If you’ve been scrolling through social media lately, you have likely seen an ad from TurboDebt. Some of these ads might tell you that TurboDebt could save you from financial disaster, that it won’t negatively impact your credit score, and that you won’t have to pay back what you borrow.

It all sounds way too good to be true, and, unfortunately, it may be. Since many people seek effective ways to manage and reduce their debt, Turbo debt is an attractive option. But what exactly is TurboDebt? How Does TurboDebt Work? And why do these ads make bold claims about its offerings?

TurboDebt is a debt relief company designed to help people struggling with debt by creating personalized plans to reduce or eliminate it. They offer a variety of options that are customized to fit the financial situation of each client.

We will now explain in great detail how TurboDebt works, how much it costs, which debts it can help you with, and its benefits. We will also break down TurboDebt’s tools, such as debt consolidation, debt repayment, and debt settlement options.

Understanding TurboDebt

TurboDebt is a debt relief company specializing in individual debt settlement by creating personalized repayment plans that end debt faster and reduce consumers’ debts. When a third party negotiates with your creditor on your behalf, it’s known as debt settlement. A debt settlement firm aims to find a lower payment that will settle the debt you owe.

TurboDebt service helps people dealing with large amounts of unsecured debt like credit cards, medical bills, or personal loans. They offer expert advice to guide you through the process of debt relief. Their service also helps people avoid bankruptcy, as they provide solutions that get you out of debt and keep you debt-free.

TurboDebt is not like other debt repayment strategies. Instead of paying off debts as they are due, TurboDebt actively negotiates with creditors to lower the total amount you owe, allowing you to pay a reduced sum installmentally. It is not a loan but a debt management solution to help you resolve your debt so you can pay off less than what you owe.

If you’re wondering at this point how TurboDebt came about, what exactly is its history? We’re about to find out.

ALSO READ: Good Debt vs Bad Debt: What Is the Difference

History of Turbo Debt

TurboDebt, sometimes also spelled Turbo Debt, is part of a broader movement of debt relief companies established to address the growing debt among American consumers. It is a certified American Association for Debt Resolution (AADR) member and has only had a digital presence since March 24, 2020.

As personal debt levels enriched among Americans, so did the demand for effective debt management solutions, which led to the founding of companies like TurboDebt. Over the years, TurboDebt has helped thousands regain control of their finances by offering debt negotiation and settlement services.

TurboDebt’s goal has always been to empower people with the tools and strategies needed for long-term debt relief rather than temporary solutions. Their approach is to educate clients on financial strategies and budgeting methods that help sustainably reduce debt and avoid future economic disasters.

Services Offered by TurboDebt

The following are the services currently offered by TurboDebt:

- Debt Management Plans: Turbo Debt offers Debt Management Plans (DMPs) to make managing your debt easier.

- Debt Settlement: This service involves negotiating directly with lenders to settle your debt for less than what you owe.

- Credit Counseling: Turbo Debt evaluates your debt situation and offers professional advice and guidance.

- Credit Consolidation: If you have a good credit score, you might be eligible for a lower-interest-rate debt consolidation loan to combine all your debts into a single monthly payment.

- Debt Forgiveness: Although total debt forgiveness is rare, Turbo Debt counselors may help you see if you qualify for partial loan forgiveness.

- Bankruptcy: If you don’t qualify for any of the options above, bankruptcy may be the only solution. The good news is that it will wipe out most of your debt. But the bad news is that the effect on your credit score will last for many years.

How Does Turbo Debt Work: A Step-by-Step Guide

How does Turbo Debt work? TurboDebt’s process is designed to make debt relief accessible, achievable, and less stressful. Here’s a step-by-step guide on how it works:

Step 1: Start a Consultation

The first step is consultation; this is usually free. You’ll need to speak with a TurboDebt team member or agent so they can understand your financial situation. During this stage, they review your debt and discuss which debt relief method works best for you.

Step 2: Debt Assessment

Once the consultation is complete, TurboDebt will thoroughly evaluate your debts, paying particular attention to the kinds of debt you have, interest rates, balances, and monthly payments. They’ll also offer advice on how to manage and pay off your debts.

Step 3: Create a Customized Debt Relief Plan

During this stage, TurboDebt will create a personalized debt relief plan for you based on the assessment carried out. This plan may include negotiating with creditors to reduce balances, setting up an installment agreement, or combining multiple debts into a manageable monthly payment.

Step 4: Negotiation With Creditors

TurboDebt’s negotiating experts will contact your creditors to work on reducing your debt. They negotiate for reduced balances and new payment terms to make the debt easier to manage.

Step 5: Support and Monitoring to Stay Debt-Free

After a settlement between Turbo Debt and your creditors, you must make monthly accelerated payments based on the revised terms. TurboDebt will monitor your progress and offer support and resources to ensure you stay on track. They will also provide budgeting advice and credit management tips to help you avoid debt in the future.

Which Debts Can TurboDebt Assist With?

