby’s Fair

This is one of the free budgeting apps for young adults. Pigby’s Fair is an exciting app that helps kids learn how to handle money by playing a game. In the game, kids run a stand at a fair. At this stand, they sell things and manage their supplies.

The most exciting part is that they enjoy playing while learning important money management skills. It is a fun way to learn about saving and spending.

5. Otly!

Otly! is an excellent app designed for kids. It helps them keep track of their money. Both parents and kids can use it on their devices. Parents have the primary control and can set up a record of the pocket money they give to their teenagers. This way, they can also see how much they spend. This will help kids understand how money comes in and goes out.

Teenagers can use a particular version of the app to divide their money into different saving categories, like for a toy, grocery shopping, or a game. They can see interesting graphs that show how their savings grow. This app also has a countdown feature that lets the kids know how long until they get their next pocket money.

6. Natwest Rooster

This app is a prepaid card and budgeting app that is made for kids and teens. Natwest Roster helps them learn how to handle money and be responsible with their finances. With this card, kids and teens can easily keep track of how much they spend. They can also create budgets and save for things that they want. It also includes a chore tracker that helps them manage tasks.

7. Starling Kite

Starling Kite is a debit card app for kids ages 6 to 16. This card makes it easy for kids to manage their pocket money, save, and budget. The Starling app has a simple version just for kids, where they can check how much money they have, see what they have spent, and get notifications when they purchase anything. Parents can control the card. They can also set spending limits and keep track of their child’s money.

8. Revolut<18

Revolut<18 offers an app and a prepared debit card that helps teens learn how to manage their money. The app has parental controls, so a parent can set spending limits and get instant notifications about their child’s purchases. However, to get a Revolut<18 card, a child must have a parent or legal guardian who already has a Revolut bank account.

Budgeting apps for kids are vital to teaching money management and financial literacy at a young age. You can get your child started with any of these apps, but ensure you go with the one that best meets your needs.