Several family offices are adopting a new strategy to win in the ongoing talent war. With deal profits and offers of lucrative equity shares, family offices are making all efforts to secure the top talents in their industry.

These are actively jostling with venture funds and private equity firms for the best talents available on the job market.

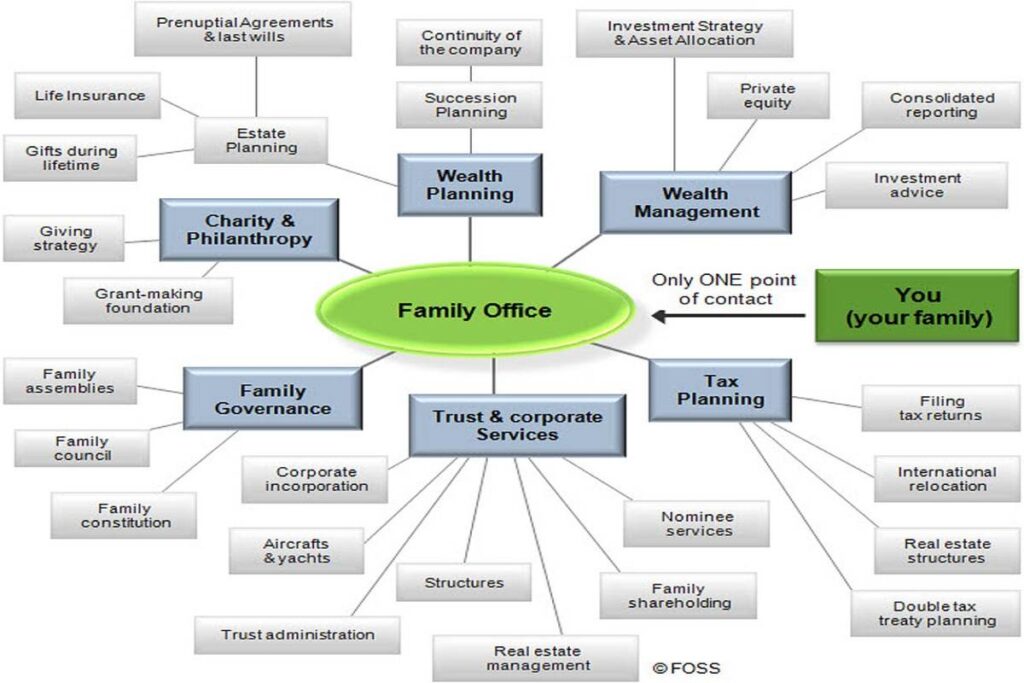

What is a Family Office?

As the number of ultra-high-net-worth (UNHW) individuals increases around the globe, the demand for wealth management entities to manage their financial portfolios increases.

Instead of contracting these services out to wealth advisory firms, these UNHW individuals and families often establish private wealth management firms. These firms are called Family Offices. So, to make the most return on this investment, UNHW individuals strive to hire top talents to manage their financial portfolios.

How Family Offices Attract Top Talents

Now, it is a given for family offices to offer attractive pay packages to their employees, as they are often headhunted for being the best at their craft. However, most family offices have to engage in a talent war to attract these talents to their firm.

So, besides the basic salary of their staff members, they offer other attractive compensation methods.

ALSO READ: The Number of Ultra-Wealthy People in the World Increases Due to Global Gain of Stocks

Profit Sharing vs. Equity

Some family offices offer their employees profits on interest, while some permit co-investment or give equity compensation. However, profit shares and equity compensation are the most common in family offices.

Interestingly, which of the two gets adopted is often predicated on the size of the family office and their average profit on investments. So, what works best for one family office may be unsuitable for another.

Giving Staff Equity in Your Company

Equity compensation often involves a company offering staff members shares in addition to or as a replacement for their pay package. This form of staff compensation allows onboarded talents to partake in the ownership of the company managed by the family office.

However, equity offers are preferable for startups that want to recycle a large portion of their profits as capital. Equity compensation may also be the way to go in some robust family offices with complex conglomerates and holdings under their oversight.

How Do Staff Benefit From Profits Interest?

On the contrary, profits interest allows an employee to share a percentage of the profits on deals or investments under the oversight of a family office or company. The implication is that the employee gets no profit shares when there is no profit.

However, employees who do get profit shares can save on taxes. Here’s how it works: the employee pays for capital gains only on a long-term basis, and even that is capped at 20%, unlike ordinary income taxes, which could go as high as 37%.

How Family Offices Compete for Top Talent

According to Patrick McCurry, a partner at the Chicago-based McDermott Will & Emery LLP, family offices have to acclimatize to the talent war in the hiring landscape. So, they need to up their game in compensation to attract and retain the very best of talents.

McCurry is quite familiar with the odds stacked against family offices because he works with single-family offices. So, he’s aware of the lengths that wealthy families go to employ professionals to assist in managing their financial portfolios.

Compensation that Makes the Mission Statement of the Employee and Employer the same

McCurry said of the ongoing contest, “Family offices are competing for talent against each other, and against traditional private equity, hedge funds and venture capital.”

However, he also observed that family offices are shifting from the previously highlighted compensation strategies to profit shares. McCurry suggests this shift is a ploy to avoid conflict of interest and to make sure the wealthy families and their employees are gunning for similar incentives.

Some Other Attributes of Family Offices

From how we described family offices earlier, it is easy to perceive them as strictly being involved in the business end of the finances of UHNW individuals and families. However, nothing could be farther from the truth.

On the contrary, many family offices may be involved in tax services, generational wealth transfer planning, charitable donations, insurance, budgeting, and even some mundane things like travel plans.

Family Offices Often Adopt the Financial Strategies of their Owners

What a family office does depends on the marching order laid out by the owner of the wealth being managed. So, it is possible for a billionaire to get indicted for tax evasion despite having a family office to manage their fortune.

Indeed, some wealthy families or individuals charge their family office to seek out lawful methods of evading taxes, or of exploiting tax waivers where available.

ALSO READ: Citigroup Smashes Second-Quarter Expectations in Both Profit and Revenue

Family Offices are Umbrella Companies

One of the reasons why a family office may try to woo away top talents from private equity firms, and other family offices is because their activities go way beyond balancing of accounts and giving of financial advice.

Family offices may require the services of a virtual assistant, hedge fund manager, travel planner, social media manager (if UHNW uses social media to further their business or personal brand), personal trainer, in addition to the very best finance advisers and lawyers around.

Family Offices Have Changed the Rules of Employee Compensation Forever

The entire team is often assembled to create a comprehensive wealth management plan that puts the money and assets of UHNW individuals to work. At the same time, they concentrate on the activities that bring them what they perceive as the best values.

So, about staff compensation, most family offices are raking in top talents through these attractive packages. The competition has gotten so rife that even some private equity firms have also started offering equity share profit to attract top staff of other companies.

You Might Also Like:

Washington, D.C., Attorney General Files Lawsuit Against StubHub Over Alleged Deceptive Pricing

Stellantis Proposes Broad Buyouts for U.S. Salaried Employees, Potential Layoffs Loom

JetBlue Shares Surge 12% Following Surprise Profit and $3 Billion Aircraft Spending Deferral

Spirit Airlines Introduces Premium Complimentary Services for a Budget-Friendly Travel Experience

Walmart Slashes Price on $130 Rolling Utility Cart to $35—Shoppers Says It’s ‘Helpful in Organizing’