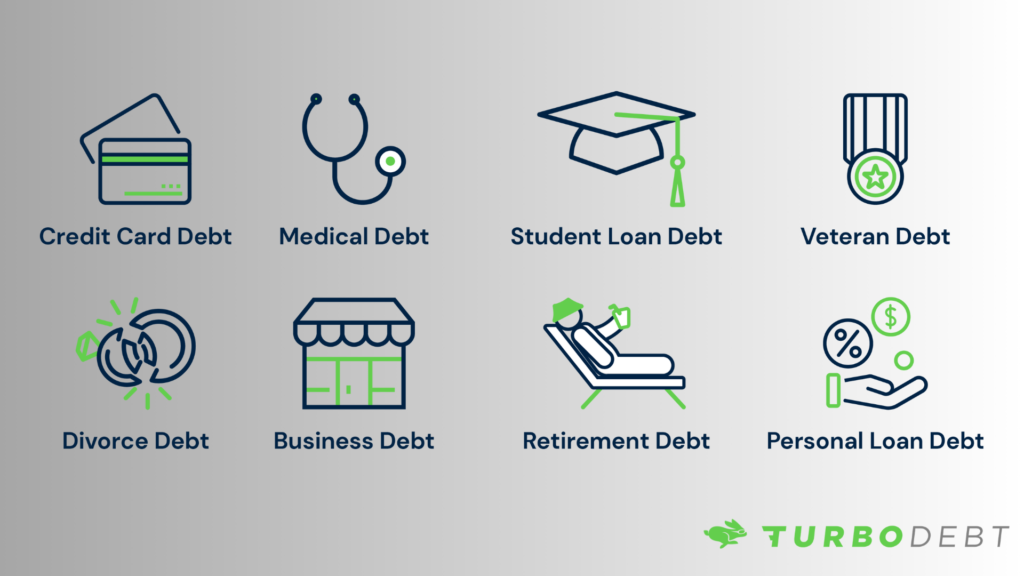

TurboDebt can help you with the following types of debt:

- Personal Loans: TurboDebt allows clients with trouble paying off large debt balances from personal loans, including some student loan debt. They can help you in negotiating and consolidating them.

- Business Debt: Debt such as loans, credit lines, or business credit cards that a business owner incurs to finance or maintain business operations.

- Car Debt: Debt resulting from an auto loan that was taken out to finance the purchase of a car and is usually paid back in monthly installments.

- Private Student Loans: Although TurboDebt excludes federal loans, it may help with private unsecured student loans.

- Credit Card Debt: Credit cards are a common source of high-interest debt. TurboDebt can help you reduce and pay off what you owe on credit card balances over $10,000.

- Divorce Debt: TurboDebt can help with debt accumulated during or due to divorce proceedings, including legal fees, alimony, and the division of shared debts.

- Medical Debt: Debt incurred from healthcare expenses, including hospital bills, treatments, and surgeries not covered by insurance.

- Tax Debt: Debt owed to the government due to unpaid taxes, which may include penalties and interest on overdue amounts.

- Veteran Debt: Debt exclusive to veterans, which may include loan payoff, unpaid benefits, or other financial obligations tied to military service.

- Mortgage Debt: Debt secured by real property through a mortgage loan usually paid back over an extended period, such as 15 or 30 years.

- Retirement Debt: Debt that remains or accumulates during retirement, often from loans, credit cards, or unpaid interest savings and mortgage payments.

TurboDebt: How Much Does It Cost?

TurboDebt doesn’t charge you in advance for your debt relief. They only charge a percentage of your enrolled debt after you pay it off. For example, if TurboDebt manages to reduce your debt by $10,000, they may charge a percentage of the amount you save as their fee.

Since their fees include 25% of your enrolled debt, you will pay 25% of $10,000 to TurboDebt. This covers managing your account and negotiating with creditors to reduce your debt.

Here’s a general idea of TurboDebt’s fee structure:

- Free Consultation: TurboDebt offers an initial free consultation to discuss options and verify eligibility.

- Service Fee: TurboDebt’s fees are usually based on a percentage of the amount saved through debt reduction. This means that the success and outcome of the debt relief plan directly determine their payment structure.

- Monthly Payments: TurboDebt works with clients to create monthly payments they can afford based on their financial situation.

Although using TurboDebt may cost you some money, many people feel that the money saved from the debt and the stress they reduce make it worth the investment. It’s essential to fully understand the fee structure before committing to ensure it aligns with your financial goals.

ALSO READ: How To Consolidate Business Debt

Benefits of Using TurboDebt for Debt Relief

TurboDebt offers a variety of benefits for people struggling with debt. They include:

- Reduced Total Debt: TurboDebt can help reduce total debt by negotiating with creditors, providing financial relief, and helping clients save.

- Flexible Payment Schedule: TurboDebt simplifies debt repayment by combining several debts into a monthly payment.

- Professional Guidance: TurboDebt’s experts help guide clients through the debt relief process, providing advice on credit management, budget methods, and repayment schedules.

- Various Debt Relief Options: If you’re struggling to manage your debt, TurboDebt will provide a viable personalized option based on each client’s financial situation to get back on track.

- Improved Financial Freedom: Debt relief through TurboDebt allows clients to work toward financial freedom, often faster than traditional debt repayment methods.

Alternative Strategies for Debt Relief

While TurboDebt offers a structured approach to debt relief, it’s worth considering other options depending on your financial situation. Here are some alternative strategies:

- Debt Consolidation Loan: A debt consolidation loan payoff is a sound financial strategy for those who qualify as it combines debts into a single payment, often at a lower interest rate.

- Debt Repayment Plan: Some people prefer to pay off debt using a repayment plan like the snowball or avalanche method.

- Financial Strategy Coaching: Working with a financial coach can provide more information on budgeting methods and debt reduction.

As we have answered the question on how Turbo Debt works and addressed the claims from ads, getting out of debt may not be as complicated as we think. With a focus on debt settlement and repayment, accelerated payments, interest savings, and credit management, there is hope for financial freedom for every American.

If you intend to get out of business debt using TurboDebt, remember that financial strategy and payment schedules are critical to long-term success. So whether you’re consolidating loans or negotiating settlements, Turbo Debt Relief Services still offers a solid foundation for financial stability so clients can avoid falling back into debt and continue working toward their financial goals.