In this piece, we set forth seven surefire steps on how to get out of business debt fast. However, the questions to ask are, “How do businesses run into debt in the first place?” and “How much debt is OK for a small business?” Good debts can be an excellent stimulus for small businesses when complemented with financial planning. Most businesses use loans to expand operations, improve their income generation, and expand their inventory or reach. However, things don’t always go according to plan.

Sometimes, organizations’ or businesses’ debt burden becomes overwhelming. Sluggish sales or major shifts in financial projections could result in such outcomes, causing businesses to buckle under the weight of debt. Nonetheless, with expert credit counseling, it is possible to salvage the situation.

It is worth noting that business debt seldom goes bad without prior notice, meaning telltale signs often precede. So, once a small business owner starts seeing any of these signs, it is time to get proactive about keeping the debt in reins. Once the pain points have been identified, here are seven ways to work your business out of its debt strain.

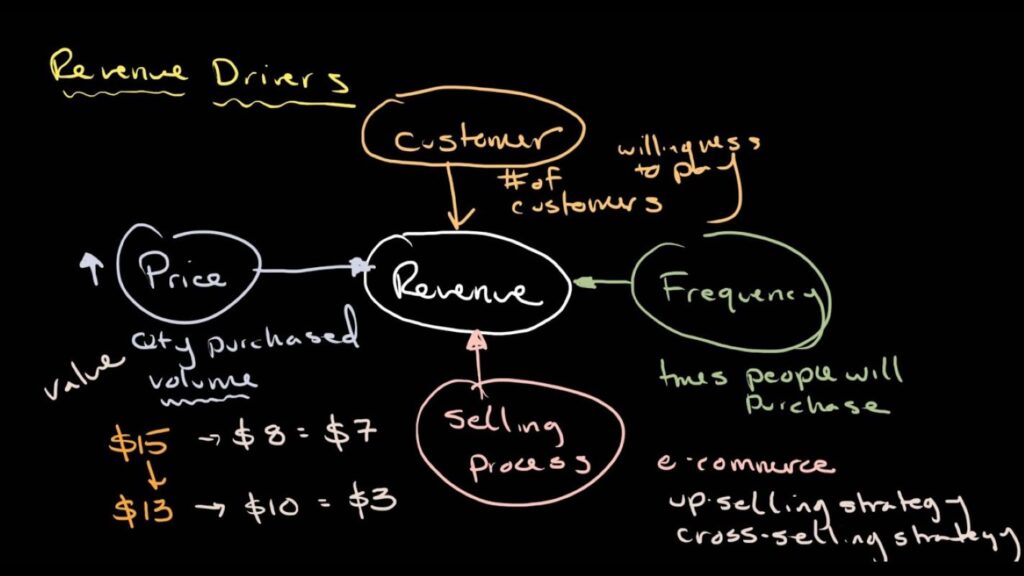

Work On Driving Up the Business Revenue

It’s a no-brainer that businesses use portions of their revenue to service active debt. So, a higher revenue naturally makes debt management easier. Indeed, when revenue is high, the business could even proceed to get financially adventurous as it has surplus funds in the kitty. The savings strategies of such businesses can help them expand without taking on more debt.

Promotions and special offers are great examples of ways to increase sales and revenue. These tactics may involve giving up a few cents or dollars of profit, but they will definitely pay off in the long run. You may want to normalize including the expense of such promotions when budgeting.

ALSO READ: Does Debt Consolidation Affect Buying a Home?

Incentivize Early Remittances or Shorten the Payment Process

Businesses that do not operate a digital payment system, meaning they still bill customers with invoices, will inevitably have late payments to deal with. There are two potential routes out of this bottleneck. The first and best option is to transition to digital payments.

However, if your operations necessitate giving customers a buffer period before paying, you may want to motivate them to pay on the stipulated day. Discounts on the next purchase or coupons should do the trick. Alternatively, you can shorten the payment wait time altogether.

Find Ways To Streamline Business Expenses

Nothing goes for nothing. The revenue of a business directly correlates to the investment. So, if you have maxed out all the tricks in the book to increase revenue, it may be reasonable also to audit your costs. As a business owner, living within your means may not do the trick. Besides, you are expected to have a personal emergency fund to fall back on during financial stress.

Revisit financial planning records to check for items that incur the greatest expense in your inventory and operations. Consequently, look for ways of cutting costs without compromising on quality. For example, you could switch to cheaper energy sources or shop for more sustainable materials to use in your production process. These simultaneous income generation and savings strategies should increase the profit margin of your business.

Never Neglect Your Debts, Instead Prioritize Them

When it comes to debts it’s always best to prioritize the major. Pay off your most enormous debts or debts with the highest interest rates first! That bit cannot be overemphasized. In addition, some debts will leave you in bad standing with your vendors, even if it is zero interest and a small amount. To court the favor of such vendors in the future, pay off debts owed to them early.

Another class of debt to prioritize is secured business loans, those with business collateral. Pay these too fast if you’re unwilling to lose your business assets to lenders or negotiate with creditors to buy back properties.

Renegotiate the Payment Terms

Just like yourself, lenders are equally in business to make profits or, at the very least, break even. You’ll be surprised at what peaceable fruits negotiating with creditors can yield. So, to prevent your debt from becoming a bad one, the average lender would agree to renegotiate the payment terms. So, keep the communication line open between you and your creditor. Help them understand your situation and suggest that they review your payment terms.

While some lenders may not agree to review the terms, most would offer to extend the payment period and, in effect, the monthly payments. Some lenders will alternatively make cuts to the initial interest rate.

Ask Family and Friends for Help

Most small businesses start with the financial input of family members and friends. So, when things are going south but are still salvageable, don’t shy away from approaching such people for help. Indeed, this may be a hypothetical source of emergency funds for small business owners troubled about how to get out of debt and live within their means.

The advantage of this kind of bailout is that it may come at meager interest or none at all. However, making good of such solid and paying back in due time is essential.

ALSO READ: Business Auto Loans Without Personal Guarantee

Consider Opting for Business Debt Consolidation

If your business juggles several debts simultaneously, you may want to consider debt consolidation. As a sequel to negotiating with creditors, all your business debts get compounded into a single large loan. Consequently, your business gets to make a single monthly payment to offset the consolidated loan.

Interestingly, that is not the only sweet spot of debt consolidation. In addition to having all your debts merge into one, you get to renegotiate the payment conditions to come off with better terms. By better terms, we mean lower monthly payments or a lesser interest rate.

Business debt management is much more difficult than individuals living within their means to avoid personal debt. However, using the above tips and with some professional credit counseling, we hope to see your business stay afloat.