If you’re looking to invest your money for a short period with minimal risk, you might want to consider a Negotiable Certificate of Deposit (NCD). A negotiable certificate of deposit is a special type of investment instrument that allows investors to earn a fixed interest rate for a specific period while also having the option to sell the certificate before it matures.

A negotiable certificate of deposit is more flexible for investors who might need cash before the end of the term as it is bought and sold on the secondary market, unlike a regular certificate of deposit, which locks your funds until maturity.

To better understand, we’ll explore the key features of a negotiable certificate of deposit, how it works, the risks involved, and the differences between it and non-negotiable CDs.

What Is a Negotiable Certificate of Deposit?

A negotiable certificate of deposit is a time deposit issued by banks with a fixed interest rate and a set maturity date. It is also known as Jumbo CDs. What makes it unique is its ability to be sold or transferred in the secondary market, making it “negotiable.”

An NCD is short-term, with maturities ranging from two weeks to one year. The interest is usually paid either twice a year or at maturity. Typically, NCDs are issued in larger denominations, usually with a minimum par value of $100,000.

Although they carry a much higher face value, they are often used by institutional investors, corporations, and high-net-worth individuals. Small investors, however, can also indirectly invest in NCDs by buying smaller shares of Negotiable Certificates of Deposits on the secondary market or through funds.

Features of Negotiable Certificate of Deposit

The following are some of the critical features of a negotiable certificate of deposit:

- Large Face Value: NCDs are issued in large amounts, usually starting at $100,000 or more. This makes them more appealing to institutional investors and businesses with big cash reserves.

- Fixed Interest Rate: Like regular CDs, NCDs are low-risk and offer a fixed interest rate that doesn’t change throughout the term. This provides a predictable return on your investment.

- Tradable on the Secondary Market: The primary feature of an NCD is its ability to be sold on the secondary market before it reaches maturity. You can sell the NCD to another investor without facing early withdrawal penalties if you need liquidity.

- Shorter-Term Investment: NCDs sometimes have short-term maturities of a few months to a few years, giving investors flexibility if they don’t want to lock up their money for a longer period of time.

- Backed by Banks: Like all Certificates of Deposits, banks issue NCDs, considered low-risk investments, especially when compared to stocks or more volatile investment options like using a savings account.

ALSO READ: Certificate of Deposit Calculator: All You Need to Know About It

How Does a Negotiable Certificate of Deposit Work?

When a bank issues an NCD with set denominations, terms, and interest rates, it promises to pay the holder a fixed interest rate over a set period.

The investor (a major investor like corporations or mutual funds) buys the NCD for a set amount (the face value). At maturity, the bank returns the principal amount and the agreed-upon interest.

What sets NCDs apart from regular CDs is the ability to trade them on the secondary market. If the holder of an NCD needs to liquidate the investment before maturity, they can sell it to another investor at its current market value. The buyer then takes over ownership and will receive the principal and interest at the end of the term.

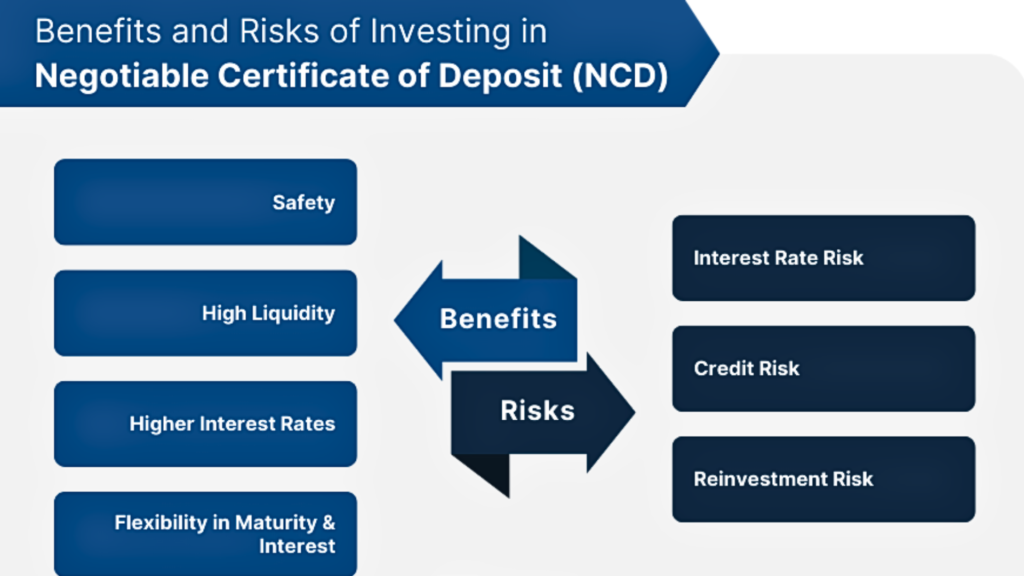

Advantages and Disadvantages of Negotiable Certificate of Deposit

The following are some of the advantages and disadvantages to bear in mind when considering an investment in a negotiable certificate of deposit:

Advantages:

- Liquidity: One of the most significant advantages of an NCD is its liquidity. You can sell the NCD on the secondary market without facing early withdrawal penalties if you need access to your money before the term ends.

- Low Risk: NCDs are generally considered low-risk investments since reputable banks issue them. The Federal Deposit Insurance Corporation (FDIC) insures them for up to $250,000 per depositor per bank and is often seen as a safe investment.

- Fixed Returns: NCDs give you a predictable return on your investment with fixed interest rates. This can be a significant advantage during periods of market volatility.

Disadvantages:

- Significant Minimum Investment: NCDs are often issued in large denominations, which makes them less accessible to individual investors unless they are bought through a mutual fund or similar financial product.

- Market Risk: While NCDs are low-risk in terms of the issuing bank, their value can fluctuate on the secondary market based on changes in interest rates. You may not get the total face value back if you sell an NCD before maturity.

- Limited Interest Payments: Interest on NCDs is usually paid at maturity, which may not be ideal for investors looking for regular income.

- Riskier than Treasury bills: NCDs are generally riskier than Treasury bills. This is because the probability of a specific bank or financial institution defaulting is higher than the probability of default for the U.S. government.

ALSO READ: Top 10 Best Investments Opportunities for 2024

Negotiable vs. Non-Negotiable Certificate of Deposit

It’s essential to understand the differences between negotiable and non-negotiable certificates of deposit, as they cater to different investors.

Negotiable Certificate of Deposit:

- Can be bought and sold on the secondary market.

- Issued in large denominations.

- Usually bought by institutional investors.

- Provides liquidity without imposing penalties for early withdrawals.

Non-Negotiable Certificate of Deposit:

- Once it’s been bought, it cannot be traded or transferred.

- Usually issued in smaller denominations.

- Interest rates are often higher because money is locked in until maturity.

- Suitable for individual investors looking for a low-risk savings option.

While both types of CDs offer fixed returns and low risk, the choice between negotiable and non-negotiable certificates of deposit depends on your liquidity needs, the size of your investment, and whether you’re comfortable keeping your money locked away until maturity.

Choosing the Right Investment

When considering any investment, it’s important to balance risk and return. An NCD may be a good option if you are looking for a short-term, reasonably safe investment and are comfortable with the larger denomination requirements.

However, always compare certificate of deposit options with other low-risk investments, such as Treasury bills or money market accounts, to ensure you choose the best option for your financial goals.