CapitalG’s bold investment move is not unrelated to Monzo’s impressive 2023 returns. In return, Monzo is looking to ride the wave of fresh liquidity to expand into the juicy American market.

CapitalG is the investment arm of Google’s parent company, Alphabet. Providing funds for the scaling of profitable ventures.

What Is Monzo?

Monzo is a British company that is largely making waves in digital banking and once had operations in the US. Last week, the company announced that it had raised an impressive capital volume.

With this new round of funds, Monzo will be reviving its comatose operations in the United States.

The New Beehive of Venture Capitalists

While CapitalG was one of the major Venture Capitalist firms to put down money for the upscaling of Monzo, they were not alone in the gold rush.

One of the co-investors is a longtime Monzo supporter, Tencent. Likewise, Passion Capital and HongShan equally put down some of their loose cash. Interestingly, the Chinese HongShan broke away from Sequoia Capital just last year.

Strictly Digital

Monzo is, by far, one of the most popular digital-only banks in the UK. Most of Monzo’s banking facilities are made available through their app. During the announcement of the fresh funding, Monzo CEO TS Anil explained that it would help accelerate the company’s market coverage.

For one, the United States is a field Monzo is looking to glean.

One Bad Break

In its initial stint in the United States, Monzo had a bad streak with banking regulators and eventually pulled out. However, Anil is confident that Monzo will crack the US market this time, given the present robustness of its financial base.

Anil explained that Monzo has been building its organizational resilience all this time. Finally, it’s starting to pay off.

A Renewed Confidence

To reiterate Monzo’s present poise, Anil said, “With backing from global investors, we have the rocket fuel to go after our ambitions harder and faster, building Monzo into the one app that sits at the center of our customers’ financial lives.”

Interestingly, Monzo performed so well in 2023 that it won global venture ‘s confidencecapitalists.

A Recoil That Precedes the Relaunch

Anil also explained that all their previous pitfalls and milestones have toughened the company to prepare for greater exploits. According to him, the time to leave their comfort zone and scale is now.

So, the $430 million is the correct springboard to help Monzo launch to greater heights. Financial analysts are already lookingwtoesee company would deploy its newfound resources.

Blooming After the Drought

Early in 2023, the prominent UK digital bank came out of the red for the first time. Interestingly, Monzo’s stint of profits were quite significant by the end of last February.

The sudden change in Monzo’s financial fate in 2023 was thanks to its capitalizing on the lending arm of its business. This spike in the neobank’s lending activities can be attributed to the recent bite of inflation.

Global Reverses, a Blessing for Financial Institutions?

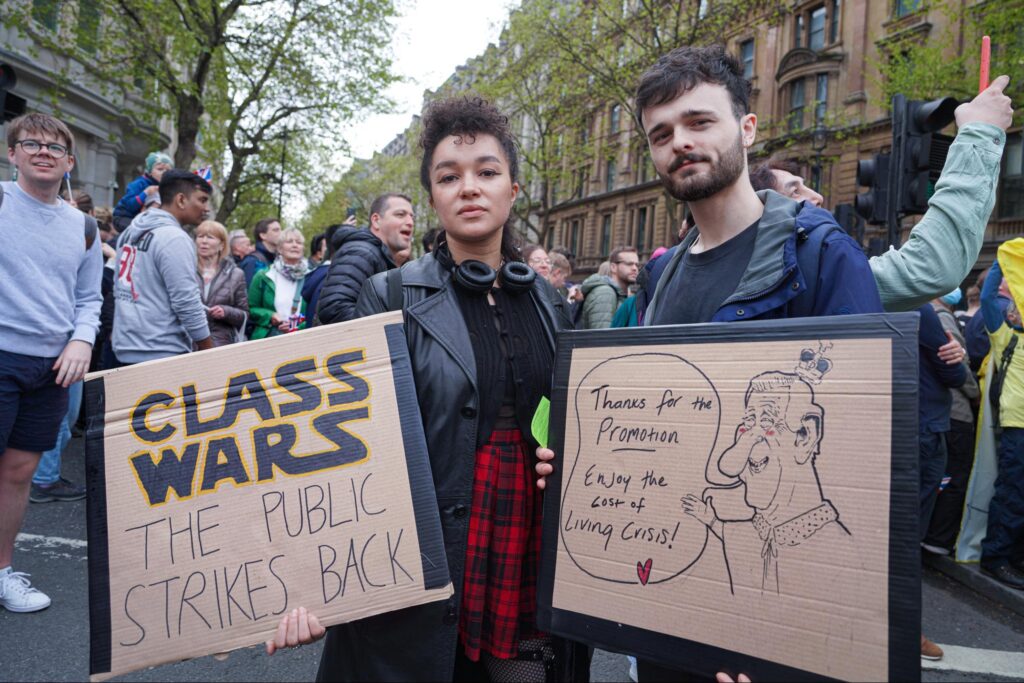

Another indication that the trigger of banking profitability is across the board is that some other banks equally reported a spike in returns. For example, Starling Bank and Allica Bank have equally reported spouts of profits in the past year.

Global inflation has caused the cost-of-living crisis to bite harder than ever. So much so that the PwC reported the household debt in the UK to have exceeded two trillion pounds last year.

How Customers Made Monzo Rich

So, the cost-of-living crisis favored Monzo’s lending business, leading to the reported profit spike. With a base of about 7.4 million users, Monzo did not find it difficult to make a few pounds from the loans of its financially struggling customers.

This brief period of spike was the eye-opener that investors needed to see the potentials of Monzo.

Customer Debts, Banker’s Profits

After entering the black, Monzo’s returns in the first two months of 2023 spiked by a whopping 88%. In 2022, the company struggled to amass a total profit of $144.6 million. However, by February of the following year, the company’s profits jumped to $272 million.

A substantial volume of these profits came from Monzo financial facilities like pay later service, Flex buy now, and customer overdrafts.

Failures May Precede a Success Streak

With all these wild experiences and victories in the UK, CEO Anil is confident that Monzo would perform superbly in the American market. A relaunch of the neo banking app is imminent albeit this time as a standalone business concern.

Monzo’s first foray in the American market was a collaborative one, as the company collaborated with a US community bank, Sutton Bank.

Strict Banking Regulations in the US

However, since Monzo is incorporated in the UK, it had to obtain a banking license to operate fully in the US. Unfortunately, the two-year-long discourse with regulatory bodies broke down, and Monzo pulled out in 2021.

However, Monzo is recommitting to a US reentry, and is looking to exploit a hole in the wall. The plan is to initiate a partnership to bypass the need to obtain a US banking license.

Hiring a Banking Tour Guide

With the new partnership, Monzo will be able to recruit customers in the US and get a bite of the banking market share. Part of Monzo’s assault plan is to use the services of a US CEO for its operations in the country.

They have successfully scaled that hurdle as they hired Conor Walsh in October 2023. Walsh was a former executive at a popular fintech firm.

The Future is Bright

Probably as part of their preparations to penetrate the US market, Monzo recently launched a new product. The product allows customers to lock their savings as an investment in portfolios managed by BlackRock.

At the moment, Monzo boasts of 9 million customers in the UK. They are eyeing a similar, or even better, market share in the US.