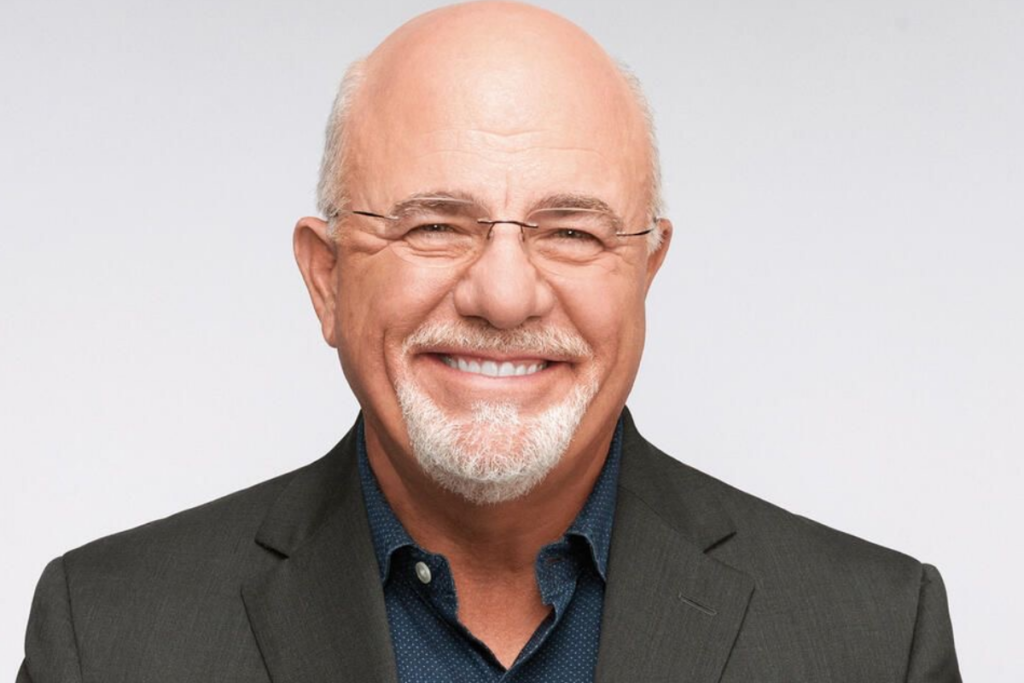

When you start living on a budget, some important tips from Dave Ramsey can help you. One major notion you should have at the back of your mind is that budgeting fluctuates. This means your budget would not always stay the same.

Things are always happening. For example, you might want to go on your summer vacation and need school supplies or new clothes to take back to school. There are also birthdays and holidays. These events happen regularly, and you should be ready for them. You can plan ahead by setting aside money for these things.

You also need to be flexible with your projects so that you can adjust them when these expenses come up. However, you should know you cannot be too strict with your budget. If you are, you might not be able to be prepared for these events when they appear. This article will share Dave Ramsey’s budget tips that will help you make better budgets.

Dave Ramsey‘s Budgeting Tips

The following are five of Dave Ramsey’s budgeting tips for beginners:

1. Budgeting From Zero

Dave Ramsey’s zero-based budget tip means that each month, you take the money you make and decide where every dollar should go. It does not mean you end up with zero dollars in your bank account. What it means is that every penny you make has a purpose. You are making a plan for every dollar so that none of it is just sitting around without a job.

Below is an example to make it easier to understand:

Let’s say you make $5,000 a month. You need to figure out what to do with the money. You can spend it on bills, save some, donate, or invest, but by the end, when you add everything up, it should equal $5,000, and you need to mark it as such in your budget.

For instance, if your monthly bill is $3,000, you have to mark $3,000 out of the $5,000 for those bills. Then, you can decide to put $1,000 in savings. This means you have accounted for $4,000, leaving you with $1,000 to plan for.

You can review your budget and decide where to put the last $1,000. The main idea of this tip is that every dollar has a place to go. This way, you will always know where your money is going. If you don’t have a plan for some of your money, it becomes easy to overspend or lose track of it.

ALSO READ: 9 Tips To Stretch Your Food Budget

2. Savings First, Then Debt

Another one of Dave Ramsay’s tips for managing your money is to save before you focus on paying off debts. Even though you might want to pay off your debts immediately, creating an emergency fund is essential. This way, if something unexpected happens, you have money set aside to handle it, and you would not have to rely on credit cards or take out another loan.

Things are more challenging if you keep getting into more debt while trying to pay it off. It would be best if you tried to save $1,000 as fast as you can for emergencies. This amount will help cover those unforeseen or unexpected expenses. After saving $1000, you can start focusing on paying off your debt.

When ready to pay off your debt, you can use the “snowball method.” This approach makes it feel like you are making progress.

First, write down all your debts and list them from the smallest to the largest. Pay the minimum required for all your debts except the smallest one. Focus all your extra money on paying off that smallest debt first. Once it is gone, move on to the next smallest debt and do the same thing. Keep doing this until all your debts are paid off.

3. Decrease Grocery Spending

Dave Ramsey’s budgeting tips offer ways to help you spend less to save more money. When trying to manage your budget, you might have to make tough choices to avoid overspending. One of the biggest surprises in your budget can be groceries.

You might not even realize how much money you spend at the grocery store until you stop and look at the prices. Groceries are expensive, and prices seem to keep rising. If you do not have a plan, it is easy to go down the aisles and grab random items, even if you do not need them. These extra purchases can quickly add up and mess up your budget.

One way to save money is to list what you need before going to the store. When you get there, make sure you stick to your list. Do not buy anything that is not on your list, no matter how tempted you might be. Before making your list, check what you already have at home. This will prevent you from buying things that you do not need.

Also, if possible, go shopping alone because if you bring kids or spouses, they might ask for extra stuff you do not need. Another helpful tip is to use grocery pickup. You will order online with grocery pickup and only get what is on your list. This way, you will avoid the temptation to buy things while walking around the store.

ALSO READ: 8 Best Budgeting Apps for Teens

4. Cut the Cable

One of Dave Ramsey’s budgeting tips is to reduce how much you pay for cable. You could cancel your cable and find other ways to watch TV.

Many online options are cheaper than traditional cable. Cable can cost over $100 monthly, up to more than $1,200 a year. Imagine how much money you could save and use to pay off debts if you did not spend that much on cable.

If you do not want to get rid of cable, try reducing your bill. Cable companies have a lot of competition. They often offer better deals to keep customers from leaving. It would not hurt to call them and ask for a discount. The worst thing that can happen is that you will end up with a lower bill.

5. Lower Energy Consumption

Dave Ramsey‘s budgeting advice also includes reducing your energy consumption, which means using less electricity. This budget-friendly tip suggests some easy ways to reduce your energy bill. One method is to adjust your thermostat by a few degrees.

For example, you can lower your thermostats in the winter and raise them in the summer. This can save you a lot of money without making your home feel different. In time, these small changes can add hundreds of dollars in savings.

Another tip is to unplug devices when you are not using them. Even when turned off, plugged-in appliances and gadgets still use a small amount of electricity, which will cost you money. This includes things like phone chargers, toasters, and even your TV.

It can also help to change your regular light bulbs to energy-saving ones. These bulbs use less electricity but provide the same amount of light, and using them can save you a significant amount annually.

Creating a budget is essential because it helps you see exactly how much money you are earning and how you are spending it. Tracking where your money goes can help you manage your spending and savings. Finally, regardless of your financial goals or what you want to achieve, your budget can help you reach those goals.